WI DO 1 Form

What is the WI DO 1

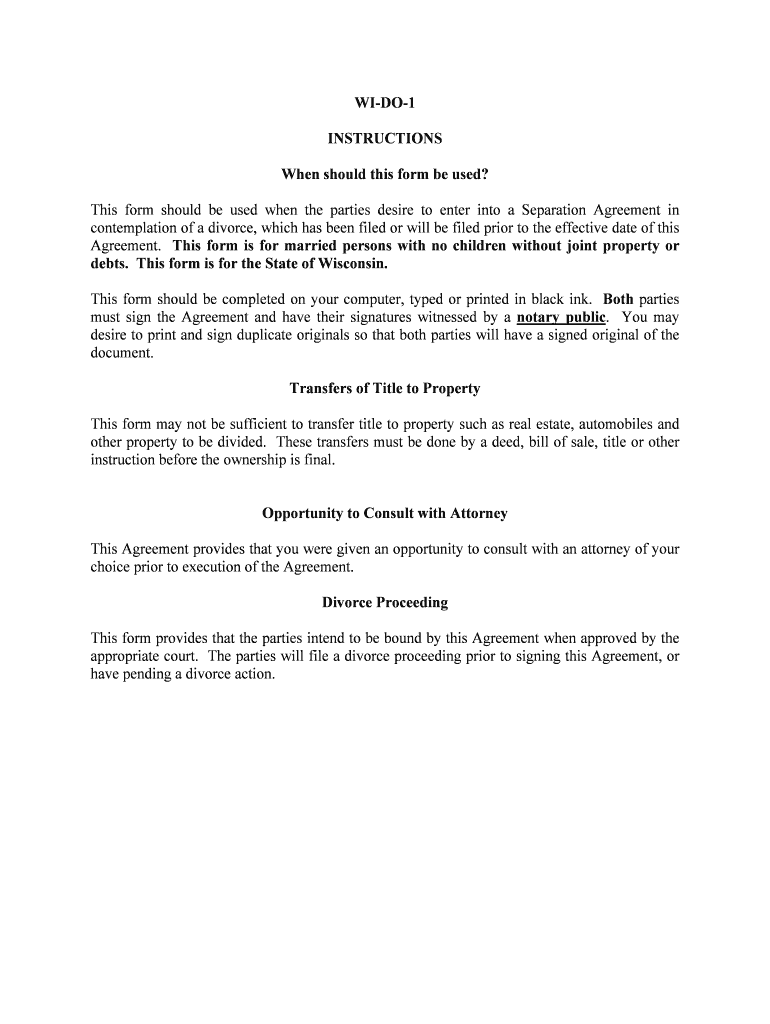

The WI DO 1 form is a document used in the state of Wisconsin for specific legal and administrative purposes. It is often utilized for various applications, including those related to business and tax matters. Understanding the purpose of this form is crucial for individuals and businesses to ensure compliance with state regulations. The form collects essential information that may include personal identification details, business information, and other relevant data required for processing.

How to use the WI DO 1

Using the WI DO 1 form involves a straightforward process. First, gather all necessary information, such as your name, address, and any pertinent business details. Next, fill out the form accurately, ensuring all sections are completed. Once filled, review the information for accuracy before submitting it. Depending on the specific requirements, you may need to submit the form electronically or via mail. Familiarizing yourself with the guidelines for submission will help streamline the process.

Steps to complete the WI DO 1

Completing the WI DO 1 form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including identification and any supporting materials.

- Access the form through the appropriate state website or office.

- Fill in your personal and business information as required.

- Double-check all entries for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the WI DO 1

The legal use of the WI DO 1 form is defined by state regulations. To ensure that the form is legally binding, it must be completed in accordance with the relevant laws governing its use. This includes providing accurate information and adhering to any specific guidelines set forth by the state. Understanding these legal requirements is essential to avoid potential issues or disputes regarding the validity of the form.

Key elements of the WI DO 1

The key elements of the WI DO 1 form include various sections that capture essential information. These typically consist of:

- Personal identification details, such as name and address.

- Business information, including type and registration details.

- Specific declarations or statements required by state law.

- Signature lines for necessary parties to validate the form.

Form Submission Methods

The WI DO 1 form can be submitted through several methods, depending on the requirements set by the state. Common submission methods include:

- Online submission via the official state portal.

- Mailing the completed form to the designated state office.

- In-person submission at local government offices.

Quick guide on how to complete wi do 1

Complete WI DO 1 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle WI DO 1 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign WI DO 1 without hassle

- Obtain WI DO 1 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign WI DO 1 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is WI DO 1 and how does it work with airSlate SignNow?

WI DO 1 is a unique feature of airSlate SignNow that allows businesses to streamline their document signing process. With WI DO 1, users can send, manage, and eSign documents effortlessly, making it ideal for teams looking to enhance their productivity and save time.

-

What are the pricing options for WI DO 1?

airSlate SignNow offers flexible pricing plans that incorporate the WI DO 1 feature. The plans are tailored to meet the needs of businesses of all sizes, ensuring cost-effective solutions without compromising on functionality. You can choose from various subscription tiers based on your usage requirements.

-

What features does WI DO 1 provide?

WI DO 1 includes a comprehensive set of features such as customizable templates, real-time notifications, and cloud storage integration. This ensures that users can manage their documents efficiently while maintaining control and visibility throughout the signing process.

-

How can WI DO 1 benefit my business?

The WI DO 1 feature in airSlate SignNow helps businesses reduce turnaround times for document signing, thereby improving overall efficiency. By simplifying the signing process, it allows teams to focus more on their core tasks while minimizing the hassle of paperwork.

-

Can I integrate WI DO 1 with other tools?

Yes, WI DO 1 is designed to integrate seamlessly with a variety of productivity and collaboration tools. This enables businesses to enhance their workflows by combining the document eSigning capabilities of airSlate SignNow with other applications they already use.

-

Is WI DO 1 secure for handling sensitive documents?

Absolutely, WI DO 1 prioritizes security by implementing industry-standard encryption and authentication measures. This ensures that all documents signed through airSlate SignNow are protected, making it a reliable choice for businesses dealing with sensitive information.

-

What types of documents can be signed using WI DO 1?

WI DO 1 supports a wide range of document types, including contracts, agreements, and forms. Users can easily upload their documents to airSlate SignNow and prepare them for eSigning, accommodating various business needs and legal requirements.

Get more for WI DO 1

- Schedule appointment request form

- La jolla gastroenterology medical group patient forms la

- Fst intake formdocx

- Center for pediatric and adolescent medicine form

- Excellus claim form 100853424

- What do i do if an applicant who has a binding commitment to form

- Mountainview cardiovascular and thoracic surgery controlled substance agreement controlled substance agreement form

- Iv therapy consent form template

Find out other WI DO 1

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation