Form 64 Nebraska and County Lodging Tax Return Revenue Ne

What is the Form 64 Nebraska And County Lodging Tax Return

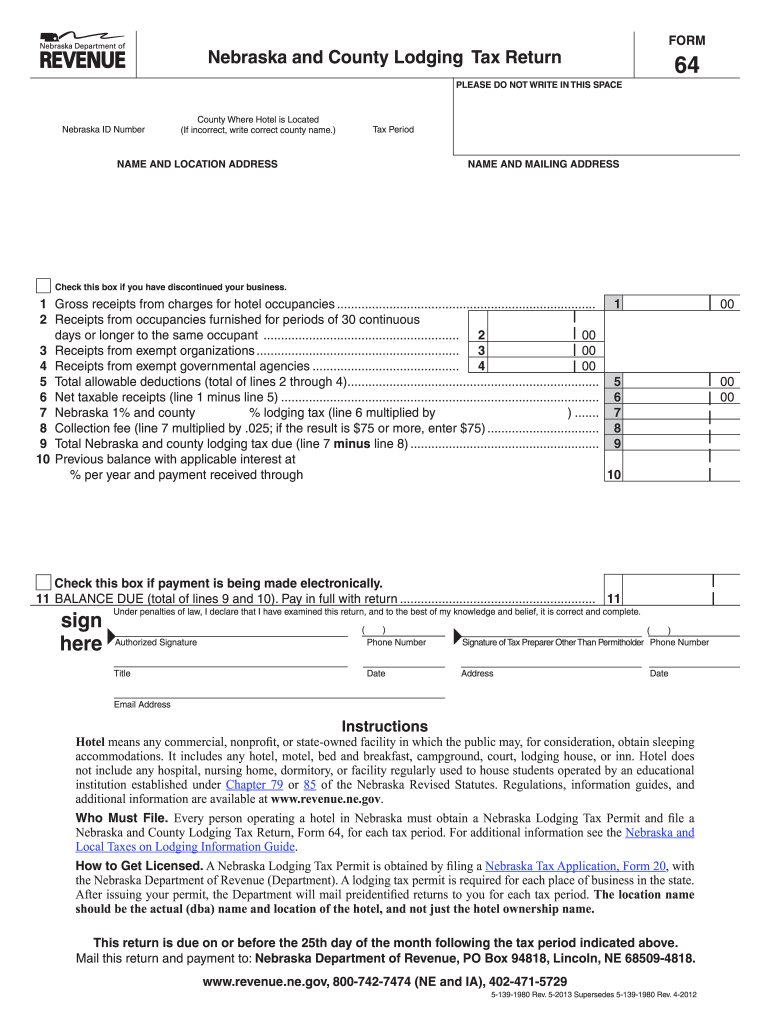

The Form 64 is a critical document used for reporting and remitting the Nebraska and County lodging tax. This form is required for businesses that provide lodging services, such as hotels, motels, and short-term rentals. The lodging tax is imposed on the gross receipts from the rental of rooms or other accommodations. Understanding the purpose of Form 64 is essential for compliance with state tax regulations and for ensuring that all lodging taxes are accurately reported and paid.

Steps to complete the Form 64 Nebraska And County Lodging Tax Return

Completing the Form 64 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including receipts and sales data for the reporting period. Next, fill out the form by providing details such as your business name, address, and tax identification number. Be sure to calculate the total gross receipts and apply the appropriate lodging tax rate. After completing the form, review it for any errors before submitting it to the relevant tax authority.

Legal use of the Form 64 Nebraska And County Lodging Tax Return

The legal use of Form 64 is governed by Nebraska state tax laws. It serves as an official declaration of the lodging tax owed by businesses. To be considered legally binding, the form must be filled out accurately and submitted by the designated deadline. Additionally, electronic submissions are valid as long as they meet the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. Ensuring compliance with these regulations helps protect businesses from potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 64 are crucial for maintaining compliance with state tax regulations. Typically, the form must be submitted quarterly, with specific due dates that vary based on the reporting period. It is essential for businesses to mark these dates on their calendars to avoid late fees and penalties. Keeping track of these deadlines ensures that lodging taxes are reported and paid on time, thus avoiding any legal issues with tax authorities.

Key elements of the Form 64 Nebraska And County Lodging Tax Return

Key elements of the Form 64 include the identification of the lodging provider, the period of the report, total gross receipts, and the calculated lodging tax due. Additionally, the form may require information about any exemptions or deductions applicable to the lodging tax. Understanding these elements is vital for accurately completing the form and ensuring that all necessary information is provided for tax assessment.

Form Submission Methods (Online / Mail / In-Person)

The Form 64 can be submitted through various methods, providing flexibility for lodging providers. Businesses may choose to submit the form online through the Nebraska Department of Revenue's website, which often allows for quicker processing. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated locations. Each method has its own advantages, and businesses should select the one that best suits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete form 64 nebraska and county lodging tax return revenue ne

Effortlessly prepare Form 64 Nebraska And County Lodging Tax Return Revenue Ne on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-conscious substitute to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 64 Nebraska And County Lodging Tax Return Revenue Ne on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

The easiest way to modify and electronically sign Form 64 Nebraska And County Lodging Tax Return Revenue Ne without hassle

- Find Form 64 Nebraska And County Lodging Tax Return Revenue Ne and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to send your form, through email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 64 Nebraska And County Lodging Tax Return Revenue Ne and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the form 64 nebraska and county lodging tax return revenue ne

How to generate an eSignature for the Form 64 Nebraska And County Lodging Tax Return Revenue Ne in the online mode

How to create an electronic signature for the Form 64 Nebraska And County Lodging Tax Return Revenue Ne in Chrome

How to make an eSignature for signing the Form 64 Nebraska And County Lodging Tax Return Revenue Ne in Gmail

How to generate an electronic signature for the Form 64 Nebraska And County Lodging Tax Return Revenue Ne from your smartphone

How to make an eSignature for the Form 64 Nebraska And County Lodging Tax Return Revenue Ne on iOS devices

How to generate an electronic signature for the Form 64 Nebraska And County Lodging Tax Return Revenue Ne on Android OS

People also ask

-

What is Nebraska Form 64?

Nebraska Form 64 is a state-specific tax form used for various financial reporting purposes. Understanding how to complete and submit this form is essential for businesses operating in Nebraska. Using airSlate SignNow can simplify the eSigning process for Nebraska Form 64, making it more manageable for businesses.

-

How can airSlate SignNow help with Nebraska Form 64?

airSlate SignNow helps streamline the process of completing and eSigning Nebraska Form 64 by providing easy-to-use features. Users can upload, edit, and send this form electronically, reducing time spent on paperwork. With secure eSignature capabilities, businesses can ensure compliance and efficiency.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit businesses of all sizes. The plans include various features that enhance your ability to eSign documents like Nebraska Form 64. Potential users can explore the options and select a plan that fits their requirements while staying cost-effective.

-

Is airSlate SignNow compliant with Nebraska regulations?

Yes, airSlate SignNow is designed to comply with Nebraska regulations and standards for eSignatures, ensuring legal validity for documents like Nebraska Form 64. The platform uses advanced security measures to protect your sensitive information. Trusting airSlate SignNow means your transactions remain secure and compliant.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes various features for effective document management, such as templates, custom workflows, and automated reminders. These features make handling forms like Nebraska Form 64 more efficient and organized. Users benefit from a centralized platform for their document-related needs.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow supports integration with various third-party applications, enhancing its utility for processes involving Nebraska Form 64. Users can connect it seamlessly with tools they already use, streamlining their workflow and improving overall productivity.

-

What are the benefits of using airSlate SignNow for Nebraska Form 64?

The benefits of using airSlate SignNow for Nebraska Form 64 include increased efficiency, reduced paper usage, and secure document handling. This platform allows businesses to quickly send and receive signed documents without delays. As a result, you can focus more on building your business rather than getting bogged down with paperwork.

Get more for Form 64 Nebraska And County Lodging Tax Return Revenue Ne

- I of county maryland form

- Remember to sign your form

- Designate which children or grandchildren if any are adopted are stepchildren or are children of a form

- Aw form

- State of maine district court location docket no form

- Signature of transferee buyer form

- Bill of sale form maine dmv bill of sale templates

- Percent per annum form

Find out other Form 64 Nebraska And County Lodging Tax Return Revenue Ne

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile