Is Not a Part of the Homestead of Grantors, or Form

What is the Is Not A Part Of The Homestead Of Grantors, Or

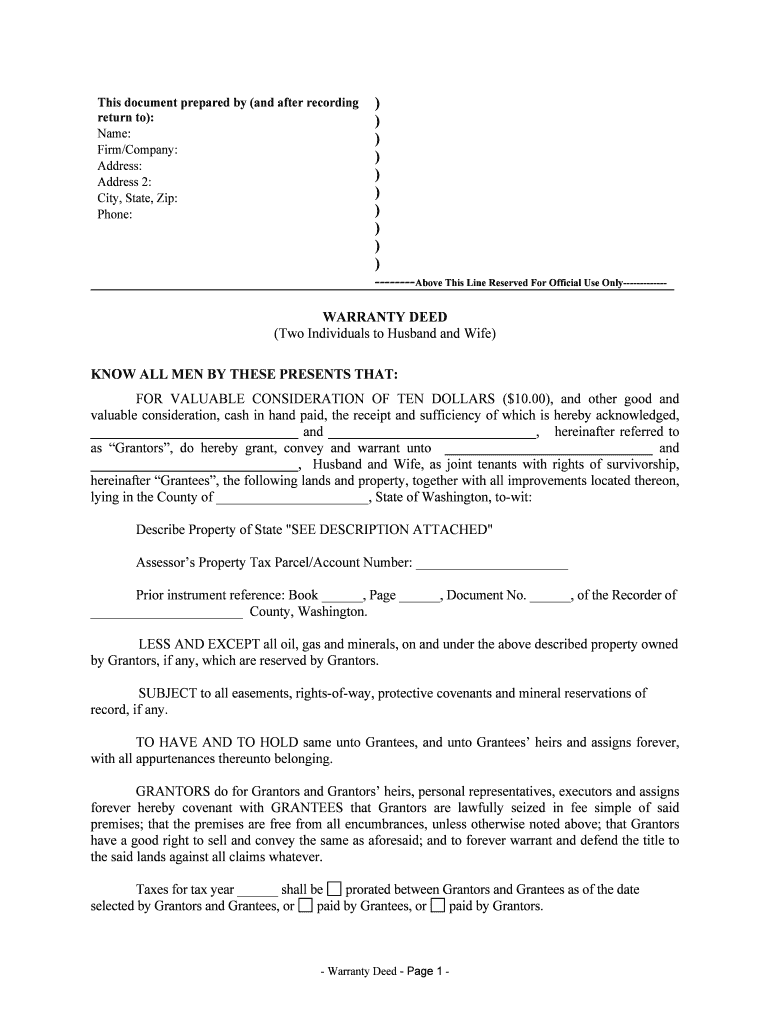

The form "Is Not A Part Of The Homestead Of Grantors, Or" is a legal document often used in real estate transactions and estate planning. Its primary purpose is to clarify the status of certain properties in relation to the homestead exemption. This exemption can affect property taxes and legal protections for homeowners. By completing this form, grantors can specify which properties are not considered part of their homestead, ensuring that these assets are treated differently under the law.

How to use the Is Not A Part Of The Homestead Of Grantors, Or

Using the "Is Not A Part Of The Homestead Of Grantors, Or" form involves several steps. First, gather all necessary information regarding the properties in question. This includes legal descriptions, addresses, and any relevant ownership documents. Next, accurately fill out the form, ensuring that all details are correct and complete. Once completed, the form should be signed by the grantors and may need to be notarized, depending on state requirements. Finally, submit the form to the appropriate local authority, such as the county clerk or assessor's office.

Steps to complete the Is Not A Part Of The Homestead Of Grantors, Or

Completing the "Is Not A Part Of The Homestead Of Grantors, Or" form can be straightforward if you follow these steps:

- Review the form to understand its requirements.

- Collect necessary information about the properties you wish to exclude from your homestead.

- Fill out the form with accurate details, including names, addresses, and property descriptions.

- Sign the form in the presence of a notary if required by your state.

- Submit the completed form to the relevant local authority.

Legal use of the Is Not A Part Of The Homestead Of Grantors, Or

The legal use of the "Is Not A Part Of The Homestead Of Grantors, Or" form is significant in managing property rights and tax implications. By formally declaring which properties are not part of the homestead, grantors can protect these assets from certain legal claims and tax liabilities. This form is often utilized in estate planning to ensure that properties are distributed according to the grantor's wishes and to maintain compliance with local laws regarding property exemptions.

State-specific rules for the Is Not A Part Of The Homestead Of Grantors, Or

State-specific rules regarding the "Is Not A Part Of The Homestead Of Grantors, Or" form can vary significantly. Each state may have different requirements for completing and submitting the form, including notarization, filing fees, and deadlines. It is essential for grantors to familiarize themselves with their state’s regulations to ensure compliance and avoid potential legal issues. Consulting with a local attorney or real estate professional can provide clarity on these specific rules.

Examples of using the Is Not A Part Of The Homestead Of Grantors, Or

Examples of using the "Is Not A Part Of The Homestead Of Grantors, Or" form include situations where a grantor owns multiple properties and wishes to protect a rental property from being classified as part of their homestead. Another scenario could involve a grantor who is selling a portion of their real estate portfolio and wants to ensure that only specific properties remain under homestead protection. In both cases, the form serves to clarify intentions and safeguard the grantor's interests.

Quick guide on how to complete is not a part of the homestead of grantors or

Complete Is Not A Part Of The Homestead Of Grantors, Or effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary format and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Is Not A Part Of The Homestead Of Grantors, Or across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to edit and electronically sign Is Not A Part Of The Homestead Of Grantors, Or with ease

- Obtain Is Not A Part Of The Homestead Of Grantors, Or and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Mark relevant sections of your documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs within just a few clicks from your chosen device. Edit and electronically sign Is Not A Part Of The Homestead Of Grantors, Or while ensuring outstanding communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean when a document Is Not A Part Of The Homestead Of Grantors, Or?

When a document Is Not A Part Of The Homestead Of Grantors, Or, it indicates that the property in question does not fall under protections provided by homestead laws. This might affect how the property is treated in cases of bankruptcy or creditor claims. Understanding this concept can be vital for proper estate planning and legal documentation.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security by implementing industry-leading encryption and compliance standards. This ensures that any document, whether it Is Not A Part Of The Homestead Of Grantors, Or or otherwise, remains protected against unauthorized access. Our services also include secure cloud storage to keep your documents safe.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers several pricing tiers to meet different business needs. Each plan provides features that help streamline your document management processes, even for documents that Is Not A Part Of The Homestead Of Grantors, Or. You can choose a plan that best aligns with your organization’s size and needs.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integration with various software solutions to enhance workflow efficiency. Whether you are using CRM tools or project management systems, airSlate SignNow can integrate to manage documents that Is Not A Part Of The Homestead Of Grantors, Or, and improve collaboration across platforms.

-

What features does airSlate SignNow provide for electronic signatures?

airSlate SignNow provides a variety of features tailored for electronic signatures, including customizable signing workflows and templates. Users can easily sign documents that Is Not A Part Of The Homestead Of Grantors, Or with just a few clicks. This simplifies the signing process, making it faster and more efficient.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, from startups to large enterprises. No matter your organization's scale, you can effectively manage documents, including those that Is Not A Part Of The Homestead Of Grantors, Or, without sacrificing quality or efficiency.

-

How can airSlate SignNow improve my business's document workflow?

By utilizing airSlate SignNow, businesses can signNowly enhance their document workflow through automation and easy access to electronic signatures. Documents, including those that Is Not A Part Of The Homestead Of Grantors, Or, can be processed faster, allowing for quicker decision-making and improved productivity.

Get more for Is Not A Part Of The Homestead Of Grantors, Or

- Ohio bmv handicap placard form

- Dr 2922 072519 colorado department of revenue state of form

- Certification of equipment compliance for homemade coloradogov form

- Forms vehiclesdepartment of revenue colorado dmv

- Penndot form mv 911 gibbons fastag

- Consumer complaint instruction sheet mva marylandgov form

- Form hsmv 83146 florida highway safety and motor vehicles

- Vtr 34 form

Find out other Is Not A Part Of The Homestead Of Grantors, Or

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form