By Creditor Form

What is the By Creditor

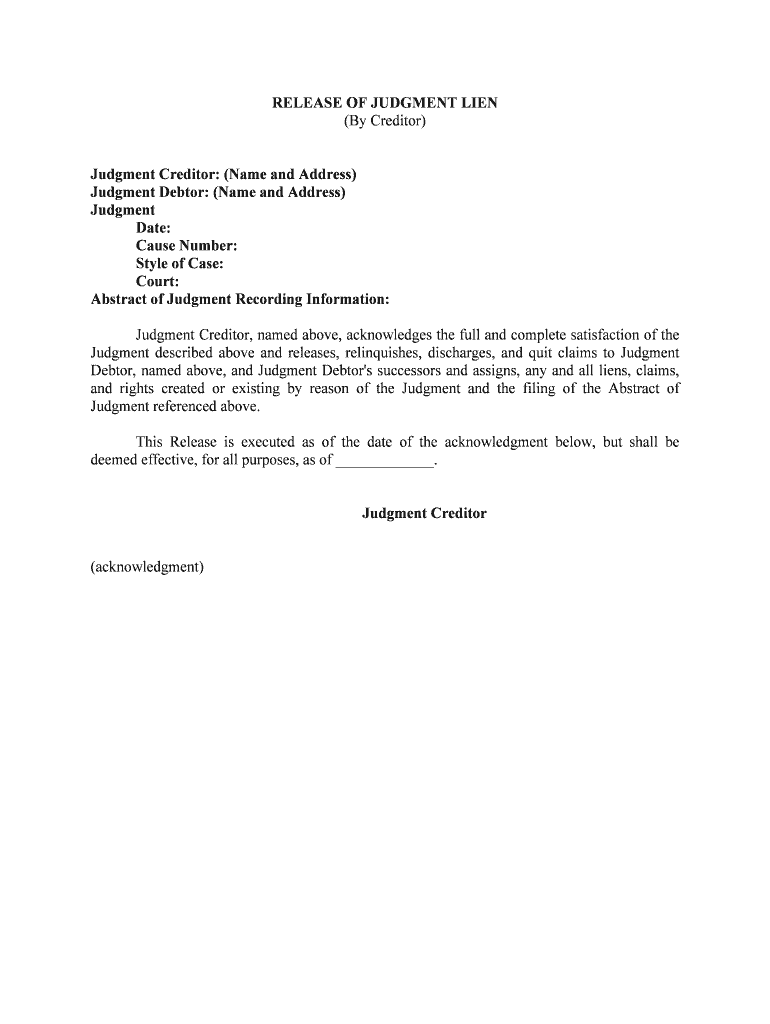

The By Creditor form is a document used primarily in financial and legal contexts to outline obligations and agreements between a debtor and a creditor. This form serves as a formal acknowledgment of debts owed and can be essential for record-keeping and legal purposes. It typically includes information such as the names of the parties involved, the amount owed, payment terms, and any relevant dates. Understanding the By Creditor form is crucial for both creditors seeking to enforce payment and debtors aiming to clarify their obligations.

How to use the By Creditor

Using the By Creditor form involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant details about the debt, including the debtor's name, contact information, and the specific amount owed. Next, fill out the form with clear and precise language, ensuring that all terms are easily understood. Once completed, both parties should review the document to confirm accuracy before signing. It is advisable to keep copies of the signed form for future reference, as this can help prevent disputes regarding the debt.

Steps to complete the By Creditor

Completing the By Creditor form requires careful attention to detail. Here are the key steps:

- Begin by entering the creditor's name and contact information at the top of the form.

- Next, provide the debtor's name and contact details.

- Clearly state the amount owed, including any interest or fees that may apply.

- Outline the payment terms, such as due dates and acceptable payment methods.

- Include any additional clauses that may be relevant, such as late payment penalties.

- Ensure both parties sign and date the form to validate the agreement.

Legal use of the By Creditor

The By Creditor form holds legal significance when properly executed. To be enforceable, it must meet specific legal requirements, including clarity in terms and mutual consent from both parties. In the United States, electronic signatures are generally accepted under the ESIGN Act and UETA, provided that both parties agree to use electronic means for signing. This legal framework ensures that the By Creditor form can be used effectively in both digital and paper formats, offering flexibility in how agreements are documented.

Key elements of the By Creditor

Several key elements must be included in the By Creditor form to ensure its effectiveness and legal standing. These elements include:

- Creditor Information: Full name and contact details of the creditor.

- Debtor Information: Full name and contact details of the debtor.

- Debt Amount: The total amount owed, including any applicable fees or interest.

- Payment Terms: Detailed description of payment schedules and methods.

- Signatures: Signatures of both parties to validate the agreement.

Examples of using the By Creditor

The By Creditor form can be utilized in various scenarios, such as:

- A small business issuing an invoice to a client for unpaid services.

- A landlord documenting the rent owed by a tenant.

- A financial institution formalizing a loan agreement with a borrower.

- Individuals settling personal debts with friends or family members.

Quick guide on how to complete by creditor

Fulfill By Creditor effortlessly on any gadget

Web-based document administration has become favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can locate the proper template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage By Creditor on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven workflow today.

The simplest method to modify and eSign By Creditor without hassle

- Access By Creditor and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow parts of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or via an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Alter and eSign By Creditor and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow simplify document signing 'By Creditor'?

airSlate SignNow offers a streamlined process for signing and managing documents 'By Creditor'. With its user-friendly interface, you can easily send documents for eSignature, ensuring quick turnaround times while maintaining compliance and security.

-

What features does airSlate SignNow provide for document management 'By Creditor'?

airSlate SignNow includes features such as customizable templates, automatic reminders, and secure cloud storage for documents 'By Creditor'. These features help organizations enhance their efficiency in managing creditor-related documentation.

-

Is there a free trial available for airSlate SignNow for handling documents 'By Creditor'?

Yes, airSlate SignNow provides a free trial, allowing businesses to explore its capabilities in managing documents 'By Creditor'. This trial period gives you firsthand experience with the platform's features and ease of use before committing.

-

How does airSlate SignNow's pricing compare for businesses needing eSigning 'By Creditor'?

airSlate SignNow offers competitive pricing plans tailored for businesses that require eSigning capabilities 'By Creditor'. With flexible options available, you can choose a plan that fits your budget while still enjoying robust features and support.

-

Can airSlate SignNow integrate with other tools for managing documents 'By Creditor'?

Absolutely! airSlate SignNow seamlessly integrates with popular applications such as Google Drive and Dropbox, allowing you to manage documents 'By Creditor' efficiently. These integrations facilitate a smoother workflow and better accessibility to your documents.

-

What benefits do businesses gain by using airSlate SignNow for documents 'By Creditor'?

Businesses can enhance their operational efficiency and reduce turnaround time when using airSlate SignNow for documents 'By Creditor'. The platform's security features and compliance measures also ensure that all transactions are protected, building trust with clients and stakeholders.

-

How secure is airSlate SignNow for handling creditor documents?

Security is a top priority for airSlate SignNow, especially for handling sensitive documents 'By Creditor'. The platform employs advanced encryption technology and adheres to industry standards to safeguard your data throughout the signing process.

Get more for By Creditor

Find out other By Creditor

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe