Check the Applicable Block Form

What is the Check The Applicable Block

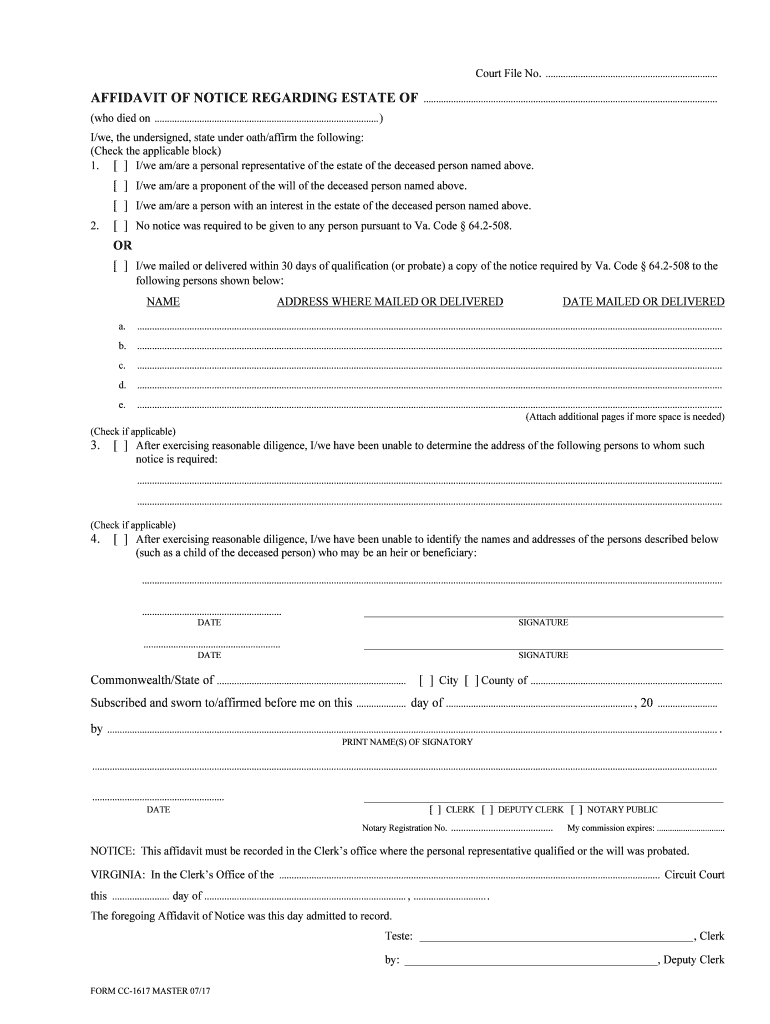

The Check The Applicable Block is a specific section within various forms that requires the signer to indicate which options or conditions apply to their situation. This section is crucial for ensuring that the form is processed correctly and that the information provided aligns with the requirements of the requesting organization. It is commonly found in forms related to tax, legal, and administrative processes, where precise information is essential for compliance and accuracy.

How to use the Check The Applicable Block

Using the Check The Applicable Block involves carefully reviewing the options presented and selecting the appropriate boxes that reflect your circumstances. This process ensures that your form is filled out accurately. It is important to read each option thoroughly, as selecting the wrong box can lead to delays or complications in processing your form. Make sure to double-check your selections before submitting the form to avoid any potential issues.

Steps to complete the Check The Applicable Block

Completing the Check The Applicable Block requires a systematic approach to ensure accuracy. Follow these steps:

- Review the entire form to understand the context of the Check The Applicable Block.

- Read each option carefully to determine which applies to your situation.

- Mark the relevant boxes clearly, ensuring your selections are legible.

- Double-check your selections against the instructions provided on the form.

- Complete any additional required sections of the form before submission.

Legal use of the Check The Applicable Block

The legal use of the Check The Applicable Block is governed by regulations that require accurate and truthful representation of information. When completing this section, it is essential to provide honest answers, as misrepresentation can lead to legal consequences. The information provided in this block can affect the validity of the entire form, making it crucial to adhere to the legal standards set forth by relevant authorities.

Examples of using the Check The Applicable Block

Examples of the Check The Applicable Block can be found in various forms, such as tax returns or legal applications. For instance, in a tax form, you may need to indicate your filing status or specific deductions that apply to you. In a legal context, you might check blocks related to your eligibility for certain programs or benefits. Each example underscores the importance of accurately completing this section to ensure proper processing and compliance.

IRS Guidelines

The IRS provides specific guidelines for completing forms that include the Check The Applicable Block. These guidelines emphasize the need for accuracy and completeness in all sections of the form. It is important to refer to the IRS instructions related to the specific form you are completing, as they will outline how to properly fill out the Check The Applicable Block and any implications of your selections.

Required Documents

When completing the Check The Applicable Block, certain documents may be required to support your selections. These documents can include identification, proof of income, or other relevant information that verifies your claims. It is advisable to gather all necessary documentation before starting the form to ensure a smooth completion process. Having these documents on hand can help you accurately check the applicable blocks and provide the necessary context for your choices.

Quick guide on how to complete check the applicable block

Complete Check The Applicable Block effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Handle Check The Applicable Block on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Check The Applicable Block without hassle

- Find Check The Applicable Block and click on Get Form to begin.

- Leverage the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Put aside worries about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Check The Applicable Block and guarantee exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to 'Check The Applicable Block' in airSlate SignNow?

To 'Check The Applicable Block' in airSlate SignNow means to ensure that all required fields and sections in your documents are properly filled out before sending them for signature. This function helps prevent delays and errors in the signing process, ensuring a smooth experience for both you and the recipients.

-

How can I effectively use airSlate SignNow to 'Check The Applicable Block' for my documents?

You can effectively use airSlate SignNow by utilizing the platform's intuitive interface, which allows you to easily identify and confirm all sections that require attention. Make sure to review and validate each block within your document to streamline the signing process and reduce the chances of missing any important information.

-

Is there a cost associated with using the 'Check The Applicable Block' feature?

No additional cost is associated with using the 'Check The Applicable Block' feature in airSlate SignNow. This capability comes as a standard part of our cost-effective solution, allowing you to enhance your document workflow without incurring extra fees.

-

What are the benefits of using airSlate SignNow to check the applicable blocks?

By using airSlate SignNow to check the applicable blocks, you enhance accuracy and speed in document processing. This leads to reduced turnaround time for signed agreements and ensures compliance with your organizational standards, which ultimately boosts overall productivity.

-

Can I integrate airSlate SignNow with other software to improve my workflow?

Yes, airSlate SignNow offers seamless integrations with various platforms to enhance your workflow. By integrating with your existing systems, you can easily check the applicable blocks within documents and manage your signing process more efficiently, transforming how you handle electronic signatures.

-

Is there customer support available if I need help to check the applicable blocks?

Absolutely! airSlate SignNow provides robust customer support to assist you with any queries regarding checking the applicable blocks. Whether you need guidance on using the features or troubleshooting issues, our support team is here to ensure you get the most out of our service.

-

How does airSlate SignNow make it easy to check the applicable block before sending?

airSlate SignNow simplifies checking the applicable blocks by providing visual cues and validation features. The platform highlights required fields and alerts you to any missing information, making ensure documents are fully completed before sending them for signature straightforward and hassle-free.

Get more for Check The Applicable Block

Find out other Check The Applicable Block

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast