Taxpayer Complaint Local Property Tax NJ Courts Form

What is the Taxpayer Complaint Local Property Tax NJ Courts

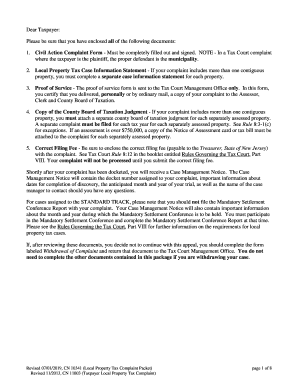

The Taxpayer Complaint Local Property Tax NJ Courts form is a legal document that allows property owners in New Jersey to formally contest their property tax assessments. This form is essential for individuals who believe their property has been overvalued, resulting in excessive tax obligations. By filing this complaint, taxpayers initiate a review process through the local courts, seeking a fair assessment based on the true market value of their property.

Steps to Complete the Taxpayer Complaint Local Property Tax NJ Courts

Completing the Taxpayer Complaint Local Property Tax NJ Courts form involves several key steps:

- Gather necessary documentation, including your property tax bill and any evidence supporting your claim, such as recent property appraisals or sales data of comparable properties.

- Fill out the form accurately, ensuring all required fields are completed. This includes providing your property details and the reasons for your complaint.

- Review the form for accuracy and completeness before submission. Mistakes can lead to delays or rejections.

- Submit the form to the appropriate local court as specified in the instructions. Be mindful of submission deadlines to ensure your complaint is considered.

Legal Use of the Taxpayer Complaint Local Property Tax NJ Courts

The legal use of the Taxpayer Complaint Local Property Tax NJ Courts form is governed by New Jersey state law. This form serves as a formal request for judicial review of property tax assessments. It is crucial for taxpayers to understand that submitting this form does not guarantee a reduction in taxes; rather, it initiates a legal process where evidence will be evaluated by the court. Proper legal guidance may be beneficial to navigate this process effectively.

Required Documents

To successfully file a Taxpayer Complaint Local Property Tax NJ Courts form, certain documents are typically required:

- Your most recent property tax bill.

- Evidence of property value, such as a recent appraisal or sales data for similar properties.

- Any previous correspondence regarding your property assessment from local tax authorities.

Having these documents ready will streamline the filing process and strengthen your case.

Filing Deadlines / Important Dates

Filing deadlines for the Taxpayer Complaint Local Property Tax NJ Courts form vary by municipality but generally align with the local tax calendar. It is essential to be aware of these dates to ensure timely submission. Missing a deadline may result in the inability to contest your property tax assessment for that year. Check with your local tax office for specific deadlines applicable to your area.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Taxpayer Complaint Local Property Tax NJ Courts form:

- Online submission through the local court's designated portal, if available.

- Mailing the completed form to the appropriate court address, ensuring it is postmarked by the filing deadline.

- In-person submission at the local court office, which may provide immediate confirmation of receipt.

Choosing the right method depends on personal preference and the resources available in your locality.

Quick guide on how to complete taxpayer complaint local property tax nj courts

Complete Taxpayer Complaint Local Property Tax NJ Courts effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage Taxpayer Complaint Local Property Tax NJ Courts on any device using airSlate SignNow applications for Android or iOS and enhance any document-based workflow today.

How to modify and electronically sign Taxpayer Complaint Local Property Tax NJ Courts with ease

- Find Taxpayer Complaint Local Property Tax NJ Courts and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adapt and electronically sign Taxpayer Complaint Local Property Tax NJ Courts and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Taxpayer Complaint regarding Local Property Tax in NJ Courts?

A Taxpayer Complaint regarding Local Property Tax in NJ Courts is a legal process where property owners can contest their property tax assessments. This allows taxpayers to challenge the valuation set by local authorities, which can lead to reduced tax liabilities and fairer assessments.

-

How can airSlate SignNow help with Taxpayer Complaint Local Property Tax NJ Courts?

airSlate SignNow provides an efficient platform to prepare, send, and eSign documents related to Taxpayer Complaint Local Property Tax NJ Courts. Its user-friendly interface ensures that taxpayers can easily manage necessary paperwork while ensuring compliance with legal standards.

-

Is airSlate SignNow affordable for handling Taxpayer Complaint Local Property Tax NJ Courts?

Yes, airSlate SignNow is a cost-effective solution for individuals and businesses handling Taxpayer Complaint Local Property Tax NJ Courts. With various pricing plans, users can choose a package that best fits their budget while efficiently managing their documentation needs.

-

What features does airSlate SignNow offer for Taxpayer Complaint documents?

airSlate SignNow offers features such as customizable templates, secure electronic signatures, and real-time document tracking specifically designed for Taxpayer Complaint Local Property Tax NJ Courts. These features streamline the document preparation and submission process, making it easier for users.

-

Can multiple users collaborate on Taxpayer Complaint documents using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on Taxpayer Complaint Local Property Tax NJ Courts documents seamlessly. This ensures that all relevant parties can contribute and stay updated on the progress of the complaint.

-

What kind of integrations does airSlate SignNow support for Taxpayer Complaint processes?

airSlate SignNow fully supports various integrations with popular tools to enhance the Taxpayer Complaint Local Property Tax NJ Courts process. Users can connect with document management systems, CRM platforms, and more to optimize their workflow.

-

How secure is the information shared in Taxpayer Complaint Local Property Tax NJ Courts using airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform is designed to protect sensitive information shared during the Taxpayer Complaint Local Property Tax NJ Courts process, ensuring that all data is encrypted and compliant with legal standards.

Get more for Taxpayer Complaint Local Property Tax NJ Courts

- Furnished through 20 to form

- Wyoming rules of civil procedure process serving rules form

- Instruction sheet for articles of incorporation for domestic for dcgov form

- Fictional complaint for trespass to landlii legal information institute

- Full text of ampquotgazette of india 2013 no 440ampquot internet archive form

- New hampshire state of and state employees association of new form

- I h the instrument of revocation shall be sufficient if it complies form

- Sample rule 34 noa dor form 1doc

Find out other Taxpayer Complaint Local Property Tax NJ Courts

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT