Less Than 3 Acre Conversion Exemption Cal Fire State of California 1999-2026

Understanding the Less Than 3 Acre Conversion Exemption

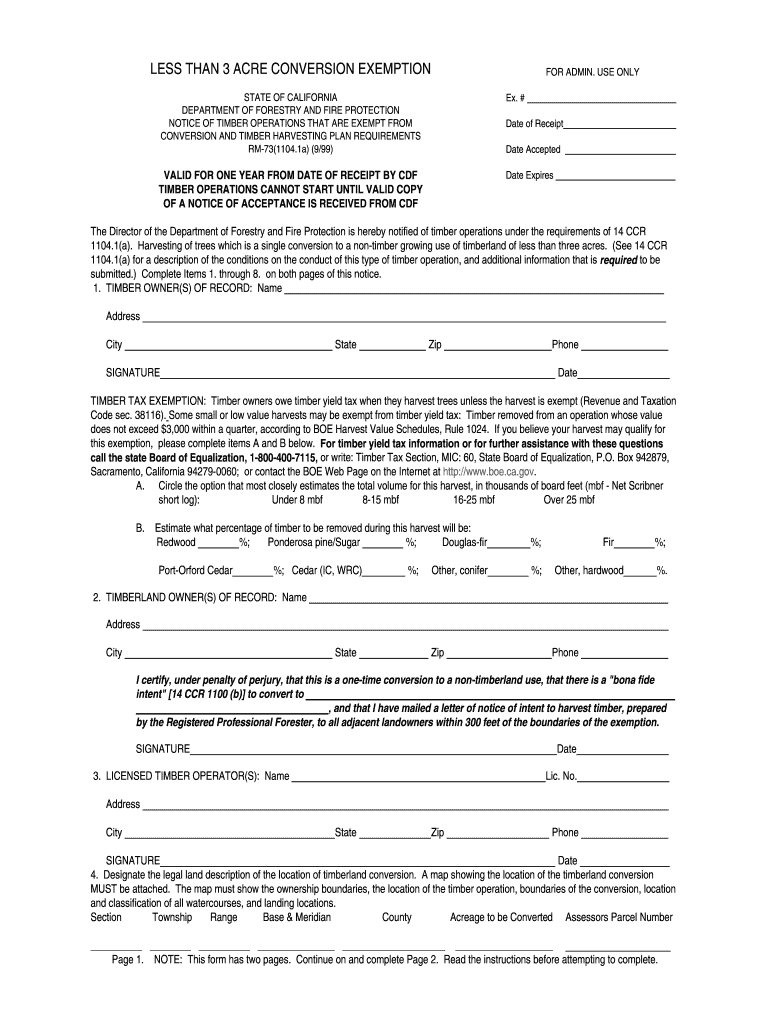

The Less Than 3 Acre Conversion Exemption, as defined by Cal Fire in the State of California, allows property owners with less than three acres to convert their land for specific uses without the need for extensive permits. This exemption is particularly beneficial for small landowners looking to engage in activities such as agricultural development or residential improvements. Understanding the criteria and limitations of this exemption is essential for compliance and effective land management.

Steps to Complete the Less Than 3 Acre Conversion Exemption

Completing the Less Than 3 Acre Conversion Exemption involves several key steps. First, gather all necessary documentation, including proof of ownership and any existing land use permits. Next, fill out the exemption application form accurately, ensuring all required information is included. After completing the form, submit it to the appropriate Cal Fire office, either online or by mail. Finally, keep a copy of your submission for your records, as it may be needed for future reference or compliance checks.

Eligibility Criteria for the Less Than 3 Acre Conversion Exemption

To qualify for the Less Than 3 Acre Conversion Exemption, several eligibility criteria must be met. The property must be less than three acres in size and located within designated areas that allow for such conversions. Additionally, the intended use of the land must align with state regulations regarding environmental impact and land use. It is advisable to review local zoning laws and consult with Cal Fire to ensure compliance with all requirements.

Legal Use of the Less Than 3 Acre Conversion Exemption

The legal use of the Less Than 3 Acre Conversion Exemption is governed by specific regulations that outline permissible activities. This exemption allows for limited development, such as agricultural practices or minor residential improvements, without extensive permitting. However, any changes to the land must still comply with local zoning laws and environmental regulations. Failure to adhere to these laws can result in penalties or the revocation of the exemption.

Required Documents for the Less Than 3 Acre Conversion Exemption

When applying for the Less Than 3 Acre Conversion Exemption, certain documents are required to support your application. These typically include proof of property ownership, a completed application form, and any existing land use permits. Additional documentation may be requested based on the intended use of the land, such as environmental assessments or plans for development. Ensuring that all documents are accurate and complete will facilitate a smoother application process.

Examples of Using the Less Than 3 Acre Conversion Exemption

There are various scenarios where the Less Than 3 Acre Conversion Exemption can be beneficial. For example, a small farmer may wish to convert a portion of their land for organic vegetable production, which is permissible under this exemption. Similarly, a homeowner may want to build a small accessory dwelling unit for family members. Each of these uses must comply with the specific regulations set forth by Cal Fire and local authorities to ensure legal standing.

Form Submission Methods for the Less Than 3 Acre Conversion Exemption

Submitting the application for the Less Than 3 Acre Conversion Exemption can be done through multiple methods. Applicants can choose to submit their forms online via the Cal Fire website, which often expedites processing times. Alternatively, forms can be mailed directly to the appropriate Cal Fire office or submitted in person at designated locations. Each method has its own processing time, so it is important to choose the one that best fits your timeline and needs.

Quick guide on how to complete less than 3 acre conversion exemption cal fire state of california

Complete Less Than 3 Acre Conversion Exemption Cal Fire State Of California effortlessly on any gadget

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without complications. Handle Less Than 3 Acre Conversion Exemption Cal Fire State Of California on any gadget using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Less Than 3 Acre Conversion Exemption Cal Fire State Of California with ease

- Obtain Less Than 3 Acre Conversion Exemption Cal Fire State Of California and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Mark essential sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Leave behind lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Less Than 3 Acre Conversion Exemption Cal Fire State Of California and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the less than 3 acre conversion exemption cal fire state of california

How to generate an eSignature for the Less Than 3 Acre Conversion Exemption Cal Fire State Of California online

How to make an eSignature for your Less Than 3 Acre Conversion Exemption Cal Fire State Of California in Google Chrome

How to create an eSignature for putting it on the Less Than 3 Acre Conversion Exemption Cal Fire State Of California in Gmail

How to create an eSignature for the Less Than 3 Acre Conversion Exemption Cal Fire State Of California from your smartphone

How to generate an electronic signature for the Less Than 3 Acre Conversion Exemption Cal Fire State Of California on iOS devices

How to generate an electronic signature for the Less Than 3 Acre Conversion Exemption Cal Fire State Of California on Android devices

People also ask

-

What is a 3 acre conversion in the context of airSlate SignNow?

A 3 acre conversion refers to the efficient management and processing of documents related to land conversion projects, specifically those involving three acres of land. With airSlate SignNow, you can streamline the signing and sharing of essential documents, ensuring that all stakeholders can quickly access and sign necessary agreements.

-

How does airSlate SignNow support document workflows for 3 acre conversion projects?

airSlate SignNow enhances document workflows for 3 acre conversion projects by providing customizable templates and easy eSigning capabilities. This ensures that documents related to land usage, permits, and approvals are handled efficiently, allowing for a smoother transition and faster project completion.

-

What are the pricing options for airSlate SignNow when dealing with multiple 3 acre conversions?

airSlate SignNow offers flexible pricing plans that can accommodate businesses handling multiple 3 acre conversions. Depending on your volume and needs, you can choose from various packages that provide signNow savings for teams managing large-scale projects.

-

Can airSlate SignNow integrate with other tools for 3 acre conversion management?

Yes, airSlate SignNow integrates seamlessly with many popular applications and tools that facilitate 3 acre conversion management. These integrations help you maintain a unified workflow, whether it involves project management software or real estate platforms.

-

What key features should I look for in a solution for 3 acre conversion?

When exploring solutions for 3 acre conversion, key features to consider include customizable document templates, secure eSigning capabilities, and robust collaboration tools. airSlate SignNow provides all these features to enhance your workflow and ensure compliance with legal requirements.

-

How does airSlate SignNow improve the speed of approvals for 3 acre conversions?

AirSlate SignNow signNowly speeds up the approval process for 3 acre conversions by allowing users to send, sign, and receive documents immediately. With its intuitive interface, stakeholders can complete essential paperwork in minutes rather than days, expediting project timelines.

-

What are the benefits of using airSlate SignNow for 3 acre conversions?

Using airSlate SignNow for 3 acre conversions provides numerous benefits, including enhanced efficiency, reduced paperwork, and greater accessibility. This leads to improved team collaboration and ensures that critical documents are processed in a timely manner.

Get more for Less Than 3 Acre Conversion Exemption Cal Fire State Of California

- Tenants or as community property with right of form

- Online library of liberty olllibertyfundorg form

- Control number nm sdeed 7 form

- Husband and wife to unincorporated association form

- New mexico quit claim deeds us legal forms

- New mexico deed forms us legal forms

- In new mexico does a deed have to specify how multiple form

- Wiatt v state farm insurance companies 560 f supp 2d form

Find out other Less Than 3 Acre Conversion Exemption Cal Fire State Of California

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word