Employer's Job Description for Disability Application Psers Psers State Pa 2012-2026

Understanding the Employer's Job Description for the PSERS Disability Application

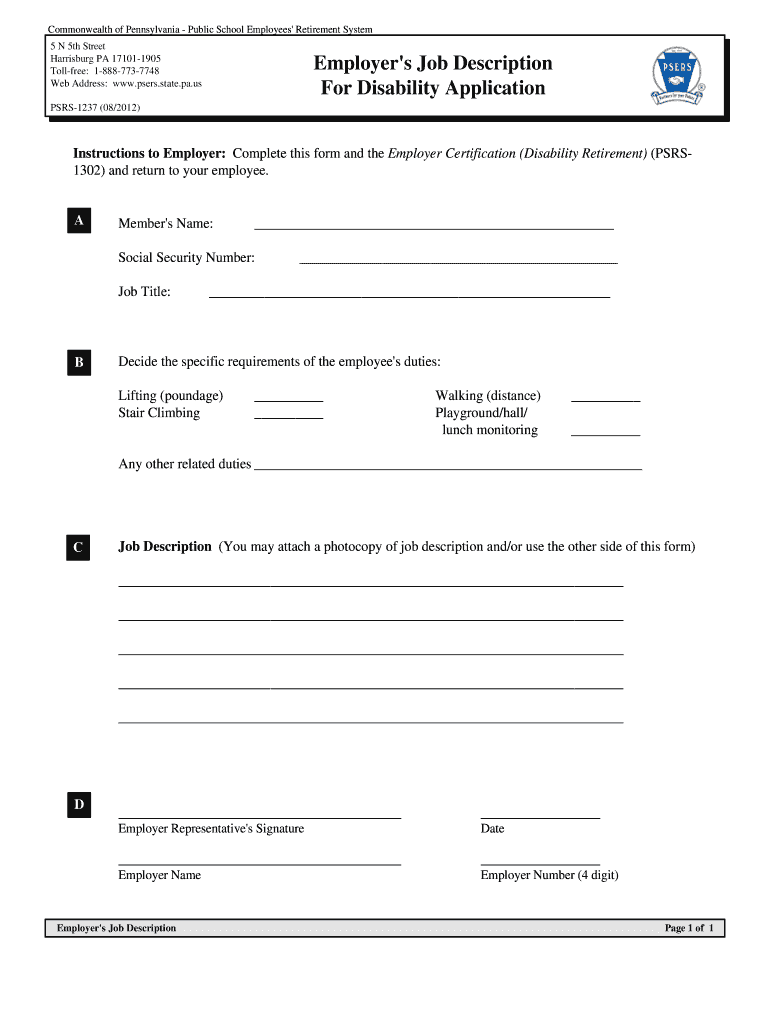

The Employer's Job Description is a crucial component of the Pennsylvania PSERS (Public School Employees' Retirement System) disability application process. This document outlines the specific duties and responsibilities of the employee's position, providing essential context for evaluating disability claims. It serves as a formal record that helps assess whether the applicant's condition impacts their ability to perform their job effectively.

When preparing this description, employers should ensure it accurately reflects the job's requirements, including physical, mental, and emotional demands. This clarity is vital for the PSERS review process, as it directly influences the determination of eligibility for disability retirement benefits.

Steps to Complete the Employer's Job Description for the PSERS Disability Application

Completing the Employer's Job Description for the PSERS disability application involves several key steps:

- Gather Job Information: Collect detailed information about the employee's role, including job title, duties, and required skills.

- Document Job Responsibilities: Clearly outline the essential functions of the job, including any physical or cognitive tasks necessary for performance.

- Review for Accuracy: Ensure that the description is accurate and up-to-date, reflecting any recent changes in job duties.

- Sign and Date: The employer must sign and date the document to validate its authenticity before submission.

Following these steps helps ensure that the job description is comprehensive and compliant with PSERS requirements.

Legal Use of the Employer's Job Description for the PSERS Disability Application

The Employer's Job Description must adhere to legal standards to be considered valid in the PSERS disability application process. It should accurately represent the job's requirements and be free from any misleading information. This document may be subject to review during the application process, and any discrepancies could lead to delays or denials of benefits.

Employers should familiarize themselves with relevant laws and regulations regarding disability documentation to ensure compliance. This includes understanding the Americans with Disabilities Act (ADA) and other applicable state laws that govern employment and disability rights.

Key Elements of the Employer's Job Description for the PSERS Disability Application

Several key elements should be included in the Employer's Job Description to enhance its effectiveness:

- Job Title: Clearly state the employee's position.

- Job Duties: List the primary responsibilities and tasks associated with the role.

- Physical Requirements: Detail any physical demands, such as lifting, standing, or walking.

- Cognitive Requirements: Include any mental or emotional skills necessary for job performance.

- Work Environment: Describe the typical work conditions, including any hazards or unique aspects of the job.

Incorporating these elements ensures that the job description is thorough and provides the necessary context for the PSERS review process.

Obtaining the Employer's Job Description for the PSERS Disability Application

Employers can obtain a template or guidance for the Employer's Job Description through various resources. The PSERS website may provide sample forms or guidelines tailored to the disability application process. Additionally, human resources departments often have standardized templates that can be adapted for this purpose.

It is essential to ensure that any template used is current and compliant with PSERS standards. Employers should also consider consulting with legal or HR professionals to ensure that the job description meets all necessary requirements.

Quick guide on how to complete employerampamp39s job description for disability application psers psers state pa

Optimize your HR workflows with Employer's Job Description For Disability Application Psers Psers State Pa Template

Every HR expert recognizes the importance of maintaining employees’ data organized and systematized. With airSlate SignNow, you gain access to an extensive collection of state-specific labor documents that signNowly ease the retrieval, management, and archiving of all employment-related paperwork in one location. airSlate SignNow enables you to oversee Employer's Job Description For Disability Application Psers Psers State Pa management from start to finish, with robust editing and eSignature functionalities available whenever you need them. Enhance your accuracy, document protection, and eliminate minor manual errors in just a few clicks.

The optimal method for editing and eSigning Employer's Job Description For Disability Application Psers Psers State Pa:

- Identify the appropriate state and look for a form you need.

- Access the form page and click Get Form to begin processing it.

- Wait for Employer's Job Description For Disability Application Psers Psers State Pa to upload in the editor and adhere to the prompts indicating required fields.

- Input your information or add additional fillable fields to the document.

- Utilize our tools and features to alter your form as necessary: annotate, redact sensitive data, and create an eSignature.

- Review your form for any mistakes before moving forward with its submission.

- Click Done to save changes and download your document.

- Alternatively, send your document directly to your recipients and gather signatures and information.

- Securely store completed forms in your airSlate SignNow account and access them whenever you wish.

Employing an adaptable eSignature solution is crucial when handling Employer's Job Description For Disability Application Psers Psers State Pa. Simplify even the most intricate workflow with ease using airSlate SignNow. Start your free trial today to learn what you can achieve with your department.

Create this form in 5 minutes or less

FAQs

-

How much paperwork does an employer have to fill out if an employee quits without putting their two weeks in?

Generally an exit interview is required to return company's items including but not limited to software. Hardware, passwords, company cars and more. The Dept head should sign as well as all the way up the ladder until human resources is satisfied with a clean break of employment

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

When I filled out my insurance form from my employer, they asked if I smoke. How can they verify this?

They can probably tell by smelling your breath or looking at your teeth, but no one is gong to challenge what you put on the form.HOWEVER…What will happen if you develop a smoking-related illness is that the insurance company can deny coverage based on your fraud when filling out the forms.That’s they way insurance contracts always work. For example, you could get cheaper car insurance if you tell them your car is a cheaper model. Then, if you have an accident and put in a claim to repair a more costly model, they deny it saying that’s not the car they insured. Or perhaps you have a homeowner policy in which you declared all electrical work had be done by licensed electricians. Then there is a fire and they find you had done some of your own wiring to finish a basement room. Coverage denied.So, no one is going to question your answers. But the insurance will be pretty worthless if you lie on the application. They will accept your statements as fact and take your money, but when it comes time to collect, they can deny payment based on your lies.

-

How should I fill out an employment background check form if I have a criminal history? (The background check is post-offer.)

When looking for records on the net try a website such as backgroundtool.com It is both open public and also exclusive information. It will go further than what just one supplier is able to do for you or what yahoo and google might present you with. You have entry to public information, social websites analysis, a all round world wide web research, court public records, criminal offender records, mobile phone data (both open public and exclusive repositories ), driving information and a lot more.How should I fill out an employment background check form if I have a criminal history? (The background check is post-offer.)Understand Employment Background ChecksWhat Is A Background Check? - An Employment Background Check may be best described as an Application Verification. An employment background check allows an employer to verify information provided by an applicant on a resume or job application. Independent sources such as criminal and civil court records, prior employers, educational institutions, and departments of motor vehicles are researched. The information obtained is then compared to the information provided by the applicant and reviewed for any negative material.Most Employers Do Background Checks - Most employers do some form of an employment background check. This can be as simple a reference check, or as in-depth as covering everything from criminal record checks to interviewing friends and neighbors.Why Employers Do Background Checks - Employers conduct background checks to meet regulatory, insurance, and customer requirements; increase applicant and new hire quality; reduce workplace violence; avoid bad publicity; protect against negligent hiring liability; reduce employee dishonesty losses; reduce employee turnover; and hire the right person the first time. An employer has the obligation to provide a safe workplace for employees, customers, and the public. See Why Background Checks?What Do They Look For In A Background Check? - Employers look for discrepancies between an applicant’s claims and what is reported by schools, prior employers, etc. They also look for negative reports such as a bad Driving Record or a Criminal History that would impact the applicant's job qualifications. See What Do Employers Look For in a Background Check?What Is In A Background Check For Employment? - Anything from an applicant's history CAN come up. It depends how detailed the background check is, who conducts the background check, how far back they go, who they talk to, what information they check, and what laws apply in the particular situation. If there are any black marks in an applicant's past, it is pretty hard to keep them a secret. See What Shows Up On A Background Check For Employment?A typical basic background check may include county criminal record checks, a social security number scan, employment history verification, and education verification. Depending on the job, a more complete background check may include common items such as a motor vehicle report, a credit report, license and certification verification, reference checks, a sex offender registry check, or county civil record searches. See Comprehensive Background Check.Your Rights - The FCRA (Fair Credit Reporting Act) is the primary federal law regulating employment background checks. Despite its name the FCRA applies to all employment backgrounds checks conducted by a third party whether they include a credit report or not. See A Summary of Your Rights Under the Fair Credit Reporting Act.In addition to the FCRA, there are many other Federal, State, and Local laws and regulations that may impact a particular employment background check. See Background Check Laws & Regulations.

-

I want to invest my IRS withholdings. How do I fill out a W-4 so my employer does not do federal withholding?

Legally you can’t. Those withholdings are not yours. They are payments towards your tax liability, made at the time that you earn the income. Pay as you go. It makes sense.So what you want to do is borrow money that isn’t really yours, interest free, invest it for a few months, and then pay it back the next year. Is that correct? While it’s not really permitted you can manage to get away with it. You can’t easily get away with stopping all withholding. That requires stating that you expect to pay zero taxes for the year, which you know is false. It looks suspicious and is easy for the feds to check. Instead, what you can do is reduce your withholding by claiming a large number of exemptions. That’s not nearly as suspicious. When you complete your return you’ll owe a lot of tax, which is clearly against the rules, but you’ll probably get away with it at least for a year or two and maybe longer depending on how lax the IRS is in enforcing the law on scamsters like yourself.I used to claim a large number of exemptions. It was legitimate since I actually had a lot of deductions at that time. But a couple of years I accidentally withheld too little money, more than a couple of thousand dollars. I paid the tax with my return and adjusted my withholding going forward and the IRS didn’t penalize me or question it afterwards. But if you’re talking about under withholding by a lot more than that and year after year then good luck. You might get caught, forced to pay a penalty and interest, and be flagged for special attention in the future.

-

If an old employer closed down its business, how do you fill out the "phone" section of an online job application?

This happened to me. I just put the last number I had available, and let HR figure it out. Not my problem. I also got one of the jobs I was applying for with this situation . I really doubt they put as much stock in these "verification of employment things" as long as there is not a pattern of inconsistent information on the rest of the application.

-

How do I fill out the employment and income section on the UK visa application if sponsored by a partner?

The answer depends on what kind of visa you are seeking, and also what you mean by the word “sponsored”…If you wish to VISIT the UK then all that your partner can do is cover the costs of your trip. The visa officer still needs to be sure that you are likely to return home after your holiday, and usually that means that you have to demonstrate that you have a decent job and a reasonable income at home.If you wish to SETTLE in the UK then what is important is your partner’s income, since that income will have to support you as well. Information about what you earn in your home country is not really relevant, since presumably you would be leaving your job in order to move to Britain.

Create this form in 5 minutes!

How to create an eSignature for the employerampamp39s job description for disability application psers psers state pa

How to make an eSignature for the Employerampamp39s Job Description For Disability Application Psers Psers State Pa in the online mode

How to create an eSignature for the Employerampamp39s Job Description For Disability Application Psers Psers State Pa in Chrome

How to generate an electronic signature for signing the Employerampamp39s Job Description For Disability Application Psers Psers State Pa in Gmail

How to create an eSignature for the Employerampamp39s Job Description For Disability Application Psers Psers State Pa straight from your smart phone

How to create an eSignature for the Employerampamp39s Job Description For Disability Application Psers Psers State Pa on iOS

How to create an eSignature for the Employerampamp39s Job Description For Disability Application Psers Psers State Pa on Android

People also ask

-

What is airSlate SignNow and how does it relate to psers pa?

airSlate SignNow is a powerful eSignature solution that enables users to send and sign documents effortlessly. For those dealing with psers pa, this platform ensures secure and compliant document management, essential for maintaining accurate records.

-

How does airSlate SignNow pricing work for psers pa users?

We offer flexible pricing plans for airSlate SignNow, tailored to fit various budgets and needs, including users involved with psers pa. Our solutions range from basic to advanced features, ensuring that organizations of all sizes can find a plan that suits their workflow and budget.

-

What features does airSlate SignNow offer that benefit psers pa organizations?

airSlate SignNow includes several features beneficial for psers pa organizations, such as the ability to create templates, send reminders, and manage documents efficiently. This enhances productivity and streamlines the signing process, making it ideal for administrative tasks.

-

Can airSlate SignNow easily integrate with other tools for psers pa?

Yes, airSlate SignNow offers seamless integrations with various applications, making it a perfect fit for psers pa workflows. Whether you use CRM systems, project management tools, or cloud storage services, our platform ensures all your tools work together smoothly.

-

What security features does airSlate SignNow provide for psers pa documentation?

Security is a top priority for airSlate SignNow, especially for sensitive psers pa documentation. Our platform employs industry-standard encryption and secure access controls to protect your documents, ensuring that your data remains safe and confidential.

-

How does airSlate SignNow improve efficiency for psers pa users?

By simplifying the signing process, airSlate SignNow helps psers pa users save time and reduce administrative burdens. With features like bulk sending and automated workflows, organizations can quickly get documents signed and returned, enhancing overall efficiency.

-

Is there customer support available for psers pa users of airSlate SignNow?

Yes, airSlate SignNow provides dedicated customer support for all users, including those involved in psers pa. Our team is ready to assist you with any inquiries, ensuring that you can maximize the benefits of our eSignature solution.

Get more for Employer's Job Description For Disability Application Psers Psers State Pa

- Control number mi p093 pkg form

- City indiana form

- Free michigan real estate power of attorney form pdf

- Foreclosure and eviction for homeownersmichigan legal help form

- Pc 100 petition for emancipation affidavit and waiver of form

- Petition to rescind order of emancipation form

- Petition to rescind form

- Petition for treatment form

Find out other Employer's Job Description For Disability Application Psers Psers State Pa

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure