Taxation IIEstate Tax in the United StatesTaxation in the Form

What is the Taxation IIEstate Tax in the United States?

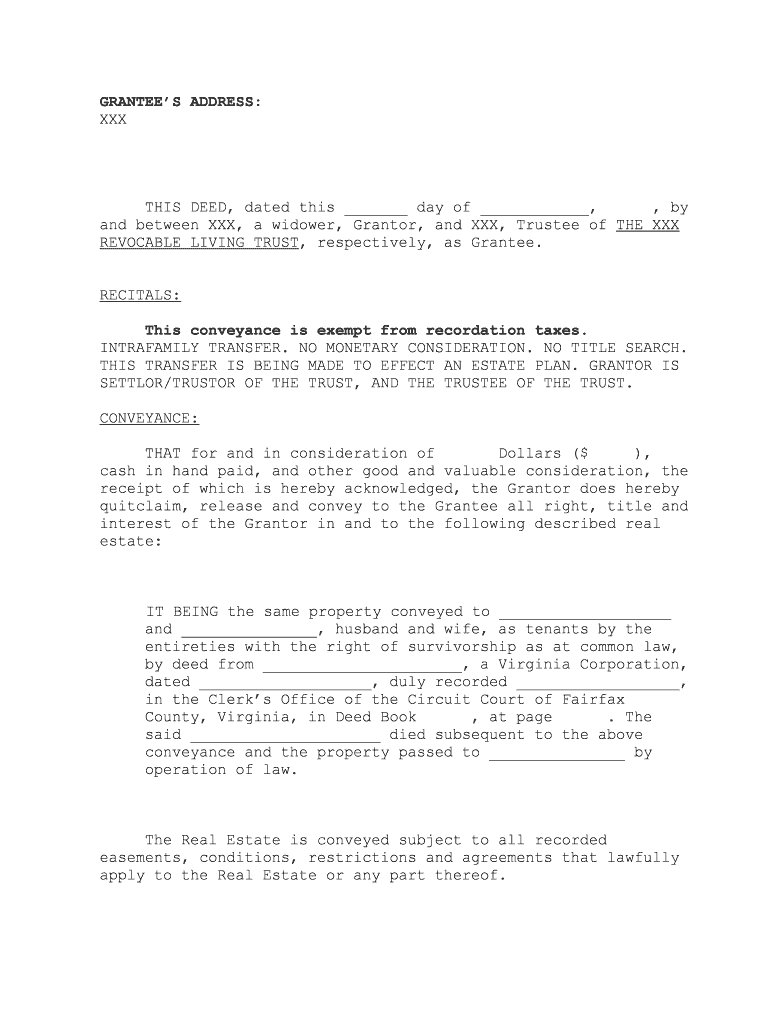

The taxation IIEstate tax in the United States refers to taxes imposed on the transfer of an individual's estate upon their death. This tax is calculated based on the total value of the estate, including cash, real estate, and other assets. The federal government and some states levy estate taxes, which can significantly affect the inheritance received by beneficiaries. Understanding the implications of estate tax is crucial for effective estate planning and ensuring that heirs receive their intended inheritance without unexpected tax burdens.

How to use the Taxation IIEstate Tax in the United States

Using the taxation IIEstate tax form involves several steps to ensure compliance with federal and state regulations. Begin by gathering necessary documentation, including a list of all assets and liabilities of the deceased. This information will help determine the total value of the estate. Next, complete the appropriate estate tax form, which may vary depending on the estate's value and the state in which the deceased resided. Finally, submit the completed form along with any required payments to the appropriate tax authority.

Steps to complete the Taxation IIEstate Tax in the United States

Completing the taxation IIEstate tax form involves a systematic approach:

- Gather all relevant financial documents, including bank statements, property deeds, and investment records.

- Determine the total value of the estate by assessing all assets and liabilities.

- Identify the appropriate estate tax form based on the estate's value and state regulations.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the form and any required payment to the relevant tax authority by the specified deadline.

Legal use of the Taxation IIEstate Tax in the United States

The legal use of the taxation IIEstate tax form is governed by federal and state laws that outline the requirements for filing and payment. It is essential to comply with these regulations to avoid penalties or legal issues. The form must be filed within a specific timeframe after the individual's death, and accurate reporting of the estate's value is crucial. Legal representation may be beneficial to navigate complex estate tax laws and ensure proper compliance.

Filing Deadlines / Important Dates

Filing deadlines for the taxation IIEstate tax vary depending on the jurisdiction and the size of the estate. Generally, the federal estate tax return must be filed within nine months of the date of death. However, extensions may be available under certain circumstances. It is important to check with state tax authorities for specific deadlines, as they may differ from federal requirements. Keeping track of these dates is vital to avoid late fees and penalties.

Required Documents

To complete the taxation IIEstate tax form, several documents are typically required:

- Death certificate of the deceased.

- Inventory of all assets, including real estate, bank accounts, and personal property.

- Documentation of debts and liabilities owed by the deceased.

- Previous tax returns, if applicable.

- Any relevant legal documents, such as wills or trusts.

Quick guide on how to complete taxation iiestate tax in the united statestaxation in the

Complete Taxation IIEstate Tax In The United StatesTaxation In The effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents promptly without interruptions. Handle Taxation IIEstate Tax In The United StatesTaxation In The on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Taxation IIEstate Tax In The United StatesTaxation In The with ease

- Locate Taxation IIEstate Tax In The United StatesTaxation In The and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign Taxation IIEstate Tax In The United StatesTaxation In The and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Taxation IIEstate Tax In The United StatesTaxation In The?

airSlate SignNow is a powerful tool that allows businesses to send and eSign documents quickly and efficiently. While it may not directly handle Taxation IIEstate Tax In The United StatesTaxation In The, our platform facilitates the management of essential tax-related documents, speeding up processes during tax season.

-

How can airSlate SignNow help with estate tax documentation?

With airSlate SignNow, users can create and manage estate tax documents seamlessly. By providing customizable templates and eSigning options, the platform simplifies the often complex processes related to estate tax documentation, ensuring compliance with Taxation IIEstate Tax In The United StatesTaxation In The requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing tiers, making it accessible for businesses of all sizes. Whether you're an individual needing basic features or a business requiring advanced functionalities related to Taxation IIEstate Tax In The United StatesTaxation In The, our plans cater to different needs and budgets.

-

Is airSlate SignNow compliant with tax regulations in the United States?

Yes, airSlate SignNow is designed to comply with U.S. regulatory standards, which is essential for handling sensitive documents like those related to Taxation IIEstate Tax In The United StatesTaxation In The. Our platform prioritizes security and legality, ensuring your documents are managed correctly.

-

Can I integrate airSlate SignNow with other software to manage taxation documents?

Absolutely! airSlate SignNow integrates easily with several popular software applications, enhancing your workflow for managing Taxation IIEstate Tax In The United StatesTaxation In The documents. This capability allows for streamlined processes across different platforms, improving efficiency.

-

What features make airSlate SignNow user-friendly for tax-related processes?

airSlate SignNow boasts a user-friendly interface that minimizes the learning curve, perfect for those dealing with Taxation IIEstate Tax In The United StatesTaxation In The. Features like drag-and-drop document upload, customizable templates, and electronic signatures make the platform intuitive and efficient.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow employs advanced security measures, including data encryption and secure access protocols, to protect your tax documents. When dealing with sensitive information related to Taxation IIEstate Tax In The United StatesTaxation In The, ensuring document security is paramount, and we take it seriously.

Get more for Taxation IIEstate Tax In The United StatesTaxation In The

Find out other Taxation IIEstate Tax In The United StatesTaxation In The

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online