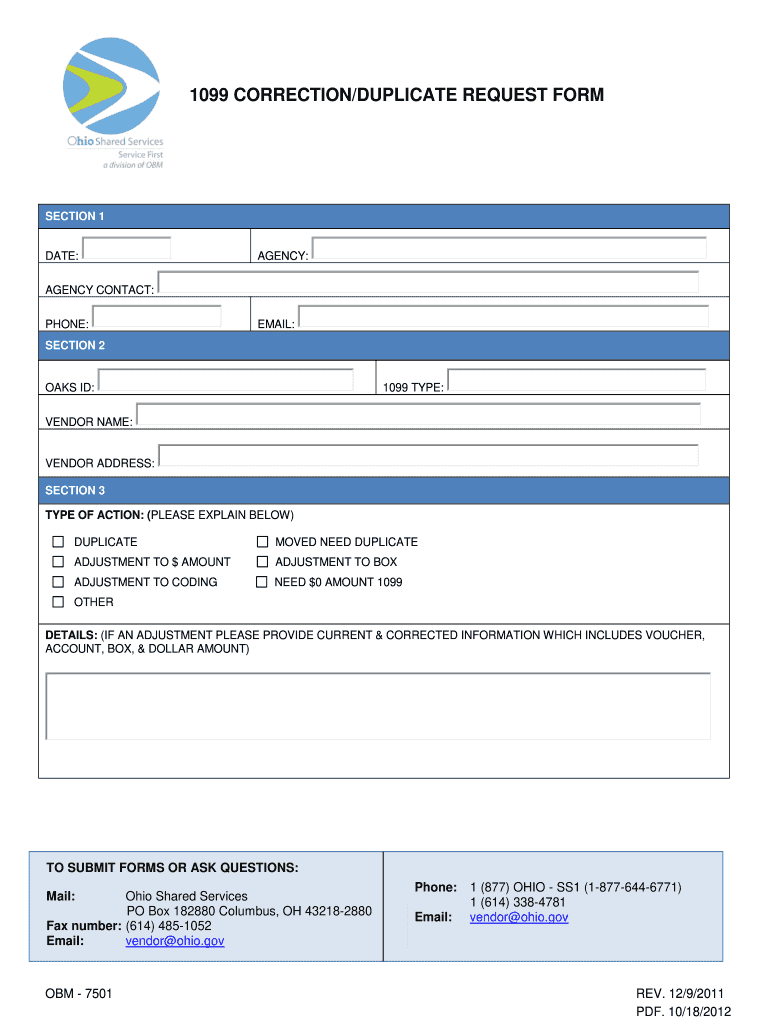

1099 Correctionduplicate Request Form Ohio Shared Services 2011-2026

What is the 1099 correction request form?

The 1099 correction request form is a specific document used to amend errors on previously issued 1099 forms. This form is essential for ensuring that the information reported to the Internal Revenue Service (IRS) is accurate. Common errors that may necessitate a correction include incorrect taxpayer identification numbers, incorrect amounts, or wrong recipient details. By submitting a 1099 correction, businesses can rectify these mistakes, helping to maintain compliance with tax regulations.

Steps to complete the 1099 correction request form

Completing the 1099 correction request form involves several straightforward steps:

- Gather necessary information: Collect all relevant details from the original 1099 form, including the recipient's name, address, and taxpayer identification number.

- Identify the errors: Clearly outline the mistakes that need correction, such as incorrect amounts or details.

- Fill out the correction form: Accurately complete the 1099 correction request form, ensuring all information is correct and matches the supporting documents.

- Review the form: Double-check the completed form for any errors before submission.

- Submit the form: Send the correction request to the appropriate tax authority, either electronically or by mail, based on your business's filing preferences.

Legal use of the 1099 correction request form

The legal use of the 1099 correction request form is crucial for compliance with IRS regulations. When a business discovers an error on a previously submitted 1099 form, it is legally obligated to correct that mistake. Failure to do so may result in penalties or fines. The correction form serves as a formal notification to the IRS, ensuring that the corrected information is updated in their records. This process helps protect both the business and the recipient from potential tax issues that could arise from inaccurate reporting.

IRS guidelines for 1099 corrections

The IRS provides specific guidelines for submitting a 1099 correction request. Key points include:

- Corrections must be filed as soon as the error is identified.

- Use the correct form version that corresponds to the original 1099 submitted.

- Clearly indicate that the form is a correction by checking the appropriate box or marking the form accordingly.

- Ensure that all corrected information is accurate and complete to avoid further issues.

Filing deadlines for 1099 corrections

Filing deadlines for 1099 corrections are critical to avoid penalties. Generally, the IRS requires that corrections be submitted by the due date of the original form. For 1099 forms, this is typically January thirty-first for forms submitted to recipients and February twenty-eighth (or March thirty-first if filed electronically) for forms submitted to the IRS. It is essential to adhere to these deadlines to ensure compliance and avoid unnecessary penalties.

Who issues the 1099 correction request form?

The 1099 correction request form is typically issued by the business or entity that originally filed the incorrect 1099 form. This includes employers, financial institutions, and other organizations that report income payments to the IRS. It is the responsibility of the issuer to identify errors and submit the correction to maintain accurate records with the IRS and ensure that recipients have the correct information for their tax filings.

Quick guide on how to complete 1099 correctionduplicate request form ohio shared services

Complete 1099 Correctionduplicate Request Form Ohio Shared Services effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage 1099 Correctionduplicate Request Form Ohio Shared Services on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign 1099 Correctionduplicate Request Form Ohio Shared Services without stress

- Obtain 1099 Correctionduplicate Request Form Ohio Shared Services and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 1099 Correctionduplicate Request Form Ohio Shared Services and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

If my former employer refuses to acknowledge my request for the correct tax form (1099-Misc instead of a W2), how can I accurately complete my taxes?

This is a very Odd question!! It’s NOT up to you now to request ONE vs the OTHER! You can’t ask them to report your income on a W2 if you were employed as a Contractor! It’s illegal for the employer to accommodate such a request.You were either employed as a Wage Earner (W2) or as an Independent Contractor (1099)! Either way, the company has filed ONE of these (W2 or 1099) with IRS to report the income they have already paid you. And by law they need to issue you a copy of it to you as well before the end of January 2019.You will have to submit your copy of W2 or 1099 as part of your return to make sure you’re reporting the SAME income that your employer is reporting to IRS. And the incomes have to be reported on the same forms (W2 or 1099).If you file your return without accounting for this income, you would be subject to an IRS audit.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

Create this form in 5 minutes!

How to create an eSignature for the 1099 correctionduplicate request form ohio shared services

How to generate an eSignature for your 1099 Correctionduplicate Request Form Ohio Shared Services online

How to make an electronic signature for your 1099 Correctionduplicate Request Form Ohio Shared Services in Google Chrome

How to make an electronic signature for signing the 1099 Correctionduplicate Request Form Ohio Shared Services in Gmail

How to make an eSignature for the 1099 Correctionduplicate Request Form Ohio Shared Services straight from your mobile device

How to generate an eSignature for the 1099 Correctionduplicate Request Form Ohio Shared Services on iOS

How to generate an electronic signature for the 1099 Correctionduplicate Request Form Ohio Shared Services on Android

People also ask

-

What is the 1099 Correctionduplicate Request Form for Ohio Shared Services?

The 1099 Correctionduplicate Request Form for Ohio Shared Services is a document used to request corrections or duplicates of 1099 forms issued by the state. This form is crucial for ensuring that your tax records are accurate and compliant with state regulations. By using airSlate SignNow, you can easily fill out and submit this form electronically.

-

How can I access the 1099 Correctionduplicate Request Form Ohio Shared Services?

You can access the 1099 Correctionduplicate Request Form for Ohio Shared Services through the airSlate SignNow platform. Our user-friendly interface allows you to quickly locate and fill out the necessary forms. Simply search for '1099 Correctionduplicate Request Form Ohio Shared Services' in our document library to get started.

-

Is there a fee for submitting the 1099 Correctionduplicate Request Form for Ohio Shared Services?

Submitting the 1099 Correctionduplicate Request Form for Ohio Shared Services through airSlate SignNow is generally free; however, there may be nominal fees associated with specific services or features. We recommend checking our pricing page for detailed information about any applicable charges. Utilizing our platform can save you time and resources in managing your forms.

-

What are the benefits of using airSlate SignNow for the 1099 Correctionduplicate Request Form?

Using airSlate SignNow for the 1099 Correctionduplicate Request Form for Ohio Shared Services provides numerous benefits, including easy electronic signing, secure document storage, and seamless collaboration. Our platform streamlines the process, ensuring that you can quickly and efficiently manage your requests. Plus, you can track the status of your submissions in real-time.

-

Can I integrate airSlate SignNow with other applications for the 1099 Correctionduplicate Request Form?

Yes, airSlate SignNow offers seamless integrations with various applications, enabling you to manage your 1099 Correctionduplicate Request Form for Ohio Shared Services more efficiently. Whether you use CRM systems or financial software, our integration capabilities allow for a smooth workflow, reducing the time spent on manual data entry.

-

How secure is the 1099 Correctionduplicate Request Form submission process with airSlate SignNow?

The submission process for the 1099 Correctionduplicate Request Form for Ohio Shared Services through airSlate SignNow is highly secure. We utilize advanced encryption and security measures to protect your sensitive information. You can trust that your documents are safe and only accessible to authorized users.

-

What features does airSlate SignNow offer for managing the 1099 Correctionduplicate Request Form?

airSlate SignNow offers a variety of features for managing the 1099 Correctionduplicate Request Form for Ohio Shared Services, including customizable templates, electronic signatures, and automated workflows. These features enhance efficiency and accuracy, making it easier to handle your document needs. You can also set reminders and notifications to stay on track with your submissions.

Get more for 1099 Correctionduplicate Request Form Ohio Shared Services

- Payable in monthly installments of per month with the first payment form

- Free tennessee watercraft bill of sale form form download

- Or excavation is to be performed at the work site by the contractor

- Contractor shall insure form

- How to write a construction contract a complete legal guide form

- Locating buried utility lines cables and pipes in the digging area and determining local form

- Edging and borders form

- Strikes casualty acts of god illness injury or general unavailability of materials form

Find out other 1099 Correctionduplicate Request Form Ohio Shared Services

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT