If Not Target Company, Then Describe Relationship to Target E Form

What is the If Not Target Company, Then Describe Relationship To Target e

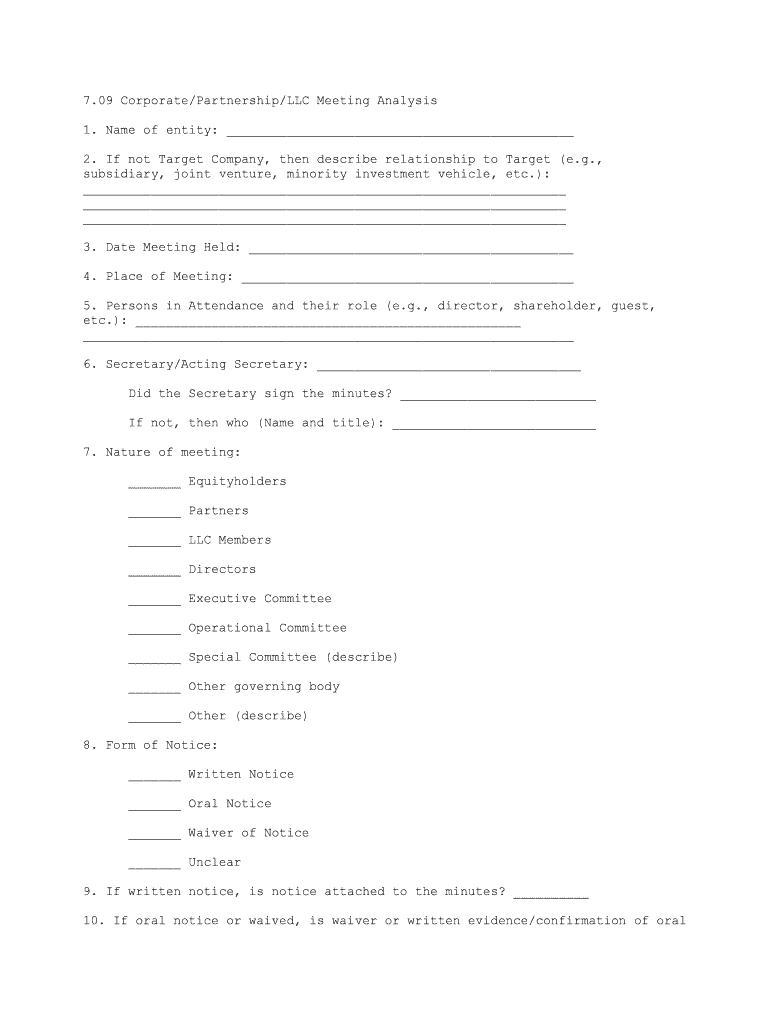

The If Not Target Company, Then Describe Relationship To Target e form is a crucial document used in various legal and business contexts. It serves to clarify the relationship between a signer and a target company when the signer is not directly affiliated with that entity. This form is often required in transactions, agreements, or legal proceedings where understanding the nature of the relationship is essential for compliance and transparency. By providing this information, parties can establish the context necessary for evaluating the validity of agreements and obligations.

How to use the If Not Target Company, Then Describe Relationship To Target e

Using the If Not Target Company, Then Describe Relationship To Target e form involves a straightforward process. Begin by accurately filling out the required fields, which typically include the names of the parties involved and a detailed description of the relationship. It is essential to be precise and clear in your descriptions to avoid any potential misunderstandings. Once completed, the form can be electronically signed, ensuring that it meets legal standards for eSignatures. This electronic submission is both efficient and secure, allowing for quick processing and record-keeping.

Steps to complete the If Not Target Company, Then Describe Relationship To Target e

Completing the If Not Target Company, Then Describe Relationship To Target e form involves several key steps:

- Gather necessary information about the target company and the relationship.

- Access the form through a reliable digital platform.

- Fill in the required fields, ensuring accuracy and clarity.

- Review the completed form for any errors or omissions.

- Sign the document electronically, utilizing a secure eSignature solution.

- Submit the form electronically or as required by the relevant parties.

Legal use of the If Not Target Company, Then Describe Relationship To Target e

The legal use of the If Not Target Company, Then Describe Relationship To Target e form is significant in ensuring that all parties understand their roles and responsibilities. For a document to be legally binding, it must comply with applicable laws governing electronic signatures, such as the ESIGN Act and UETA. This form helps establish a clear record of the relationship, which can be critical in legal disputes or contractual obligations. Proper use of this form can safeguard against misunderstandings and provide a solid foundation for legal agreements.

Key elements of the If Not Target Company, Then Describe Relationship To Target e

Several key elements are essential when completing the If Not Target Company, Then Describe Relationship To Target e form:

- Identifying Information: Names and contact details of all parties involved.

- Relationship Description: A clear and concise explanation of the relationship to the target company.

- Date: The date the form is completed and signed.

- Signatures: Electronic signatures of all parties, ensuring authenticity.

- Compliance Statements: Affirmation that the form adheres to relevant legal standards.

Examples of using the If Not Target Company, Then Describe Relationship To Target e

There are various scenarios where the If Not Target Company, Then Describe Relationship To Target e form is utilized:

- In real estate transactions, where a buyer must clarify their relationship to a seller.

- In business partnerships, where individuals must outline their roles in relation to a company.

- In legal proceedings, where witnesses may need to describe their connection to a party involved.

These examples illustrate the form's versatility and importance in establishing clear relationships in diverse contexts.

Quick guide on how to complete if not target company then describe relationship to target e

Effortlessly Prepare If Not Target Company, Then Describe Relationship To Target e on Any Device

Digital document management has gained traction among both organizations and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without complications. Manage If Not Target Company, Then Describe Relationship To Target e on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

Edit and eSign If Not Target Company, Then Describe Relationship To Target e with Ease

- Find If Not Target Company, Then Describe Relationship To Target e and then click Get Form to begin.

- Utilize the tools available to fill in your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign If Not Target Company, Then Describe Relationship To Target e to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I consider if not Target Company, then describe relationship to Target e?

When evaluating your options, consider your organization's specific needs and how they relate to operational efficiency and document management. Think about how other companies factor into your existing processes and what internal relationships may affect decision-making. Understanding these dynamics is key to optimizing your use of airSlate SignNow.

-

How does airSlate SignNow support my business if not Target Company, then describe relationship to Target e?

airSlate SignNow offers a scalable platform that adapts to your unique business relationships. By enhancing communication between stakeholders, you can streamline processes regardless of external company affiliations. This flexibility empowers you to minimize delays and improve collaboration.

-

What features does airSlate SignNow offer for those analyzing relationships?

Our platform includes advanced features like document analytics and collaborative signing, making it easier to navigate the intricacies of various business relationships. This capability allows you to track engagement and improve the signing experience based on interactions with entities beyond just a target company. It's all about fostering efficiency and transparency.

-

Is airSlate SignNow cost-effective for businesses not directly linked to Target Company?

Yes, airSlate SignNow is designed as a cost-effective solution suitable for businesses regardless of their association with a target company. Our pricing plans cater to various business sizes, enabling you to invest in a tool that enhances document workflows without overspending. You can optimize your operations while maintaining budgetary control.

-

What integrations does airSlate SignNow offer for flexible business relationships?

We provide a wide range of integrations with popular platforms that many businesses utilize outside of traditional partnerships. This means even if you are assessing relationships outside of the target company context, our integrations can help enhance your productivity. Seamless compatibility supports varying business needs.

-

How can airSlate SignNow benefit organizations establishing new external relationships?

If your organization is looking to establish new partnerships or relationships, airSlate SignNow simplifies the document signing process, enhancing the speed at which these relationships can be formalized. Our user-friendly interface ensures that you can quickly prepare and send essential contracts and agreements to various parties. This efficiency helps build trust and streamline new collaborations.

-

Can airSlate SignNow adapt to different business models beyond the target company?

Absolutely! airSlate SignNow is designed to adapt to various business models, irrespective of direct connections to the target company. Its versatile features support diverse workflows and signing scenarios, allowing you to cater to multiple relationship types and operational structures seamlessly.

Get more for If Not Target Company, Then Describe Relationship To Target e

Find out other If Not Target Company, Then Describe Relationship To Target e

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast