Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Form

What is the Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children

The Texas Living Trust for individuals who are single, divorced, or widowed with children is a legal arrangement that allows a person to manage their assets during their lifetime and distribute them after death. This type of trust is particularly beneficial for individuals with children, as it provides a structured way to ensure that assets are passed on according to the individual's wishes. It can help avoid probate, maintain privacy, and offer flexibility in asset management. The trust can be revocable, allowing the individual to make changes as needed, or irrevocable, providing more permanent asset protection.

Steps to complete the Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children

Completing the Texas Living Trust involves several key steps:

- Identify your assets: List all assets you wish to include in the trust, such as real estate, bank accounts, and investments.

- Choose a trustee: Select a reliable person or institution to manage the trust. This can be yourself, a family member, or a professional trustee.

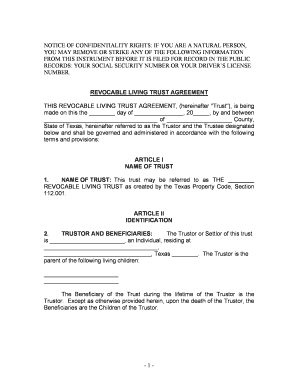

- Draft the trust document: Create a legal document outlining the terms of the trust, including how assets will be managed and distributed.

- Fund the trust: Transfer ownership of your assets into the trust. This may involve changing titles or account names to reflect the trust's ownership.

- Review and update: Regularly review the trust to ensure it meets your needs and reflects any changes in your personal circumstances.

Legal use of the Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children

The legal use of the Texas Living Trust is to provide a clear framework for asset distribution while minimizing legal complications. It is essential to ensure that the trust complies with Texas law, which includes specific requirements for trust creation and execution. The trust document must be signed and witnessed according to state regulations. Additionally, the trust must be properly funded to be effective. This means that assets must be transferred into the trust to ensure they are managed according to the trust's terms.

Key elements of the Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children

Key elements of the Texas Living Trust include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantor's death.

- Trust terms: Specific instructions regarding how assets are to be managed and distributed.

Examples of using the Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children

Examples of using a Texas Living Trust include:

- A single parent establishing a trust to ensure their children receive assets at a specific age.

- A divorced individual creating a trust to protect assets from future claims while providing for their children.

- A widow or widower setting up a trust to manage their deceased spouse's assets and provide for their children.

State-specific rules for the Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children

Texas has specific rules governing the creation and management of living trusts. These include requirements for the trust document to be in writing, signed, and witnessed. Additionally, Texas law allows for both revocable and irrevocable trusts, each with its own implications for asset management and tax treatment. Understanding these state-specific rules is crucial for ensuring that the trust is valid and enforceable.

Quick guide on how to complete texas living trust for individual who is single divorced or widow or widower with children

Complete Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventionally printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly with no delays. Handle Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The simplest method to modify and eSign Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children effortlessly

- Locate Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas Living Trust for an individual who is single, divorced, or a widow or widower with children?

A Texas Living Trust for individuals who are single, divorced, or widowed with children is a legal document that helps manage your assets during your lifetime and distribute them after your death. This trust allows you to designate how your assets will be handled, making it easier for your heirs to avoid probate. It provides peace of mind knowing that your children's future is secured.

-

How does a Texas Living Trust benefit single parents or those who are divorced?

A Texas Living Trust offers signNow benefits for single parents or individuals who are divorced. It ensures that your assets are distributed according to your wishes, providing security for your children. Additionally, it can help in simplifying the management of your estate during difficult personal transitions, such as divorce or loss.

-

What are the costs associated with creating a Texas Living Trust for individuals who are single, divorced, or widowed?

The costs to create a Texas Living Trust typically include legal fees and any associated service charges. While the initial expense may vary based on complexity, investing in a Texas Living Trust for individuals who are single, divorced, or widowed can save money in the long run by avoiding probate costs. It's important to consult with a legal expert to understand the full scope of potential costs.

-

Can I modify my Texas Living Trust if my circumstances change?

Yes, you can modify your Texas Living Trust as your circumstances change, such as marriage, divorce, or the birth of a child. This flexibility is one of the key advantages of setting up a Texas Living Trust for individuals who are single, divorced, or widowed with children. Regular reviews and updates ensure that your trust aligns with your current wishes and family dynamics.

-

What happens to a Texas Living Trust if I become incapacitated?

If you become incapacitated, a Texas Living Trust provides a seamless transition of control to your designated successor trustee without court intervention. This ensures that your financial and healthcare decisions are managed according to your wishes, protecting the interests of any children involved. It is an essential aspect for individuals who are single, divorced, or widowed with children to consider.

-

How does airSlate SignNow facilitate the creation of a Texas Living Trust?

airSlate SignNow simplifies the process of creating a Texas Living Trust by providing an easy-to-use and cost-effective platform for drafting and signing essential documents. With features like document templates and eSignature capabilities, you can efficiently create a Texas Living Trust for individuals who are single, divorced, or widowed with children. Our platform streamlines the entire process, making it accessible for everyone.

-

Are there any integrations available with airSlate SignNow for managing my Texas Living Trust?

Yes, airSlate SignNow offers various integrations that can help manage your Texas Living Trust efficiently. These integrations can connect to other financial or legal software you might be using, enhancing document management and ensuring all relevant data is in one place. This can be particularly beneficial for individuals who are single, divorced, or widowed with children, as it simplifies access to vital information.

Get more for Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children

- Guarantors address is as follows form

- If no how long form

- Vip vendor information pages

- Single family dwelling lease 3132017web form

- Date of birth form

- Fillable online inventory and condition of leased premises form

- After we have provided tenant with 60 day move out notice form

- Improvements or additions form

Find out other Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast