Example 2 Adjustments of Rent Complex Operating Expense Form

What is the Example 2 Adjustments Of Rent Complex Operating Expense

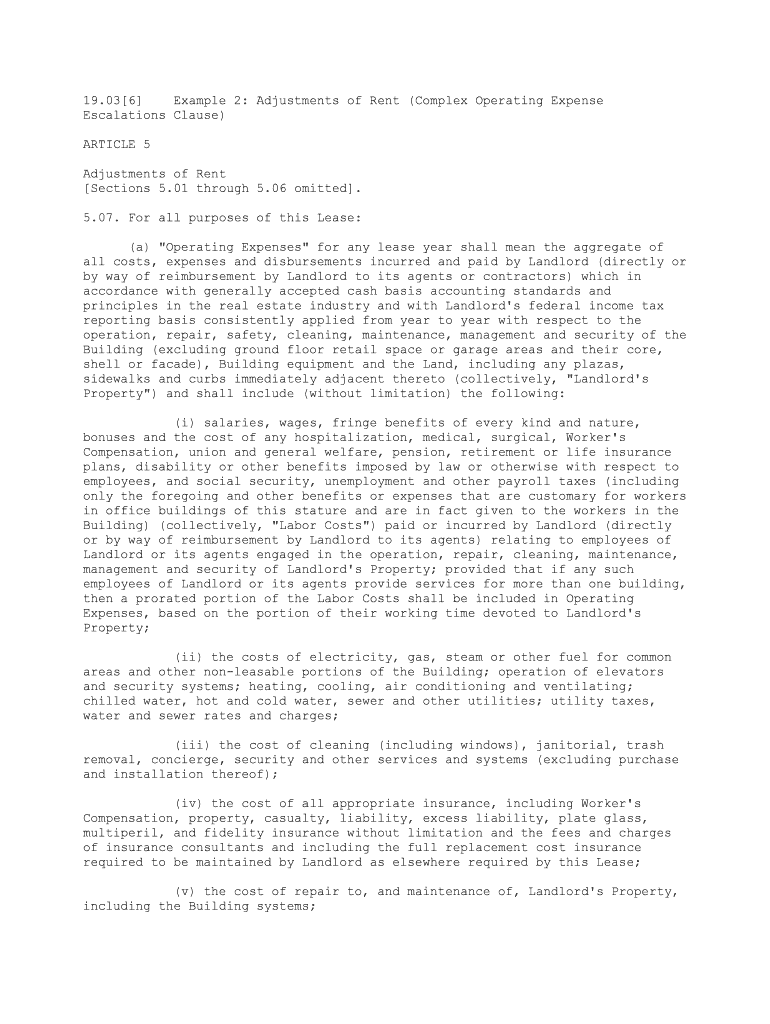

The Example 2 Adjustments Of Rent Complex Operating Expense form is a crucial document used primarily in the context of property management and real estate. It allows property owners and managers to adjust rental expenses based on various operational factors. This form is essential for accurately reflecting the financial status of a rental property, ensuring that both landlords and tenants have a clear understanding of the costs associated with property management.

How to use the Example 2 Adjustments Of Rent Complex Operating Expense

Using the Example 2 Adjustments Of Rent Complex Operating Expense form involves several steps. First, gather all relevant financial documents related to the property, including previous operating expense records. Next, fill out the form by detailing the adjustments needed, such as changes in maintenance costs or utility expenses. Ensure that all calculations are accurate to prevent discrepancies. Finally, submit the completed form to the appropriate parties, such as tenants or property management companies, to formalize the adjustments.

Steps to complete the Example 2 Adjustments Of Rent Complex Operating Expense

Completing the Example 2 Adjustments Of Rent Complex Operating Expense form requires careful attention to detail. Follow these steps:

- Review previous operating expense records to identify areas needing adjustment.

- Clearly outline each adjustment, providing a rationale for the changes.

- Calculate the total adjusted operating expenses accurately.

- Ensure all necessary signatures are obtained from relevant parties.

- Submit the completed form to the designated recipients.

Key elements of the Example 2 Adjustments Of Rent Complex Operating Expense

Several key elements must be included in the Example 2 Adjustments Of Rent Complex Operating Expense form to ensure its effectiveness:

- Property Information: Include the address and details of the property in question.

- Adjustment Details: Clearly specify each adjustment, including the type of expense and the amount.

- Justification: Provide a brief explanation for each adjustment to clarify the reasons behind the changes.

- Signatures: Ensure that all relevant parties sign the document to validate the adjustments.

Legal use of the Example 2 Adjustments Of Rent Complex Operating Expense

The legal use of the Example 2 Adjustments Of Rent Complex Operating Expense form is essential for maintaining compliance with rental agreements and local laws. This form serves as a formal record of any changes made to rental expenses, which can be critical in disputes or audits. By ensuring that the form is completed accurately and signed by all parties, property managers protect themselves from potential legal issues that may arise from misunderstandings regarding operating expenses.

Examples of using the Example 2 Adjustments Of Rent Complex Operating Expense

There are various scenarios in which the Example 2 Adjustments Of Rent Complex Operating Expense form may be utilized:

- Adjusting rent due to increased maintenance costs after a major repair.

- Modifying rental expenses based on changes in utility rates.

- Implementing adjustments following a property inspection that reveals unforeseen expenses.

Quick guide on how to complete example 2 adjustments of rent complex operating expense

Effortlessly Prepare Example 2 Adjustments Of Rent Complex Operating Expense on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without setbacks. Handle Example 2 Adjustments Of Rent Complex Operating Expense on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Alter and eSign Example 2 Adjustments Of Rent Complex Operating Expense with Minimal Effort

- Find Example 2 Adjustments Of Rent Complex Operating Expense and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries over lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Example 2 Adjustments Of Rent Complex Operating Expense and ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Example 2 Adjustments Of Rent Complex Operating Expense in airSlate SignNow?

Example 2 Adjustments Of Rent Complex Operating Expense are specific financial calculations used to modify rent expenses based on operational costs. In airSlate SignNow, we seamlessly integrate this adjustment into our document management process, ensuring that all involved parties can easily understand and agree on rental modifications.

-

How does airSlate SignNow help streamline Example 2 Adjustments Of Rent Complex Operating Expense?

airSlate SignNow simplifies the process of handling Example 2 Adjustments Of Rent Complex Operating Expense by providing a user-friendly platform for document sharing and eSigning. This eliminates paperwork delays and reduces the risk of errors in rent adjustments, allowing for quicker resolutions.

-

What are the pricing options for airSlate SignNow's services related to Example 2 Adjustments Of Rent Complex Operating Expense?

Our pricing is designed to be flexible and affordable, accommodating businesses of all sizes. For those interested in managing Example 2 Adjustments Of Rent Complex Operating Expense, we offer several plans that provide access to all essential features, including document templates and eSignature functionalities.

-

Can I customize documents for Example 2 Adjustments Of Rent Complex Operating Expense in airSlate SignNow?

Yes, airSlate SignNow allows for extensive document customization, enabling you to specify terms related to Example 2 Adjustments Of Rent Complex Operating Expense. You can create templates that include necessary fields and instructions, ensuring clarity and compliance in every document.

-

What features should I look for in airSlate SignNow for managing Example 2 Adjustments Of Rent Complex Operating Expense?

Key features to look for include template creation, bulk sending, automatic reminders, and secure storage. These functionalities will enhance your experience when managing Example 2 Adjustments Of Rent Complex Operating Expense, making the process more efficient and reliable.

-

Are there any integrations available for handling Example 2 Adjustments Of Rent Complex Operating Expense?

Absolutely! airSlate SignNow integrates with various third-party applications, allowing you to streamline your workflow around Example 2 Adjustments Of Rent Complex Operating Expense. You can connect with CRM, accounting software, and project management tools to ensure a cohesive operational process.

-

How secure is the airSlate SignNow platform for adjusting Example 2 Adjustments Of Rent Complex Operating Expense?

Security is a top priority for airSlate SignNow. Our platform employs robust encryption methods and complies with industry standards to protect documents related to Example 2 Adjustments Of Rent Complex Operating Expense, ensuring that your information remains confidential.

Get more for Example 2 Adjustments Of Rent Complex Operating Expense

Find out other Example 2 Adjustments Of Rent Complex Operating Expense

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document