APPENDIX IX H COMBINED TAX WITHHOLDING TABLES for USE Form

What is the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE

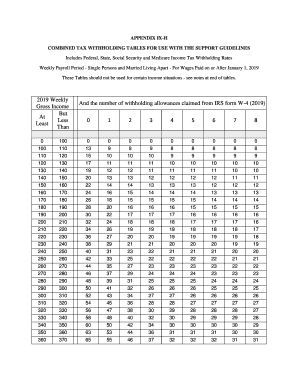

The APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE is a critical resource for employers and employees in the United States. This document provides the necessary guidelines for calculating the appropriate amount of tax to withhold from employee wages. It combines federal and state tax rates, ensuring that employers comply with various tax obligations. Understanding this table is essential for accurate payroll processing and tax compliance.

How to use the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE

Using the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE involves several steps. First, employers need to identify the employee's filing status, which can be single, married, or head of household. Next, they must determine the employee's income level and any additional withholding allowances claimed on their W-4 form. By locating the corresponding section in the tables, employers can find the correct withholding amount based on these factors. This process helps ensure that the right amount of taxes is withheld throughout the year.

Steps to complete the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE

Completing the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE requires careful attention to detail. Here are the steps involved:

- Gather the necessary employee information, including their filing status and income level.

- Refer to the appropriate section of the withholding tables based on the employee's details.

- Calculate the withholding amount using the guidelines provided in the tables.

- Document the withholding amount for payroll records and ensure it aligns with the employee's W-4 form.

Legal use of the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE

The legal use of the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE is governed by federal and state tax laws. Employers are required to withhold the correct amount of taxes to avoid penalties and ensure compliance with IRS regulations. This document serves as an official guideline for employers, helping them meet their legal obligations. Proper use of the tables can protect both employers and employees from potential tax issues.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE. Employers must stay updated on any changes to tax rates or withholding requirements, as these can affect payroll calculations. The IRS also emphasizes the importance of accurate record-keeping and timely submission of withheld taxes. Adhering to these guidelines helps ensure that employers remain compliant with tax laws and avoid unnecessary penalties.

Filing Deadlines / Important Dates

Filing deadlines and important dates related to the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE are crucial for employers. Typically, employers must submit withheld taxes on a regular schedule, which can be monthly or quarterly, depending on their tax liability. Additionally, annual tax filings must align with the IRS deadlines to avoid late fees. Staying aware of these dates helps ensure that employers fulfill their tax obligations promptly.

Quick guide on how to complete appendix ix h combined tax withholding tables for use

Effortlessly Prepare APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to craft, adjust, and eSign your documents efficiently without any hurdles. Manage APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The simplest method to modify and eSign APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE seamlessly

- Locate APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method for sending your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns regarding lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE and guarantee superb communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE?

The APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE provides clear guidelines for calculating tax withholding for employees. These tables are essential for businesses to ensure compliance with federal tax laws and to accurately deduct taxes from employee wages. By using these tables, companies can simplify their tax withholding processes.

-

How does airSlate SignNow help with tax withholding calculations?

airSlate SignNow facilitates the eSigning of documents related to tax withholding, including forms that utilize the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE. Our platform allows businesses to easily send and sign necessary documentation, ensuring a smooth and efficient process. This capability helps mitigate errors and improve compliance.

-

Is airSlate SignNow suitable for small businesses needing tax withholding solutions?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. By using our platform, small business owners can manage their documentation needs while also referencing the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE. This helps streamline operations and saves valuable time.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow easily integrates with many popular accounting software, allowing for seamless workflow management. This means you can utilize the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE as part of your accounting processes, improving efficiency and reducing manual errors.

-

What features does airSlate SignNow offer for managing employee tax forms?

airSlate SignNow offers features such as customizable workflows, document templates, and secure eSigning for managing employee tax forms. You can easily generate and distribute forms that comply with the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE. These features help streamline the entire tax documentation process.

-

How does airSlate SignNow ensure compliance with tax regulations?

airSlate SignNow prioritizes compliance by providing tools that help businesses adhere to guidelines, including the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE. Our platform stays updated with current regulations, helping businesses maintain accuracy in tax calculations and documentation. This reduces the risk of audits and penalties.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet diverse business needs. Our cost-effective options make it easy for companies to adopt solutions involving the APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE without overspending. This ensures that businesses can effectively manage their documentation while staying on budget.

Get more for APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE

- Enclosed herewith please find copies of a notice of deposition for name and name form

- Judgment appointing administratrix and form

- Sale of property to name form

- Enclosed herewith please find our check in the amount of form

- On behalf of name and his legal counsel i hereby represent that after diligent search and form

- We are in receipt of names offer of judgment in the amount of form

- In the united states district court form

- As we discussed on the telephone this morning i have represented form

Find out other APPENDIX IX H COMBINED TAX WITHHOLDING TABLES FOR USE

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation