Transfer on Death Form

What is the Transfer On Death

The Transfer On Death (TOD) is a legal mechanism that allows individuals to designate beneficiaries who will receive their property upon their death, bypassing the probate process. This form is particularly useful for real estate and financial accounts, ensuring that assets are transferred smoothly and efficiently. By naming a beneficiary on a TOD deed, property owners can maintain control over their assets during their lifetime while providing a clear directive for their distribution after death.

Steps to complete the Transfer On Death

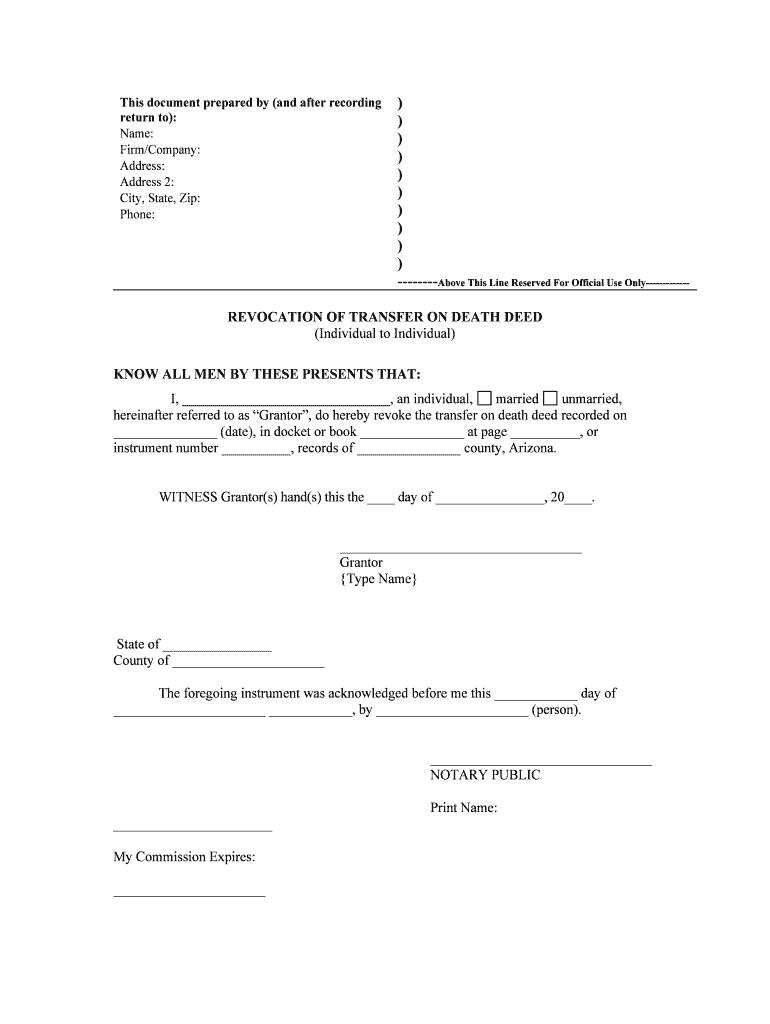

Completing a Transfer On Death deed involves several key steps to ensure its validity and effectiveness. First, the property owner must obtain the appropriate TOD form, which can typically be found through state or local government resources. Next, the owner should fill out the form, including details such as the property description and the designated beneficiary's information. It is crucial to sign the deed in the presence of a notary public to validate the document. Finally, the completed TOD deed must be filed with the appropriate county recorder's office to make it legally binding.

Legal use of the Transfer On Death

The Transfer On Death deed is legally recognized in many states, including Arizona, as a means to transfer property without going through probate. This legal framework allows property owners to designate beneficiaries who will automatically inherit the property upon the owner's death. It is essential to understand that while the TOD deed simplifies the transfer process, it must comply with specific state laws and regulations to be enforceable. Consulting with a legal professional can help ensure that the deed meets all necessary legal requirements.

Required Documents

To complete a Transfer On Death deed, several documents are typically required. These include the completed TOD form, which must include accurate property details and beneficiary information. Additionally, a valid form of identification for the property owner may be necessary to verify identity during the signing process. If applicable, any prior deeds or documents related to the property may also be needed to confirm ownership and ensure a clear title.

State-specific rules for the Transfer On Death

Each state has its own regulations regarding the Transfer On Death deed, which can affect how it is executed and enforced. In Arizona, for instance, the TOD deed must be recorded within a specific timeframe following the owner's death to be valid. Understanding these state-specific rules is crucial for property owners to ensure that their intentions are honored and that the transfer occurs without complications. It is advisable to consult state laws or legal professionals for guidance on local requirements.

Examples of using the Transfer On Death

Using a Transfer On Death deed can provide clarity in estate planning. For example, a homeowner may choose to designate their child as the beneficiary of their home. Upon the homeowner's death, the child would automatically inherit the property, avoiding the lengthy probate process. Another scenario could involve a bank account where the account holder names a sibling as the beneficiary, ensuring that the funds are transferred directly to them without legal delays. These examples illustrate the practical benefits of utilizing a TOD deed in estate planning.

Quick guide on how to complete transfer on death

Easily Prepare Transfer On Death on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage Transfer On Death on any platform using the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

The easiest way to edit and electronically sign Transfer On Death effortlessly

- Find Transfer On Death and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Transfer On Death to guarantee effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a transfer death form?

A transfer death form is a legal document used to transfer ownership of assets or accounts after someone's death. This form is necessary to ensure that the assets are correctly passed to beneficiaries, following the deceased's wishes. Using airSlate SignNow makes it simple to create and sign this document securely.

-

How do I fill out a transfer death form using airSlate SignNow?

Filling out a transfer death form with airSlate SignNow is straightforward. Simply upload the document, add the necessary information about the deceased and beneficiaries, and then share it for electronic signatures. Our platform guides you through the process, ensuring everything is completed accurately and efficiently.

-

What are the benefits of using airSlate SignNow for a transfer death form?

Using airSlate SignNow for a transfer death form allows for quick, secure, and legally binding signatures. Our platform is user-friendly and cost-effective, helping you save time and reduce the stress associated with the documentation process. Additionally, you can store and manage all your documents in one place.

-

Is there a cost associated with using airSlate SignNow for a transfer death form?

Yes, airSlate SignNow offers various pricing plans depending on your needs, starting with a free trial. Our solutions are designed to be cost-effective to help you manage essential documents, including the transfer death form, without breaking the bank. Check our pricing page for specific details.

-

Can I track the status of my transfer death form after sending it?

Absolutely! airSlate SignNow provides real-time tracking for all sent documents, including your transfer death form. You will receive notifications when the form is opened, viewed, signed, or completed, giving you peace of mind throughout the entire process.

-

Does airSlate SignNow integrate with other applications to manage my transfer death form?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your productivity when managing a transfer death form. You can connect it with tools like Google Drive, Dropbox, and popular CRM systems. These integrations ensure that your documents are synchronized and easily accessible.

-

Is airSlate SignNow legally binding for a transfer death form?

Yes, documents signed via airSlate SignNow, including a transfer death form, are legally binding and compliant with electronic signature laws. Our platform adheres to industry standards to ensure all signatures are secure and verifiable, giving you full confidence in the legality of your documents.

Get more for Transfer On Death

- Gas pipe outlets form

- Scope of work refrigeration work involves the use of hand tools instruments and gauges form

- Scope of work drainage services may include plumbing repair work for drains sinks form

- Scope of work brick masonry is the construction process in which masons tools form

- Roofing contract pdf heilmagnetismus heil magnetismus form

- Service as per specifications from electric company overhead form

- Drywall contract form

- Molding form

Find out other Transfer On Death

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free