ANALYSIS of IMPROPER PAYMENT Form

What is the ANALYSIS OF IMPROPER PAYMENT

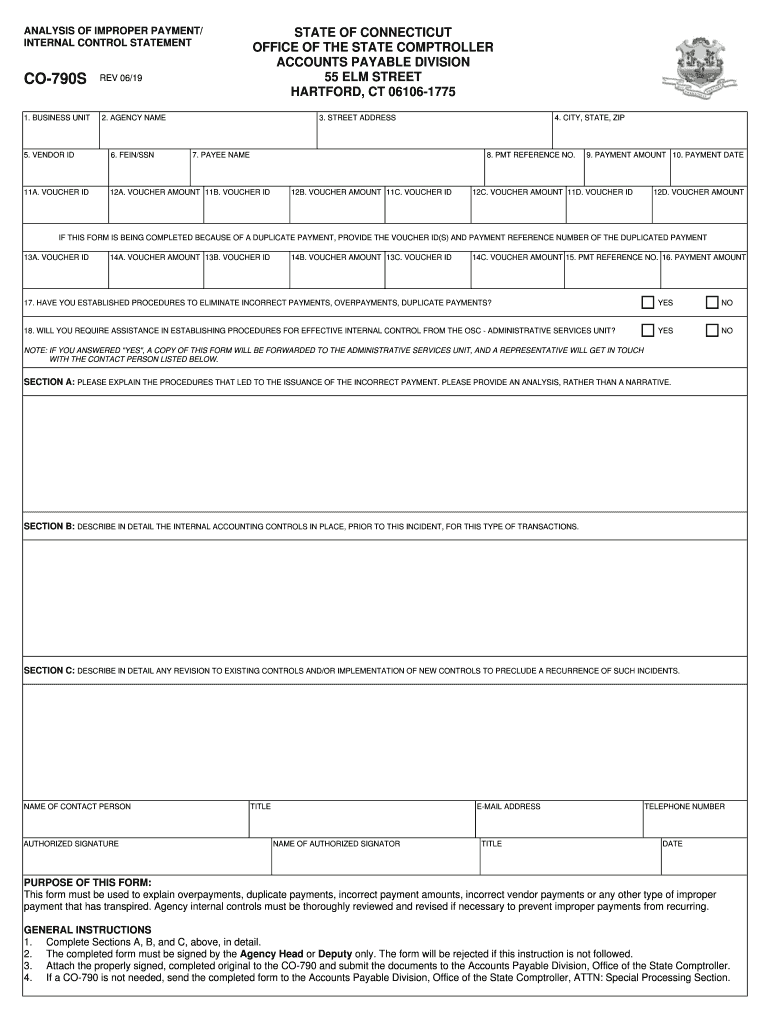

The Analysis of Improper Payment is a critical document used to assess and identify errors in payment processes. This form is particularly relevant for organizations that manage federal funds or any financial transactions where accuracy is paramount. It serves as a tool for ensuring compliance with regulations and for maintaining financial integrity. By analyzing improper payments, organizations can mitigate risks associated with fraud, waste, and abuse, thereby enhancing accountability and transparency in financial management.

How to use the ANALYSIS OF IMPROPER PAYMENT

Using the Analysis of Improper Payment involves several key steps. First, gather all relevant financial records and transaction details that pertain to the payments in question. Next, review these records against established criteria to identify any discrepancies or errors. This may involve cross-referencing with payment authorization documents and verifying recipient information. Once the analysis is complete, document your findings in the form, ensuring that all necessary fields are filled out accurately to reflect the results of your review.

Key elements of the ANALYSIS OF IMPROPER PAYMENT

Several key elements are essential for a comprehensive Analysis of Improper Payment. These include:

- Transaction Details: Information about the payment, including date, amount, and recipient.

- Authorization Records: Documentation that verifies the legitimacy of the payment.

- Discrepancy Identification: A clear outline of any errors or issues found during the analysis.

- Corrective Actions: Recommendations for addressing identified improper payments.

Incorporating these elements ensures a thorough evaluation and helps in developing strategies to prevent future occurrences.

Steps to complete the ANALYSIS OF IMPROPER PAYMENT

Completing the Analysis of Improper Payment involves a systematic approach:

- Collect all relevant payment documentation.

- Verify the accuracy of payment amounts and recipient details.

- Cross-check against authorization records.

- Identify any discrepancies or improper payments.

- Document findings and recommended actions in the form.

- Submit the completed form to the appropriate authority.

Following these steps ensures a comprehensive review and helps maintain compliance with financial regulations.

Legal use of the ANALYSIS OF IMPROPER PAYMENT

The legal use of the Analysis of Improper Payment is crucial for organizations that handle federal funds or are subject to regulatory scrutiny. This form aids in demonstrating compliance with laws and regulations governing financial transactions. Properly completed, it can serve as evidence in audits, investigations, or legal proceedings. Organizations must ensure that the analysis is conducted in accordance with applicable laws, including those related to data privacy and financial reporting.

Examples of using the ANALYSIS OF IMPROPER PAYMENT

Examples of utilizing the Analysis of Improper Payment include:

- Identifying duplicate payments made to vendors.

- Assessing payments made without proper authorization.

- Evaluating payments that do not align with contract terms.

- Reviewing reimbursements that lack adequate supporting documentation.

These examples illustrate the form's application in various scenarios, highlighting its importance in maintaining financial accuracy and integrity.

Quick guide on how to complete analysis of improper payment

Effortlessly Prepare ANALYSIS OF IMPROPER PAYMENT on Any Device

Digital document management has become popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage ANALYSIS OF IMPROPER PAYMENT across any platform using the airSlate SignNow Android or iOS applications and simplify your document-driven processes today.

How to Adjust and Electronically Sign ANALYSIS OF IMPROPER PAYMENT with Ease

- Obtain ANALYSIS OF IMPROPER PAYMENT and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign ANALYSIS OF IMPROPER PAYMENT and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of ANALYSIS OF IMPROPER PAYMENT in document management?

The ANALYSIS OF IMPROPER PAYMENT is crucial for businesses as it helps identify any errors or discrepancies in payment processes. By utilizing advanced document management tools like airSlate SignNow, businesses can streamline their eSigning workflows, reducing the chances of improper payments.

-

How can airSlate SignNow assist in the ANALYSIS OF IMPROPER PAYMENT?

airSlate SignNow offers features that enhance the ANALYSIS OF IMPROPER PAYMENT by providing clear visibility into document workflows. Users can track the status of documents, ensuring that payments align accurately with eSigned agreements, minimizing risks associated with improper payments.

-

What pricing plans are available for airSlate SignNow's features related to ANALYSIS OF IMPROPER PAYMENT?

airSlate SignNow provides flexible pricing plans that cater to various business needs, including capabilities for ANALYSIS OF IMPROPER PAYMENT. Each plan includes features that facilitate document tracking and eSigning, ensuring that businesses can optimize their payment processes.

-

Does airSlate SignNow offer integrations that enhance ANALYSIS OF IMPROPER PAYMENT?

Yes, airSlate SignNow integrates with many popular software solutions, which enhances the ANALYSIS OF IMPROPER PAYMENT process. These integrations enable seamless data flow between platforms, helping businesses analyze payment discrepancies efficiently.

-

What are the main benefits of using airSlate SignNow for ANALYSIS OF IMPROPER PAYMENT?

The main benefits of using airSlate SignNow for ANALYSIS OF IMPROPER PAYMENT include improved accuracy in document handling, time savings in payment verification, and enhanced compliance. Businesses can reduce the risk of improper payments by leveraging eSigning features and automated workflows.

-

Can airSlate SignNow help in real-time monitoring of ANALYSIS OF IMPROPER PAYMENT?

Absolutely! airSlate SignNow provides real-time monitoring tools that assist in the ANALYSIS OF IMPROPER PAYMENT. Users can receive instant notifications and updates regarding document status, enabling quick responses to any potential issues.

-

Is there a mobile app available for accessing features related to ANALYSIS OF IMPROPER PAYMENT?

Yes, airSlate SignNow has a mobile application that allows users to access features related to the ANALYSIS OF IMPROPER PAYMENT on-the-go. This ensures that businesses can manage their documents and payments efficiently, regardless of their location.

Get more for ANALYSIS OF IMPROPER PAYMENT

- Az l010 fill online printable fillable blank states business forms

- Arizona commission form

- Lee county notice of commencement form

- Maryland operating agreement template form

- Ucc 1 form louisiana

- City of chicago general contractor license renewal form

- Frequently asked questionscity of fort collins form

- Po box 12401 austin texas 78711800 835 5832512 form

Find out other ANALYSIS OF IMPROPER PAYMENT

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile