Penndot Form Ojt Eo 365 2010-2026

What is the Penndot Form Ojt Eo 365

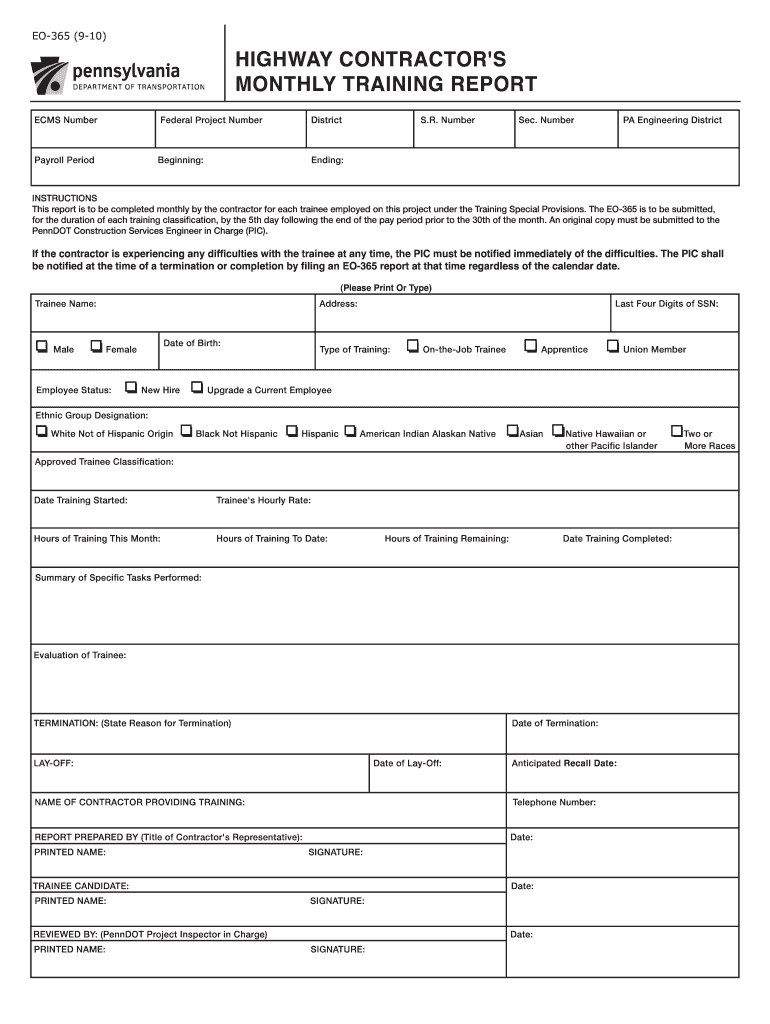

The Penndot Form Ojt Eo 365 is a specific application form used in Pennsylvania for on-the-job training programs. This form is essential for individuals seeking to participate in training initiatives that enhance their skills and employability within various industries. The Ojt Eo 365 form collects pertinent information about the applicant, including personal details, training objectives, and the employer's commitment to providing the necessary training.

Steps to Complete the Penndot Form Ojt Eo 365

Completing the Penndot Form Ojt Eo 365 involves several key steps:

- Gather necessary personal information, including your name, address, and contact details.

- Provide details about your current employment status and the employer offering the training.

- Outline the training program, including objectives and duration.

- Ensure all required fields are filled accurately to avoid delays.

- Review the completed form for accuracy before submission.

How to Obtain the Penndot Form Ojt Eo 365

The Penndot Form Ojt Eo 365 can be obtained through the Pennsylvania Department of Transportation's official website or by contacting their office directly. It is advisable to download the most current version to ensure compliance with the latest requirements. Additionally, forms may be available at local workforce development offices.

Legal Use of the Penndot Form Ojt Eo 365

The legal use of the Penndot Form Ojt Eo 365 is governed by state regulations regarding training programs. This form must be filled out accurately and submitted to the appropriate authorities to ensure that the training is recognized and funded. It is crucial to adhere to all legal requirements to avoid potential penalties or delays in processing.

Eligibility Criteria

To be eligible for the Penndot Form Ojt Eo 365, applicants typically must meet specific criteria, including:

- Being a resident of Pennsylvania.

- Having a job offer from an employer willing to provide on-the-job training.

- Meeting any age or educational requirements set forth by the training program.

Form Submission Methods

The Penndot Form Ojt Eo 365 can be submitted through various methods, including:

- Online submission via the Pennsylvania Department of Transportation's website.

- Mailing the completed form to the designated office.

- In-person submission at local workforce development offices.

Quick guide on how to complete highway contractoramp39s monthly training report eo 365 ftp dot state pa

Simplify your existence by signNowing Penndot Form Ojt Eo 365 form with airSlate SignNow

Whether you need to title a new automobile, register for obtaining a driver’s license, transfer ownership, or perform any other task related to automobiles, dealing with such RMV paperwork as Penndot Form Ojt Eo 365 is a necessary hassle.

There are several methods through which you can obtain them: by mail, at the RMV service center, or by accessing them online via your local RMV website and printing them out. Each of these is time-consuming. If you’re looking for a faster way to complete them and endorse them with a legally-binding eSignature, airSlate SignNow is the optimal choice.

How to complete Penndot Form Ojt Eo 365 effortlessly

- Click Show details to view a brief summary of the document you are interested in.

- Select Get document to begin and open the document.

- Follow the green label indicating the required fields if applicable.

- Utilize the top toolbar and employ our advanced feature set to edit, annotate, and enhance the visual appeal of your document.

- Insert text, your initials, shapes, images, and other elements.

- Select Sign in in the same toolbar to generate a legally-binding eSignature.

- Review the document content to ensure it’s free of errors and inconsistencies.

- Click Done to complete document execution.

Using our service to fill out your Penndot Form Ojt Eo 365 and other associated documents will save you a considerable amount of time and effort. Enhance your RMV document execution process from day one!

Create this form in 5 minutes or less

FAQs

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

What are some good places for independent contractors to fill out taxes online?

If you were simply filing employment income I would entirely agree with Ms. King’s response. Congratulations you are officially an entrepreneur! Considering only 5% of taxpayers are successful in venturing out on their own on the first try, you have a steep learning curve ahead. As you have been operating as a contractor your tax situation is now more complex.If you have access to a professional for advice, you might try doing it yourself via TurboTax. But I would counsel against that as, in all probability, you are not intimately familiar with the ins-and-outs of what you may or may not deduct as legitimate expenses, and how to compile your information in a manner that meets the reporting and organizational requirements of record keeping (as well as how to store and keep those records according to the Income Tax Act.It might cost a bit more initially to find a compatible tax preparer, I think it worth it the long run. I highly recommend it, especially if you find someone who will represent you for the year not just to prepare your taxes for that year. Build a relationship, just as you should do with your bank, its essential to your success.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

If you pay a contractor (in the US) do you need to fill out tax forms? Is it different if I am in the US paying contractors outside the US?

If you are paying contractors in the U.S. in connection with a trade or business, and you pay any one of them in aggregate in excess of $600, you are required to prepare a 1099 form. In aggregate means that if you paid someone $ 400, and then later paid them $ 201, you’d be liable to prepare the 1099.If you pay persons that are not in the U.S., then your only requirement is to ascertain that they are not U.S. citizens or U.S. permanent residents. If either of those situations apply, then the $ 600 rule applies.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

Which GST form should I fill out for filing a return as a building work contractor?

You need to file GSTR 3b and GSTR 1 ,if it government contract make sure to claim INPUT for TDS deducted amount.

-

Is it possible to use fly ash for embankments (highway/railway) without any failure?

Well in the modern world we can mix the fly ash with different admixtures and make it up to the mark and carry out the slopes which can be used for pavement or railway construction. Even fly ash pavements are actually into play. The characterstics of fly ash is improved using the admixtures and required design is made for it.Here you can find more: https://www.fhwa.dot.gov/pavemen...

Create this form in 5 minutes!

How to create an eSignature for the highway contractoramp39s monthly training report eo 365 ftp dot state pa

How to create an eSignature for the Highway Contractoramp39s Monthly Training Report Eo 365 Ftp Dot State Pa online

How to create an eSignature for the Highway Contractoramp39s Monthly Training Report Eo 365 Ftp Dot State Pa in Chrome

How to generate an electronic signature for signing the Highway Contractoramp39s Monthly Training Report Eo 365 Ftp Dot State Pa in Gmail

How to generate an eSignature for the Highway Contractoramp39s Monthly Training Report Eo 365 Ftp Dot State Pa straight from your smartphone

How to create an eSignature for the Highway Contractoramp39s Monthly Training Report Eo 365 Ftp Dot State Pa on iOS devices

How to generate an electronic signature for the Highway Contractoramp39s Monthly Training Report Eo 365 Ftp Dot State Pa on Android OS

People also ask

-

What is the ojt application form 2024 and how do I access it?

The ojt application form 2024 is a streamlined document designed for students seeking on-the-job training opportunities. You can easily access the form through our airSlate SignNow platform, allowing you to fill it out electronically and submit it efficiently.

-

How can airSlate SignNow simplify my ojt application form 2024 submission?

airSlate SignNow simplifies the submission process of the ojt application form 2024 by allowing users to fill, sign, and send their documents online. Our intuitive interface ensures that you can submit your application with just a few clicks, saving you time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the ojt application form 2024?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including a free trial for new users. You can choose a plan that best suits your requirements while utilizing our features for the ojt application form 2024 submission process without breaking the bank.

-

What features does airSlate SignNow offer for the ojt application form 2024?

AirSlate SignNow provides features such as eSignature, document templates, and automated workflows specifically tailored for the ojt application form 2024. These tools help ensure your application is completed accurately and sent promptly.

-

Can I integrate airSlate SignNow with other tools for the ojt application form 2024?

Absolutely! airSlate SignNow supports integrations with popular platforms, making it easy to link your existing tools and streamline the process for your ojt application form 2024. This flexibility enhances your workflow and increases efficiency.

-

How secure is my information when using the ojt application form 2024 on airSlate SignNow?

Security is a priority for airSlate SignNow. When filling out the ojt application form 2024, your data is protected by advanced encryption and secure storage protocols, ensuring that your personal information remains confidential and safe.

-

What are the benefits of using airSlate SignNow for the ojt application form 2024?

Using airSlate SignNow for the ojt application form 2024 minimizes paperwork and enhances efficiency. You gain access to a reliable platform that simplifies document management, making it convenient to apply for opportunities without hassles.

Get more for Penndot Form Ojt Eo 365

- Form 4 sm 2

- Fca413 416 424 425 form 4 2 439 439a

- Stipulation for child support form

- How to file an objection or a rebuttal for a child support order form

- Get the fca 522 523 form 5 1 ssl 111 g paternity petition

- Summons paternity form

- The above named petitioner respondent having moved this form

- Get the agreementwaiver of participation for state of form

Find out other Penndot Form Ojt Eo 365

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT