RELEASE of MORTGAGEDEED of TRUST Form

What is the release of mortgage deed of trust

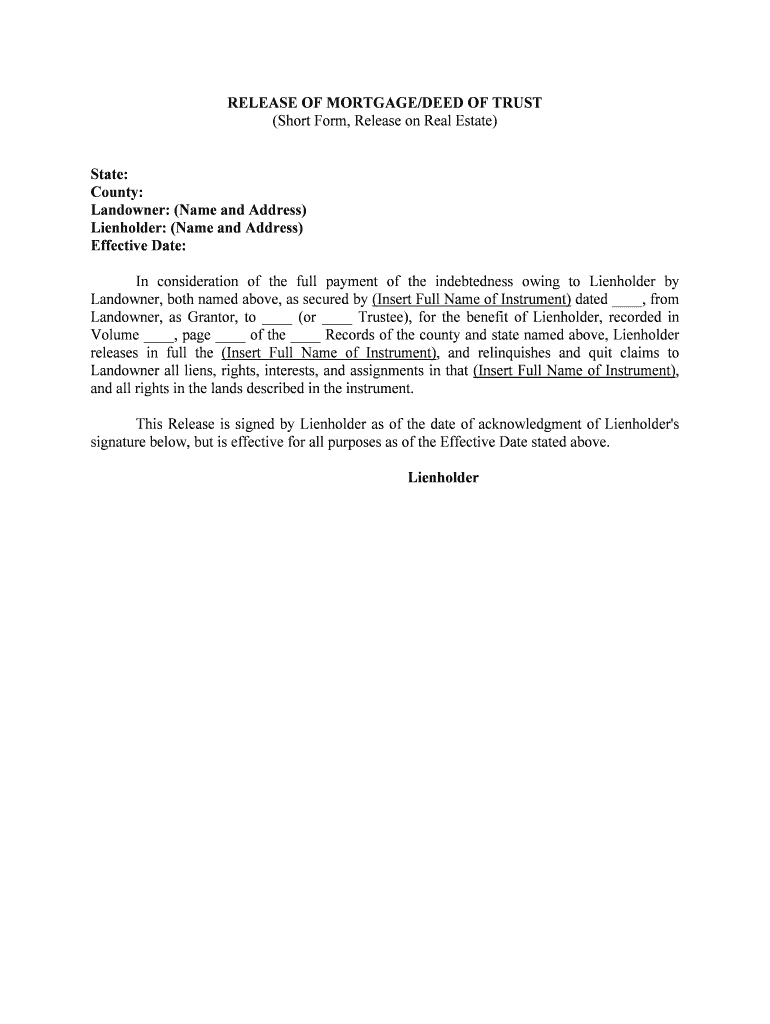

The release of mortgage deed of trust is a legal document that signifies the termination of a mortgage or deed of trust. This document is essential in confirming that the borrower has fulfilled their obligations under the loan agreement, and it formally releases the lender's claim on the property. Once executed, the release is recorded in the appropriate county office, ensuring that public records reflect the property's clear title.

How to use the release of mortgage deed of trust

Using the release of mortgage deed of trust involves several steps. First, ensure that all loan payments have been made in full. Next, the lender prepares the release document, which must include specific details such as the names of the parties involved, the property description, and the original loan information. After the document is signed, it should be filed with the local county recorder's office to update the public records. This process is crucial for protecting the borrower's ownership rights.

Steps to complete the release of mortgage deed of trust

Completing the release of mortgage deed of trust involves the following steps:

- Confirm that the mortgage or deed of trust has been fully paid.

- Obtain the release document from the lender, ensuring it includes all necessary details.

- Sign the document in the presence of a notary public, if required by state law.

- File the signed release with the local county recorder's office.

- Keep a copy of the filed release for personal records.

Legal use of the release of mortgage deed of trust

The release of mortgage deed of trust serves a vital legal purpose. It is a formal acknowledgment that the borrower has satisfied their debt obligations, which is essential for maintaining clear property titles. This document protects the borrower from future claims by the lender and is often required when selling or refinancing the property. Ensuring that this release is properly executed and recorded is crucial for legal protection in real estate transactions.

Key elements of the release of mortgage deed of trust

Several key elements must be included in the release of mortgage deed of trust to ensure its validity:

- The names of the borrower and lender.

- The legal description of the property.

- The date of the original mortgage or deed of trust.

- A statement confirming that the loan has been paid in full.

- The signature of the lender or authorized representative.

State-specific rules for the release of mortgage deed of trust

Each state in the U.S. may have specific requirements regarding the release of mortgage deed of trust. These can include variations in the notarization process, filing fees, and the time frame for recording the release. It is important for borrowers to familiarize themselves with their state's rules to ensure compliance and avoid potential legal issues. Consulting with a local real estate attorney can provide clarity on these regulations.

Quick guide on how to complete release of mortgagedeed of trust

Effortlessly Prepare RELEASE OF MORTGAGEDEED OF TRUST on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Manage RELEASE OF MORTGAGEDEED OF TRUST on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Modify and eSign RELEASE OF MORTGAGEDEED OF TRUST with Ease

- Obtain RELEASE OF MORTGAGEDEED OF TRUST and select Get Form to begin.

- Leverage the tools available to submit your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specially provides for this function.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal authenticity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing fresh copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign RELEASE OF MORTGAGEDEED OF TRUST and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the RELEASE OF MORTGAGEDEED OF TRUST process?

The RELEASE OF MORTGAGEDEED OF TRUST process involves officially removing a mortgage lien from a property. This typically occurs once a mortgage loan is fully paid off, indicating that the borrower has satisfied their financial obligations. Using airSlate SignNow, you can streamline this process by electronically signing and sending documents, making it quick and easy.

-

How can airSlate SignNow help with the RELEASE OF MORTGAGEDEED OF TRUST?

airSlate SignNow is designed to facilitate the RELEASE OF MORTGAGEDEED OF TRUST by providing an efficient platform for eSigning necessary documents. Our solution simplifies the workflow, allowing you to manage, send, and sign mortgage release documents seamlessly. This not only saves time but also reduces the chances of errors in documentation.

-

What are the pricing options for using airSlate SignNow for RELEASE OF MORTGAGEDEED OF TRUST?

airSlate SignNow offers flexible pricing options tailored to your business needs, including monthly and annual subscriptions. Each plan provides access to features that make the RELEASE OF MORTGAGEDEED OF TRUST process more efficient. For specific pricing details, please visit our website or contact our sales team for personalized assistance.

-

What features does airSlate SignNow offer for managing the RELEASE OF MORTGAGEDEED OF TRUST?

Our platform offers an array of features for managing the RELEASE OF MORTGAGEDEED OF TRUST, including customizable templates, automated workflows, and secure cloud storage. These features help you keep track of your documents and ensure all parties involved can access and sign documents efficiently. Enhanced security measures also protect sensitive information throughout the process.

-

Is airSlate SignNow suitable for businesses of all sizes for RELEASE OF MORTGAGEDEED OF TRUST?

Yes, airSlate SignNow is suitable for businesses of all sizes looking to streamline the RELEASE OF MORTGAGEDEED OF TRUST process. Whether you're a small business or a large enterprise, our platform adapts to your specific needs, ensuring you can easily manage and execute mortgage release documents. The user-friendly interface makes it accessible for everyone.

-

What integrations does airSlate SignNow support for the RELEASE OF MORTGAGEDEED OF TRUST?

airSlate SignNow supports various integrations with popular tools and platforms, enhancing your ability to manage the RELEASE OF MORTGAGEDEED OF TRUST efficiently. You can easily connect with CRM systems, document management software, and cloud storage services. This integration flexibility allows for a smoother workflow across your business processes.

-

How secure is the process of using airSlate SignNow for RELEASE OF MORTGAGEDEED OF TRUST?

Security is a top priority for airSlate SignNow, especially for sensitive processes like the RELEASE OF MORTGAGEDEED OF TRUST. Our platform uses advanced encryption and secure access controls to protect your documents and data. Additionally, we comply with industry standards to ensure that all signed documents are verifiable and legally binding.

Get more for RELEASE OF MORTGAGEDEED OF TRUST

- Call n ride call n ride cnr montgomery county maryland form

- 604 school attendance verification form 488898162

- Anne arundel county lien certificate form

- New student form

- Anne arundel county lien certificate 202913759 form

- Pre enrollment survey form

- Community service hours log sheet 2017 2018 form

- New student admission new student admission application form

Find out other RELEASE OF MORTGAGEDEED OF TRUST

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF