Protection Trust Create Form

Understanding the Protection Trust

The protection trust is a legal arrangement designed to safeguard assets from creditors and legal claims. It allows individuals to place their assets into a trust, providing a layer of protection against potential lawsuits or financial liabilities. This trust is particularly beneficial for business owners, professionals, and anyone concerned about asset exposure. By utilizing a protection trust, individuals can maintain control over their assets while enjoying enhanced security.

Steps to Complete the Protection Trust

Completing a protection trust involves several key steps to ensure its validity and effectiveness. Begin by gathering necessary information about your assets and beneficiaries. Next, consult with a legal professional to draft the trust document, ensuring it complies with state laws. Once the document is prepared, sign it in the presence of a notary to make it legally binding. Finally, fund the trust by transferring ownership of the designated assets into it. This process helps establish the trust's legal framework and protects your assets effectively.

Legal Use of the Protection Trust

The legal use of a protection trust is grounded in its ability to shield assets from creditors while allowing the grantor to retain certain rights. This trust must be established in accordance with state-specific regulations to ensure its enforceability. It is essential to follow all legal requirements, including proper documentation and funding, to maintain the trust's protective benefits. Additionally, understanding the implications of the trust on tax obligations and estate planning is crucial for effective asset management.

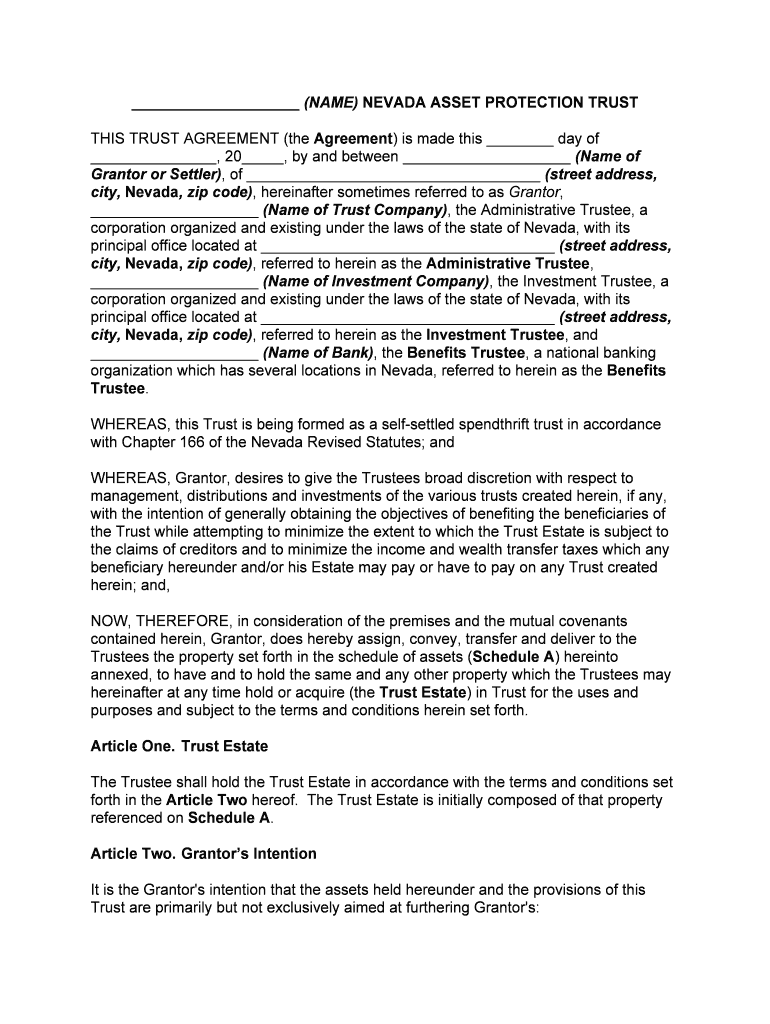

Key Elements of the Protection Trust

Several key elements define the structure and function of a protection trust. These include:

- Trustee: The individual or entity responsible for managing the trust assets.

- Beneficiaries: Those who will receive benefits from the trust, typically family members or designated individuals.

- Trust Document: A formal legal document outlining the terms and conditions of the trust.

- Funding: The process of transferring assets into the trust to activate its protective features.

State-Specific Rules for the Protection Trust

Each state has its own regulations governing the establishment and operation of protection trusts. It is important to be aware of these state-specific rules, as they can affect the trust's validity and the level of protection it offers. For instance, some states may have stricter requirements for funding or may impose limitations on the types of assets that can be protected. Consulting with a legal expert familiar with local laws can help ensure compliance and optimize the trust's benefits.

Required Documents for the Protection Trust

Establishing a protection trust requires specific documentation to ensure its legality and effectiveness. Essential documents include:

- Trust agreement outlining the terms and conditions.

- List of assets to be placed in the trust.

- Identification documents for the grantor and trustee.

- Any additional documentation required by state law.

Having these documents prepared and organized can streamline the process and help avoid potential legal issues.

Examples of Using the Protection Trust

Protection trusts can be utilized in various scenarios to safeguard assets. Some common examples include:

- Business owners protecting their company assets from potential lawsuits.

- Individuals shielding personal assets from divorce settlements.

- Professionals in high-risk fields, such as healthcare or finance, safeguarding against malpractice claims.

These examples illustrate the versatility of protection trusts in providing security for a wide range of asset types and personal circumstances.

Quick guide on how to complete protection trust create

Finish Protection Trust Create effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all necessary tools to create, alter, and electronically sign your documents quickly without any hold-ups. Manage Protection Trust Create on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The easiest method to modify and electronically sign Protection Trust Create with ease

- Locate Protection Trust Create and click on Retrieve Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically supplies for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Finish button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Protection Trust Create and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a protection trust and how does it work?

A protection trust is a legal arrangement designed to safeguard your assets from creditors and legal claims. By placing your assets within a protection trust, you can ensure they are managed according to your wishes while benefiting from enhanced privacy and security. This trust structure minimizes the risks associated with unforeseen financial liabilities.

-

How can airSlate SignNow assist with the management of protection trusts?

airSlate SignNow provides a streamlined platform for creating, signing, and managing documents related to protection trusts. With our eSigning solution, you can securely execute trust documents and maintain compliance effortlessly. This digital workflow simplifies the legal process, allowing for quick access to all necessary documentation.

-

What are the costs associated with setting up a protection trust using airSlate SignNow?

The cost of setting up a protection trust with airSlate SignNow varies depending on the complexity of your needs. Our platform offers flexible pricing plans designed to fit different budgets, making it a cost-effective solution for individuals and businesses. You can find detailed information about our pricing options on our website.

-

What are the key benefits of using a protection trust?

Using a protection trust provides several key benefits, including asset protection from lawsuits, enhanced privacy, and potential tax advantages. It offers peace of mind knowing your assets will be distributed according to your wishes. Additionally, the use of airSlate SignNow's digital tools makes managing these benefits more efficient.

-

Can I integrate airSlate SignNow with my existing financial software for protection trusts?

Yes, airSlate SignNow offers various integration options that allow you to connect with popular financial software. This capability ensures that you can manage your protection trust seamlessly alongside other financial tools. By utilizing these integrations, you can streamline processes and enhance your overall workflow.

-

Is it necessary to consult a lawyer when creating a protection trust with airSlate SignNow?

While airSlate SignNow simplifies the process of creating a protection trust online, it is always advisable to consult a lawyer. Legal expertise ensures that your trust is structured correctly and complies with relevant laws. Engaging legal help can also provide tailored advice specific to your financial situation.

-

How secure is my information when using airSlate SignNow for protection trusts?

airSlate SignNow prioritizes security and implements robust measures to protect your information while handling protection trusts. Our platform uses encryption technology and secure cloud storage to safeguard your documents. You can trust that your sensitive information remains confidential and accessible only by authorized users.

Get more for Protection Trust Create

- Trustee to trustee form

- Affidavit supporting motion for summary judgmentby plaintiffgeneral form

- Control number fl 020 78 form

- General personal injury negligence interrogatories to form

- Control number fl 021 79 form

- Petitionerplaintiff form

- Chapter 5 disposition of personal property remaining on form

- Decl leshefsky iso prelim inj san francisco city attorneys form

Find out other Protection Trust Create

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile