Note Payable Demand Form

What is the note payable demand?

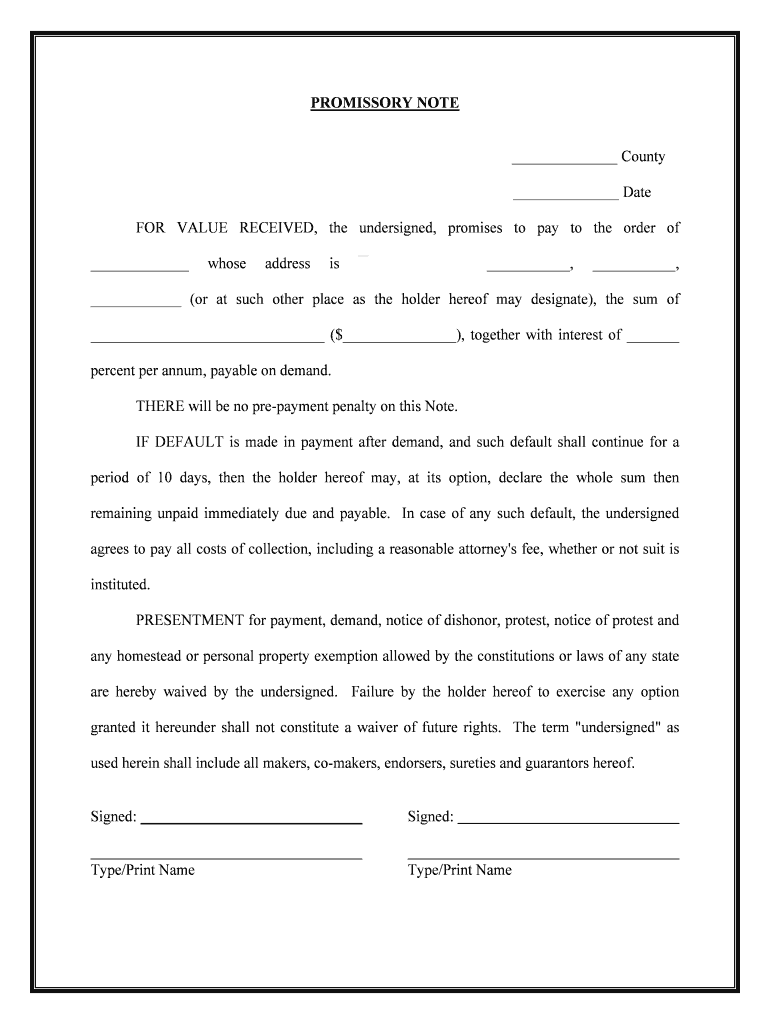

A note payable demand is a legal document that outlines a borrower's obligation to repay a specified amount of money to a lender upon request. This form serves as a formal agreement between the parties involved, detailing the terms of the loan, including interest rates, repayment schedules, and any conditions that may apply. It is crucial for both parties to understand the implications of the note, as it can be enforced in a court of law if necessary.

How to use the note payable demand

Using a note payable demand involves several steps to ensure that the document is valid and enforceable. First, both the borrower and the lender should agree on the loan terms, including the amount, interest rate, and repayment timeline. Once these details are established, the borrower fills out the note payable demand template, ensuring all necessary information is included. Both parties should then sign the document, ideally in the presence of a witness or notary, to enhance its legal standing.

Steps to complete the note payable demand

Completing a note payable demand involves a systematic approach to ensure accuracy and compliance with legal standards. Follow these steps:

- Gather necessary information, including the names and addresses of both parties.

- Specify the loan amount and the agreed-upon interest rate.

- Outline the repayment terms, including the due date and payment frequency.

- Include any additional terms or conditions that apply to the loan.

- Sign the document in the presence of a witness or notary.

Key elements of the note payable demand

Understanding the key elements of a note payable demand is essential for both borrowers and lenders. Important components include:

- Parties involved: Clearly identify the borrower and lender.

- Loan amount: Specify the total amount being borrowed.

- Interest rate: Indicate the interest rate applicable to the loan.

- Repayment terms: Detail how and when payments will be made.

- Default conditions: Outline what happens if the borrower fails to repay.

Legal use of the note payable demand

The legal use of a note payable demand is significant, as it serves as a binding agreement between the borrower and lender. For the document to be enforceable, it must meet specific legal requirements, including clarity in terms and conditions. It is advisable for both parties to retain copies of the signed document for their records. In the event of a dispute, having a properly executed note can provide essential evidence in court.

Examples of using the note payable demand

Examples of using a note payable demand can vary widely depending on the context. Common scenarios include:

- A friend lending money to another friend with a clear repayment plan.

- A small business borrowing funds from a bank or private lender.

- Formalizing a loan between family members to avoid misunderstandings.

Quick guide on how to complete note payable demand

Effortlessly Prepare Note Payable Demand on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Note Payable Demand on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Note Payable Demand with Ease

- Find Note Payable Demand and then click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Make your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Note Payable Demand and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a note demand template?

A note demand template is a predefined form used to formally request payment on a promissory note. With airSlate SignNow, you can easily create and customize a note demand template to fit your specific needs, allowing for efficient handling of outstanding debts.

-

How can I create a note demand template using airSlate SignNow?

Creating a note demand template in airSlate SignNow is simple. Just log in to your account, select the template option, and customize it with your details, terms, and conditions. This allows you to streamline your invoicing and payment request process.

-

What are the pricing options for using the note demand template feature?

airSlate SignNow offers various pricing plans, including a free trial, allowing you to test the note demand template feature without commitment. Paid plans offer additional features, cloud storage, and integrations, which can enhance your document management efforts.

-

Can I customize the note demand template to match my brand?

Yes, airSlate SignNow allows you to fully customize the note demand template to align with your brand's identity. You can add your logo, brand colors, and personal messaging to create a professional appearance in all your document communications.

-

Are there any integrations available for the note demand template?

AirSlate SignNow integrates seamlessly with various applications, enhancing the functionality of your note demand template. This includes popular tools like Google Drive, Salesforce, and Microsoft Office, making it easy to manage all your documents in one place.

-

How does using a note demand template benefit my business?

Using a note demand template can signNowly improve your business's efficiency by standardizing the process of sending payment requests. It helps maintain professionalism, saves time, and ultimately reduces the risk of misunderstandings regarding payment terms.

-

Is it secure to send a note demand template through airSlate SignNow?

Absolutely. AirSlate SignNow employs robust security measures, ensuring that all documents, including your note demand templates, are sent securely. You can send documents with confidence, knowing your sensitive information is protected.

Get more for Note Payable Demand

- This petition is submitted pursuant to 15 14 1121 3 c form

- I name am the form

- Fillable online colorado judicial branch courts denver probate form

- Interim report due on final report form

- Petition for appointment of co conservator or court forms

- From other states conservatorship for adult form

- From other states guardianship for adult form

- Instructions for informal probate with or without a will

Find out other Note Payable Demand

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now