Balloon Note Form

What is the Balloon Note Form

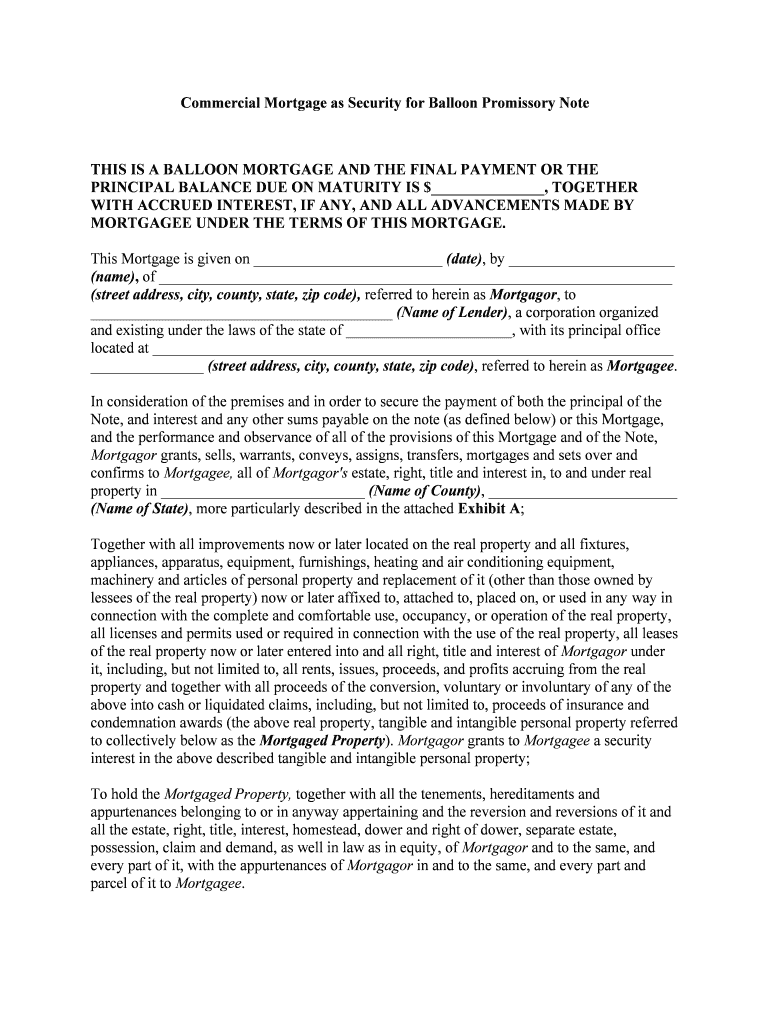

The balloon note form is a specific type of promissory note that outlines a loan agreement where the borrower makes regular payments for a set period, followed by a final larger payment, known as the "balloon payment." This form is commonly used in commercial lending and real estate transactions. It provides clarity on the terms of repayment, including the interest rate, payment schedule, and the total amount due at the end of the term. Understanding the structure of a balloon note is crucial for both lenders and borrowers to ensure compliance and avoid potential disputes.

How to use the Balloon Note Form

Using the balloon note form involves several key steps to ensure that all necessary information is accurately captured. First, both parties should review the terms of the loan to agree on the interest rate and repayment schedule. Next, the borrower fills out the form with details such as the loan amount, payment intervals, and the due date for the final balloon payment. It is essential to sign the document in the presence of a witness or notary to validate the agreement. After completing the form, both parties should retain copies for their records, ensuring that they have access to the agreed-upon terms at any time.

Key elements of the Balloon Note Form

The balloon note form includes several critical elements that define the loan agreement. These elements typically consist of:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the loan, which can be fixed or variable.

- Payment Schedule: The frequency of payments, such as monthly or quarterly.

- Balloon Payment: The larger final payment due at the end of the loan term.

- Borrower and Lender Information: Names and contact details of both parties involved in the agreement.

- Signatures: Required signatures of both the borrower and lender to validate the agreement.

Steps to complete the Balloon Note Form

Completing the balloon note form involves a systematic approach to ensure accuracy and legality. Follow these steps:

- Gather necessary information, including loan details and personal information of both parties.

- Fill out the form, ensuring all fields are completed accurately.

- Review the terms with the lender to confirm agreement on the interest rate and payment schedule.

- Sign the document in the presence of a notary or witness, if required.

- Distribute copies of the signed form to both parties for their records.

Legal use of the Balloon Note Form

The legal use of the balloon note form is governed by state and federal regulations. It is essential for both parties to understand the legal implications of the agreement, including the enforceability of the terms outlined in the form. Compliance with relevant laws, such as the Truth in Lending Act, ensures that borrowers are fully informed about their obligations. Additionally, using a legally sound electronic signature platform can enhance the validity of the agreement, providing a secure method for signing and storing documents.

State-specific rules for the Balloon Note Form

Each state may have specific rules and regulations governing the use of balloon notes. It is important to research local laws to ensure compliance. For example, some states may require additional disclosures or impose limits on the interest rates that can be charged. Familiarizing yourself with these state-specific requirements can help avoid legal complications and ensure that the balloon note form is valid and enforceable in your jurisdiction.

Quick guide on how to complete balloon note form 481367050

Complete Balloon Note Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Balloon Note Form on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Balloon Note Form with ease

- Obtain Balloon Note Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark signNow parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Balloon Note Form and facilitate excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a commercial promissory note?

A commercial promissory note is a legal document where one party promises to pay a specific amount to another party at a specified time. This type of note is commonly used in business transactions to facilitate loans and financial agreements. Understanding commercial promissory notes is essential for ensuring proper documentation in your business dealings.

-

How can airSlate SignNow help with commercial promissory notes?

airSlate SignNow streamlines the process of creating, signing, and managing commercial promissory notes. With its intuitive platform, businesses can efficiently generate and eSign their documents, reducing the time and complexity often associated with traditional methods. This leads to faster funding and improved cash flow management.

-

What features does airSlate SignNow offer for commercial promissory notes?

airSlate SignNow provides several features tailored for handling commercial promissory notes, including customizable templates, in-person signing, and automated reminders. The platform also supports document tracking and audit trails, ensuring all parties are aware of the document's status. These features promote transparency and enhance the overall signing experience.

-

Is airSlate SignNow a cost-effective solution for commercial promissory notes?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes dealing with commercial promissory notes. With various pricing plans tailored to meet different business needs, companies can choose a package that fits their budget. This affordability does not compromise the quality or features of the service provided.

-

Are there integrations available to manage commercial promissory notes more efficiently?

Yes, airSlate SignNow offers numerous integrations with popular business applications that can enhance the management of commercial promissory notes. Integrations with platforms such as CRM systems and cloud storage services allow for seamless data flow and improved workflow efficiency. This ensures that your documents are accessible and organized.

-

What are the benefits of using airSlate SignNow for commercial promissory notes?

Using airSlate SignNow for commercial promissory notes provides numerous benefits, including increased efficiency, enhanced security, and improved compliance. Businesses can quickly send, sign, and store their notes digitally, minimizing paperwork and reducing the risk of errors. This not only saves time but also strengthens business relationships through reliable, secure transactions.

-

Can airSlate SignNow help with the enforcement of commercial promissory notes?

Yes, airSlate SignNow can support the enforcement of commercial promissory notes by providing a secure and legally binding signing process. The digital signature technology ensures that all parties have consented to the terms, which is crucial for legal enforceability. Additionally, records maintained within the platform can serve as vital proof in case of disputes.

Get more for Balloon Note Form

- Attorney resourcespracticewelcome to the us court for form

- Plaintiff in this action seeks to attach property in which defendant has an interest form

- Deposition subpoena for personal appearance and production form

- Order for issuance of writ of attachment form

- Application and notice of hearing for order form

- Propublicainvestigative journalism and news in the form

- To determine sufficiency of plaintiffs sureties form

- You are notified that a hearing will be held in this court as follows form

Find out other Balloon Note Form

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed