UT DO 10 Form

What is the UT DO 10

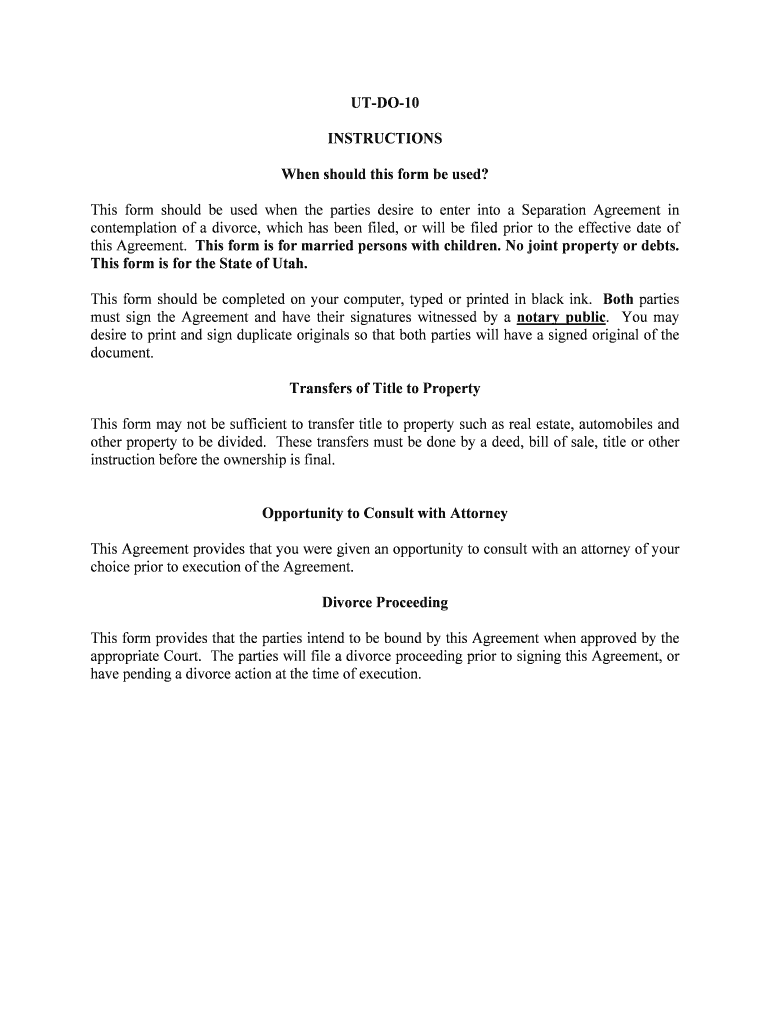

The UT DO 10 form is a specific document used in the United States, primarily for tax-related purposes. It is essential for individuals and businesses to understand its function and requirements. This form is typically used to report certain financial details to the appropriate authorities, ensuring compliance with state and federal regulations. Understanding the purpose of the UT DO 10 is crucial for accurate and timely submissions.

How to use the UT DO 10

Using the UT DO 10 form involves several key steps that ensure proper completion and submission. First, gather all necessary information, including personal identification details and financial data relevant to the form. Next, accurately fill out each section of the form, ensuring that all entries are clear and legible. After completing the form, review it for any errors or omissions before submission. This careful approach helps avoid delays and potential issues with compliance.

Steps to complete the UT DO 10

Completing the UT DO 10 form requires a systematic approach to ensure accuracy. Follow these steps:

- Collect all required personal and financial information.

- Fill in the form carefully, ensuring clarity in each entry.

- Double-check for any missing information or mistakes.

- Sign and date the form as required.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal use of the UT DO 10

The legal use of the UT DO 10 form is governed by specific regulations that ensure its validity. It is essential for users to comply with these laws to avoid penalties. The form must be completed accurately and submitted within the required timeframes. Additionally, understanding the legal implications of the information provided is crucial, as inaccuracies can lead to legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the UT DO 10 form are critical to ensure compliance with tax regulations. Typically, these deadlines align with the overall tax filing calendar for individuals and businesses. It is important to stay informed about specific dates each year to avoid late submissions, which may incur penalties. Keeping a calendar of these important dates can help in timely filing.

Required Documents

To complete the UT DO 10 form, certain documents are required. These may include:

- Personal identification, such as a Social Security number.

- Financial statements or records relevant to the reporting period.

- Any previous tax documents that may provide context for the current filing.

Having these documents ready will streamline the completion process and ensure accuracy.

Quick guide on how to complete ut do 10

Complete UT DO 10 effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents quickly without delays. Manage UT DO 10 on any platform using airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and eSign UT DO 10 with ease

- Locate UT DO 10 and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign UT DO 10 and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is UT DO 10 in relation to airSlate SignNow?

UT DO 10 refers to the specific functionalities offered by airSlate SignNow for document management and electronic signatures. This streamlined process allows users to create, send, and sign documents easily and efficiently, making it a valuable tool for businesses aiming to enhance their workflow.

-

How much does airSlate SignNow cost for using UT DO 10 features?

airSlate SignNow offers various pricing plans that accommodate different needs and budgets. Users interested in utilizing the UT DO 10 features will find competitive pricing, ensuring that businesses can take advantage of high-quality eSigning capabilities without overspending.

-

What are the main benefits of using UT DO 10?

By leveraging UT DO 10 with airSlate SignNow, businesses can signNowly reduce their document turnaround time, minimize errors, and enhance collaboration. The user-friendly interface ensures a seamless experience from document creation to signing, ultimately leading to improved productivity.

-

Is airSlate SignNow compatible with other software when using UT DO 10?

Yes, airSlate SignNow supports various integrations with popular software platforms, making it easier for businesses to incorporate UT DO 10 functionalities into their existing systems. This ensures a smooth workflow and enhanced productivity across different applications.

-

Can I try airSlate SignNow with UT DO 10 features before purchasing?

Absolutely! airSlate SignNow offers a free trial that allows users to explore the UT DO 10 features in-depth. This trial provides the opportunity to assess how the tool can meet your document management needs without any commitment.

-

How secure is the document signing process using UT DO 10?

The security of document signing is a top priority for airSlate SignNow, especially when utilizing UT DO 10. The platform incorporates advanced encryption and compliance with industry standards to ensure that all signed documents remain confidential and secure.

-

What types of documents can I manage with UT DO 10?

With airSlate SignNow's UT DO 10 features, businesses can manage a wide range of documents, including contracts, agreements, and consent forms. The platform supports various file formats, making it versatile for different industries and document types.

Get more for UT DO 10

- Your child may be eligible for additional educational services through the mckinney vento education assistance act or title i form

- Bc company dissolution package use this package to dissolve a bc limited company under section 316 of the business corporations form

- Registrar passenger transportation branch signing authority form ptr5002 registrar passenger transportation branch signing

- Henry ford wyandotte hospital waiver of liability zumba session henry ford wyandotte hospital january 9 through january 30 2013 form

- How do i file a claimmedicarehow do i file a claimmedicarebilling and claims faq department of human serviceshow do i file a form

- Report of physician if you are receiving a disability benefit this form is used to compile specific medical information in

- Follow up patient questionnaire for comprehensive spine center at newport hospital comprehensive spine center at newport form

- Autism spectrum disorder asd treatment request form providers select health of south carolina autism spectrum disorder asd

Find out other UT DO 10

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU