Personal Trust Form

What is the Personal Trust

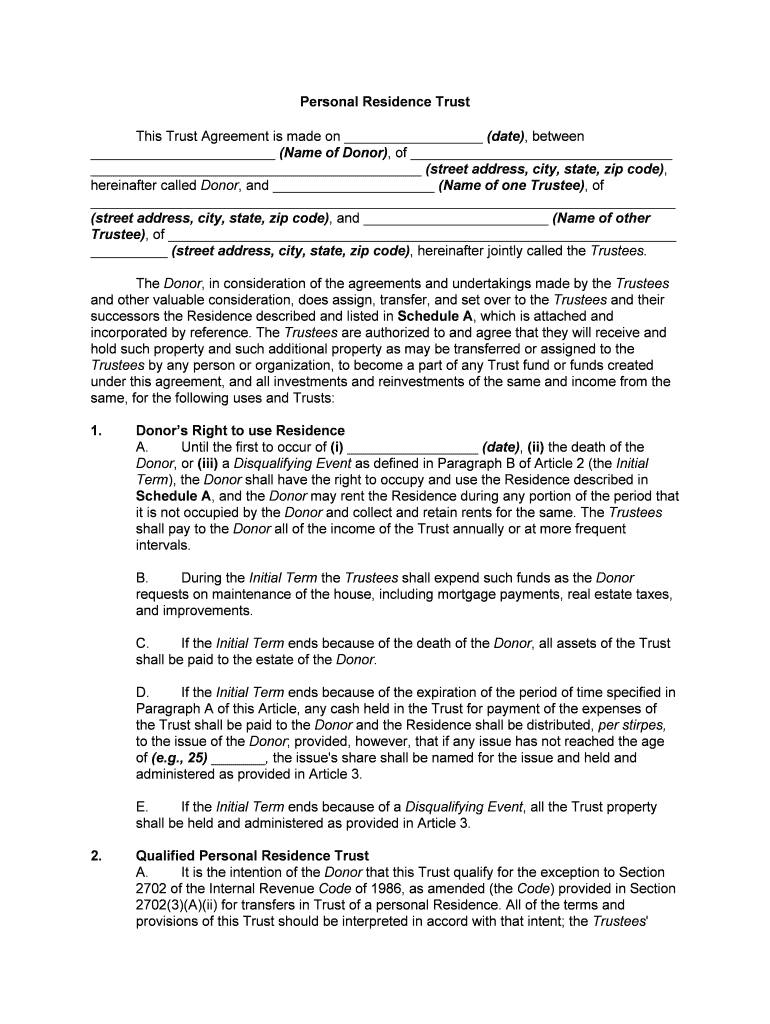

A personal trust is a legal arrangement that allows an individual (the grantor) to transfer assets to a trustee, who manages those assets for the benefit of designated beneficiaries. This structure can provide various benefits, including asset protection, estate planning advantages, and potential tax benefits. In the context of real estate, a personal trust can hold property, making it easier to manage and transfer ownership while avoiding probate. Understanding the specific terms of the trust is essential, as they dictate how assets are handled and distributed.

Steps to Complete the Personal Trust

Completing a personal trust involves several key steps to ensure it is legally binding and meets the grantor's intentions. The process typically includes:

- Defining the purpose of the trust and identifying beneficiaries.

- Selecting a reliable trustee who will manage the trust assets.

- Drafting the trust document, which outlines terms, conditions, and responsibilities.

- Funding the trust by transferring assets, such as real estate, into it.

- Executing the trust document, ensuring all legal requirements are met.

Each step is crucial for the trust to function as intended and to provide the desired benefits.

Key Elements of the Personal Trust

Several key elements define a personal trust and its operation. These include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust and its assets.

- Beneficiaries: Individuals or entities entitled to benefit from the trust assets.

- Trust Document: The legal document that outlines the terms and conditions of the trust.

- Funding: The process of transferring assets into the trust, which can include real estate, cash, or investments.

Understanding these elements helps ensure the trust operates effectively and aligns with the grantor's wishes.

Legal Use of the Personal Trust

The legal use of a personal trust is governed by state laws and federal regulations. Trusts can be utilized for various purposes, including estate planning, asset protection, and tax management. It is essential that the trust complies with applicable laws to be enforceable. This includes adhering to the requirements for creating and funding the trust, as well as following any specific state regulations that may apply. Consulting with a legal professional can help ensure that the trust is set up correctly and serves its intended purpose.

Required Documents

To establish a personal trust, several documents are typically required. These may include:

- Trust agreement: The foundational document that outlines the terms of the trust.

- Asset transfer documents: Legal paperwork needed to transfer ownership of assets into the trust.

- Identification documents: Proof of identity for the grantor, trustee, and beneficiaries.

- Tax identification number: If applicable, for tax reporting purposes.

Gathering these documents in advance can streamline the process of setting up the trust.

State-Specific Rules for the Personal Trust

Each state has its own set of rules and regulations governing personal trusts. These may include requirements for creating and managing the trust, as well as tax implications. It is important to be aware of the specific laws in your state, as they can affect the validity and operation of the trust. For example, some states may have unique requirements for trust documentation or specific tax benefits associated with certain types of trusts. Consulting a legal expert familiar with state laws can provide valuable guidance.

Quick guide on how to complete personal trust

Effortlessly manage Personal Trust on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, enabling you to acquire the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents promptly without any delays. Manage Personal Trust across any platform using airSlate SignNow Android or iOS applications and enhance your document handling processes today.

Steps to modify and eSign Personal Trust effortlessly

- Find Personal Trust and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with features specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow takes care of all your document management requirements with just a few clicks from a device of your choice. Edit and eSign Personal Trust to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a trust form in real estate?

A trust form in real estate is a legal document that outlines the terms under which property is held in a trust. It provides assurances regarding ownership and management, making it essential for those looking to secure and manage their real estate investments. Understanding how a trust form functions is critical for effective estate planning.

-

How does airSlate SignNow help with trust form real estate transactions?

airSlate SignNow streamlines the process of signing trust forms in real estate by allowing users to send and eSign documents electronically. This enhances efficiency and reduces the time taken for transactions to be finalized. With its easy-to-use interface, airSlate SignNow simplifies the management of real estate documents, including trust forms.

-

What are the pricing options for airSlate SignNow for trust form real estate?

airSlate SignNow offers various pricing plans tailored to meet different business needs, starting from affordable options for small businesses to comprehensive solutions for larger enterprises. Each plan provides access to features that facilitate the efficient handling of trust forms in real estate. Visit our pricing page for detailed information and to choose a plan that suits you.

-

Can airSlate SignNow integrate with other real estate tools for trust forms?

Yes, airSlate SignNow integrates seamlessly with various real estate tools and platforms, allowing for a streamlined process when handling trust forms. This integration means you can easily pull data from your real estate applications into airSlate SignNow for efficient document creation and management. Check our integration options to see how it can fit into your current workflow.

-

What features does airSlate SignNow offer for managing trust forms in real estate?

airSlate SignNow provides features like template creation, document tracking, and customizable workflows that make managing trust forms in real estate hassle-free. You can easily collaborate on documents, set reminders, and ensure compliance with all legal requirements. These features help in maintaining organized transactions, ultimately leading to faster closing times.

-

How secure is airSlate SignNow for handling trust form real estate documents?

Security is a top priority for airSlate SignNow when handling trust form real estate documents. Our platform utilizes advanced encryption and security protocols to ensure that all sensitive information remains protected. Furthermore, electronic signatures are legally binding, making your trust form transactions not only secure but also compliant with legal standards.

-

Are there any benefits of using airSlate SignNow for trust form real estate compared to traditional methods?

Using airSlate SignNow for trust form real estate offers several advantages over traditional methods, including speed, convenience, and cost-effectiveness. Electronic signatures eliminate the need for physical paperwork, which can often delay transactions. This modern approach enhances efficiency, allowing real estate professionals to close deals faster and with less hassle.

Get more for Personal Trust

- Fillable online garnishee transfer hawaii state judiciary fax form

- Judiciarycircuit court forms for oahu first circuit

- Motion to dismiss declaration notice of motion form

- Motion for discovery declaration notice of motion certificate of service form

- Fillable online case 509cv04134rdrkgs document 1 fax email form

- Non hearing motion for continuance declaration form

- Judiciarydistrict court forms for kauai fifth

- Free motion for reconsideration or new trial motion for r form

Find out other Personal Trust

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast