Texas Sales Tax Permit Form

What is the Texas Sales Tax Permit

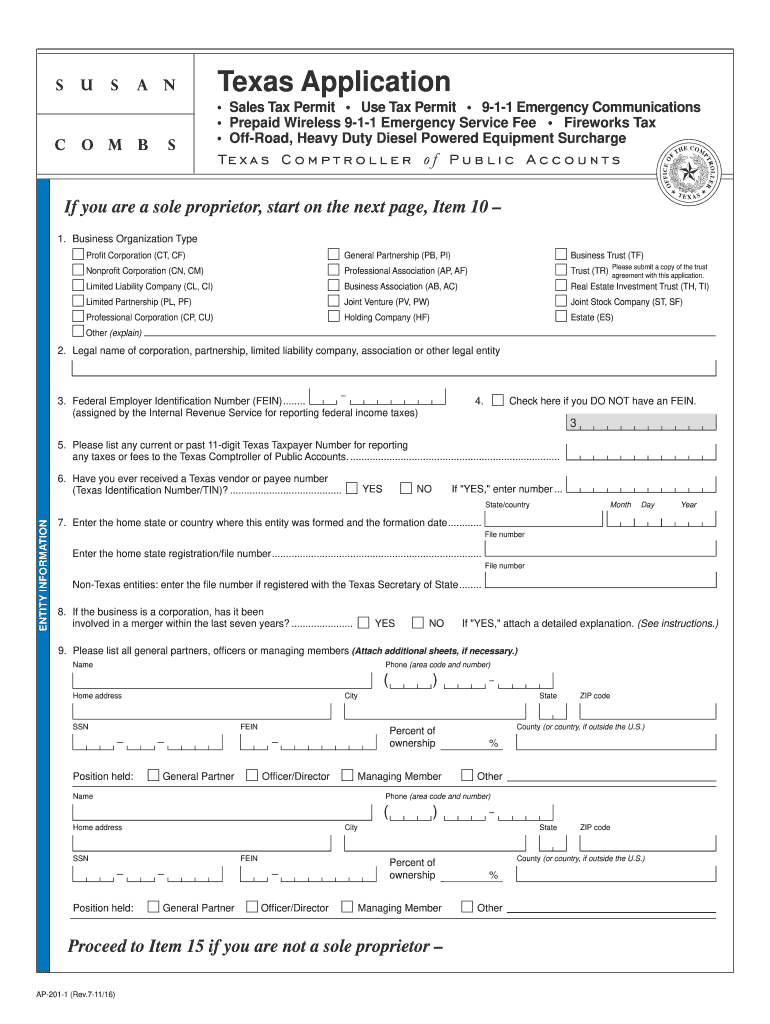

The Texas sales tax permit is a legal document that allows businesses to collect sales tax on taxable sales in the state of Texas. This permit is essential for any entity that sells goods or services subject to sales tax, including retail stores, online businesses, and service providers. Obtaining a seller's permit in Texas ensures compliance with state tax laws and enables businesses to operate legally while fulfilling their tax obligations.

How to Obtain the Texas Sales Tax Permit

To obtain a Texas sales tax permit, businesses must complete the Texas sales tax permit application. This application can be submitted online through the Texas Comptroller's website or by mailing a paper form. The process typically requires the following steps:

- Gather necessary information, including business name, address, and type of business entity.

- Provide the owner's Social Security number or Federal Employer Identification Number (EIN).

- Submit the application and pay any required fees.

Once submitted, the application is usually processed within a few days, and the permit will be issued if all requirements are met.

Steps to Complete the Texas Sales Tax Permit

Completing the Texas sales tax permit application involves several key steps to ensure accuracy and compliance. Here are the main steps to follow:

- Identify your business structure (e.g., sole proprietorship, LLC, corporation).

- Collect all required documentation, such as identification and tax information.

- Access the Texas Comptroller's online portal or download the application form.

- Fill out the application with accurate details about your business.

- Review the application for any errors before submission.

- Submit the application and keep a copy for your records.

Legal Use of the Texas Sales Tax Permit

The Texas sales tax permit is legally binding and must be used in accordance with state regulations. Businesses are required to display their permit number on invoices and receipts when collecting sales tax. Additionally, it is important to maintain accurate records of sales tax collected and remitted to the state. Failure to comply with legal requirements can result in penalties, including fines and revocation of the permit.

Required Documents

When applying for a Texas sales tax permit, certain documents are required to verify the legitimacy of the business. These documents may include:

- Proof of business registration with the state.

- Identification documents for the business owner or responsible party.

- Tax identification numbers, such as the Social Security number or EIN.

Having these documents ready can streamline the application process and help avoid delays.

Penalties for Non-Compliance

Non-compliance with Texas sales tax regulations can lead to significant penalties for businesses. Common consequences include:

- Fines for failing to collect or remit sales tax.

- Interest on unpaid taxes.

- Possible legal action or audits by the Texas Comptroller's office.

To avoid these penalties, it is crucial for businesses to stay informed about their tax obligations and ensure timely compliance.

Quick guide on how to complete sales tax permit form

Prepare Texas Sales Tax Permit effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can locate the correct form and safely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your files swiftly without delays. Manage Texas Sales Tax Permit on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign Texas Sales Tax Permit with ease

- Locate Texas Sales Tax Permit and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any selected device. Edit and eSign Texas Sales Tax Permit and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why are teddy bears more strictly regulated than guns?

As someone who has been published in The Huffington Post, I can tell you that it is a hard left (very liberal) paper. What they are reporting here isn't news. They are, instead, advocating under the guise of news. For what it's worth, this isn't me claiming this. Allsides did a pretty good job of evaluating them: Huffington Post. I'm not saying that HuffPo is a terrible paper, run by terrible people. Instead, you should remember that what you've just read is a public service announcement.Teddy Bears are more carefully regulated? You're kidding, right? This doesn't even pass on first glance. I doubt anyone who understands gun control could argue that teddy bears are more regulated.Do they regulate how big of a teddy bear you can buy? Do they tell you that you can buy a black teddy bear, but not a silver one? Do you have to wait ten days to pick up a teddy bear you've already paid for? Can you be arrested because the laws about teddy bear configurations have changed, and you didn't know? No? No need to keep abreast of the TONS of teddy bear legislation? Surprising. Be careful crossing state lines with your Teddy Ruxpin. You have no idea how New Jersey will react. Or New York. Or California. Firearms are far more regulated than just about anything, probably up to and including pharmacology.And, I should point out, this is all to regulate a constitutionally protected right which is never supposed to be infringed.Teddy Bears are regulated only in their manufacture. You, as a citizen and consumer don't have to worry about anything. On the other hand, as a gun owner, you constantly have to be on guard. I don't disagree with the necessity of this, but I do laugh at the outrageous assertion that it is otherwise.So all that being said, let’s look at what the Illinois Counsel Against Gun Violence has to say: Ah. They listed maybe three dozen lines of laws regulating teddy bears and one law which hits guns. Well. That’s pretty damning.Except for one thing. The federal government, per our constitution, doesn’t regulate guns. Not that it really doesn’t, mind you. It just isn’t supposed to.So here’s the rub! Let’s look at all 50 states’ laws regarding teddy bears:ZERO.Let’s look at just California state laws regarding guns:Well… I would, but I’m not sure that Quora could handle it. In fact, it’s such a byzantine set of laws, they have an entire governmental department (the Bureau of Firearms) to regulate it. There are laws on the books regarding just about everything concerning firearms.To sum things up, teddy bears aren't more heavily regulated. Nothing of the sort. But maybe they should be. You have no constitutional right to a teddy bear.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I get a company started in India? What kind of taxes involved in setting up?

How do I get a company started in India? What kind of taxes involved in setting up?There are important steps to follow before registering your companyTo get a Digital Signature Certificate (DSC)To also get a Director Identification Number (DIN)To fill an eForm or New user registrationTo also Incorporate the companyThese are the three important taxes involved in setting up a business:Income Tax : When operating as a small business you must file a Schedule C form (Profit or Loss from Business Activities) with the IRS to determine your total business profit or loss for the year. The Schedule C accompanies your standard 1040 form when you file your taxes. Based on the information from Schedule C, you may have to pay federal and state taxes on your business income. If you choose to start a corporate entity, you may also have to pay corporate taxes. Some municipalities also require you to pay local taxes directly to the city or town where you perform your business activities.Self Employment Tax: In addition to standard income taxes, small business owners may have to pay self-employment taxes. Self-employment tax covers the Social Security and Medicare costs that you would have to pay out of your regular paycheck if you worked for another company. The total tax is a percentage of your net earnings from your self-employment activities. Determine the tax by filling out IRS form Schedule SE. If you hire people to work at your small businesses, you may also have to pay employment taxes on behalf of your workers. You must also pay a portion of each employee's Federal Insurance Contributions Act (FICA) and Medicare tax expenses.Sales Tax: If your company is a retail operation, you may have to pay a sales tax to your state and local tax authority. For example, you must pay the New York State Department of Taxation and Finance sales tax for all jurisdictions. You must collect the tax from your customers, which is based on each sale. The tax authority sends you sales tax forms once per year or every three months and you must file a sales tax return and send the money you’ve collected directly to your state or local tax authority. In order to accept and pay sales tax you must first apply for a sales tax permit, sometimes called a certificate of tax authority.Contact websites like vakil search for availing these services

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the sales tax permit form

How to generate an eSignature for your Sales Tax Permit Form online

How to generate an electronic signature for the Sales Tax Permit Form in Google Chrome

How to generate an eSignature for putting it on the Sales Tax Permit Form in Gmail

How to generate an electronic signature for the Sales Tax Permit Form straight from your smart phone

How to make an electronic signature for the Sales Tax Permit Form on iOS devices

How to generate an electronic signature for the Sales Tax Permit Form on Android devices

People also ask

-

What is a seller's permit in Texas?

A seller's permit in Texas is a legal authorization that allows businesses to collect sales tax from customers. It's essential for anyone selling tangible personal property or taxable services. Obtaining a seller's permit Texas ensures compliance with state tax regulations.

-

How do I apply for a seller's permit in Texas?

To apply for a seller's permit in Texas, you need to complete the online application through the Texas Comptroller's website. This process involves providing your business information and any required documentation. Once approved, you will receive your seller's permit Texas to begin your sales activities.

-

What are the costs associated with obtaining a seller's permit in Texas?

There are no direct fees for applying for a seller's permit in Texas; however, businesses may incur costs related to required documentation and potential legal assistance for compliance. It's essential to consider any ongoing costs related to sales tax reporting. Ensure you're prepared to manage these responsibilities after obtaining your seller's permit Texas.

-

Do I need a seller's permit in Texas if I sell online?

Yes, if you sell products or services online to customers in Texas, you will need a seller's permit Texas. This permit allows you to collect sales tax on those transactions. Failing to obtain a seller's permit can lead to penalties and fines from the state.

-

Can I renew my seller's permit in Texas?

In Texas, seller's permits do not require renewal, as they remain valid as long as your business operates. However, if you change your business structure or ownership, you may need to apply for a new seller's permit Texas. It's important to keep your business information updated to avoid compliance issues.

-

What types of businesses need a seller's permit in Texas?

Any business that sells tangible personal property or taxable services in Texas must obtain a seller's permit Texas. This includes retail stores, eCommerce websites, and service providers that charge sales tax. Nonprofit organizations and certain exempt entities may have different requirements.

-

How can airSlate SignNow help with my seller's permit paperwork?

airSlate SignNow offers an easy-to-use platform that can streamline the documentation process for obtaining a seller's permit Texas. You can create, sign, and manage your applications digitally, saving time and reducing paperwork. This allows you to focus on your business operations while ensuring compliance.

Get more for Texas Sales Tax Permit

Find out other Texas Sales Tax Permit

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe