How to Value Overriding Royalty Interests Mercer Capital Form

What is the How To Value Overriding Royalty Interests Mercer Capital

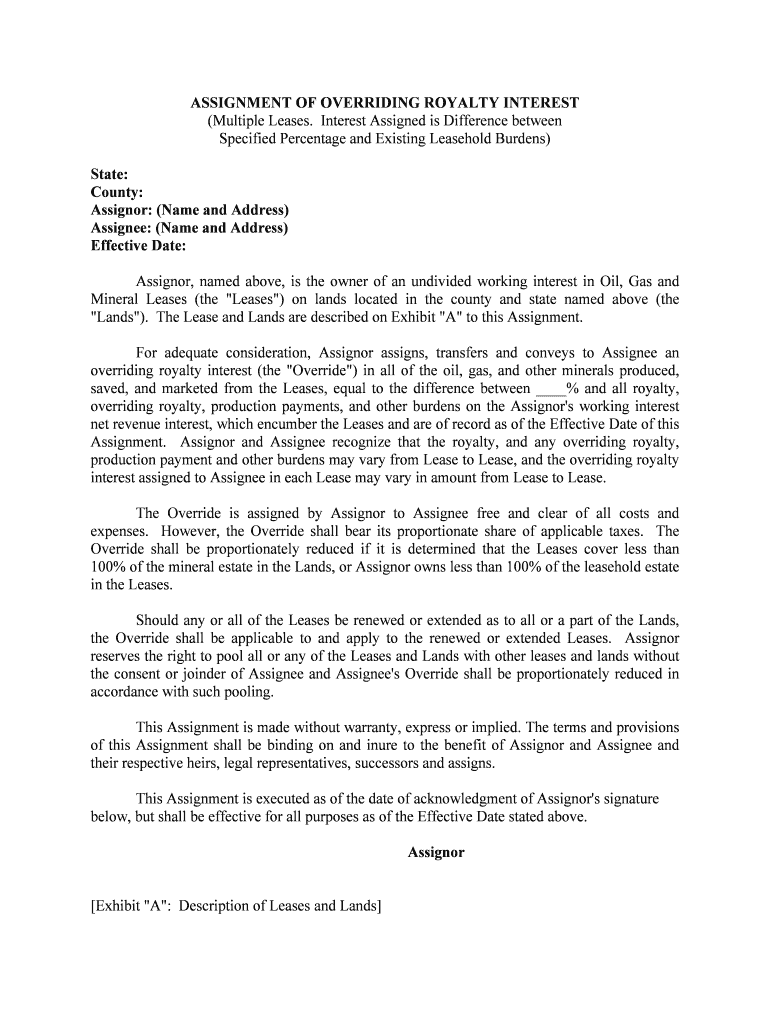

The How To Value Overriding Royalty Interests Mercer Capital form is a specialized document used to assess the value of overriding royalty interests in the oil and gas industry. Overriding royalty interests are a type of non-operating interest that entitles the holder to a percentage of the production revenue without bearing any operational costs. This form is essential for stakeholders, including investors and companies, to determine the financial implications of these interests accurately.

Steps to complete the How To Value Overriding Royalty Interests Mercer Capital

Completing the How To Value Overriding Royalty Interests Mercer Capital form involves several key steps:

- Gather all relevant information about the overriding royalty interests, including production data and market conditions.

- Assess the current value of the underlying assets, such as oil and gas reserves.

- Calculate the expected revenue based on production forecasts and market prices.

- Input all necessary data into the form, ensuring accuracy and completeness.

- Review the form for any errors before submission.

Legal use of the How To Value Overriding Royalty Interests Mercer Capital

The legal use of the How To Value Overriding Royalty Interests Mercer Capital form is governed by various regulations and industry standards. It is crucial for the form to comply with federal and state laws regarding mineral rights and royalties. Proper execution of this form ensures that the interests are recognized legally, which can prevent disputes and facilitate smoother transactions in the oil and gas sector.

Key elements of the How To Value Overriding Royalty Interests Mercer Capital

Key elements of the How To Value Overriding Royalty Interests Mercer Capital form include:

- Identification of the parties involved in the transaction.

- Detailed description of the overriding royalty interests being valued.

- Market analysis and valuation methodologies used.

- Signatures of all parties to validate the agreement.

Examples of using the How To Value Overriding Royalty Interests Mercer Capital

Examples of using the How To Value Overriding Royalty Interests Mercer Capital form can include:

- Determining the value of royalty interests for investment purposes.

- Facilitating the sale or transfer of interests between parties.

- Assessing interests for tax reporting and compliance.

Form Submission Methods (Online / Mail / In-Person)

The How To Value Overriding Royalty Interests Mercer Capital form can typically be submitted through various methods, including:

- Online submission via designated platforms that support electronic filing.

- Mailing the completed form to the appropriate regulatory body or organization.

- In-person submission at relevant offices, if required.

Quick guide on how to complete how to value overriding royalty interests mercer capital

Prepare How To Value Overriding Royalty Interests Mercer Capital effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Handle How To Value Overriding Royalty Interests Mercer Capital on any device using airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

The easiest way to edit and eSign How To Value Overriding Royalty Interests Mercer Capital without hassle

- Locate How To Value Overriding Royalty Interests Mercer Capital and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important parts of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign How To Value Overriding Royalty Interests Mercer Capital and guarantee smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of knowing how to value overriding royalty interests?

Understanding how to value overriding royalty interests is crucial for investors and stakeholders in the energy sector. Accurate valuations help in making informed decisions regarding investments and acquisitions. At Mercer Capital, we guide you on how to value these interests to maximize your financial returns.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a robust suite of features including eSignature capabilities, document templates, and secure cloud storage. These features facilitate efficient document management, crucial for professionals looking to manage contracts related to how to value overriding royalty interests. Our platform ensures you can easily and securely execute important documents.

-

How can airSlate SignNow help streamline valuation processes?

Using airSlate SignNow can signNowly streamline your valuation processes. Our platform allows you to quickly send and eSign documents that are essential for valuing overriding royalty interests. This efficiency can save time and reduce the complexities associated with traditional methods of document handling.

-

Is airSlate SignNow affordable for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing structure is transparent and competitive, making it accessible for small businesses needing to understand how to value overriding royalty interests without breaking the bank. We believe in providing value at an affordable price.

-

What integrations does airSlate SignNow offer?

airSlate SignNow offers seamless integrations with various third-party applications, including CRM and project management tools. These integrations allow businesses to manage their document workflows more effectively, especially when dealing with critical processes like how to value overriding royalty interests. This flexibility enhances productivity and collaboration.

-

How secure is airSlate SignNow for managing sensitive documents?

Security is a top priority at airSlate SignNow. We implement robust encryption and compliance measures to ensure that your sensitive documents remain protected. When dealing with how to value overriding royalty interests, you can trust our platform to safeguard your important data.

-

Can airSlate SignNow assist with compliance in document signing?

Absolutely, airSlate SignNow is designed to help businesses maintain compliance with legally binding eSignature laws. Our solution includes features that assist users in ensuring they are compliant while handling documents related to how to value overriding royalty interests. This minimizes the risk of legal issues arising from improper documentation.

Get more for How To Value Overriding Royalty Interests Mercer Capital

Find out other How To Value Overriding Royalty Interests Mercer Capital

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure