Colorado Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate Form

What is the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate

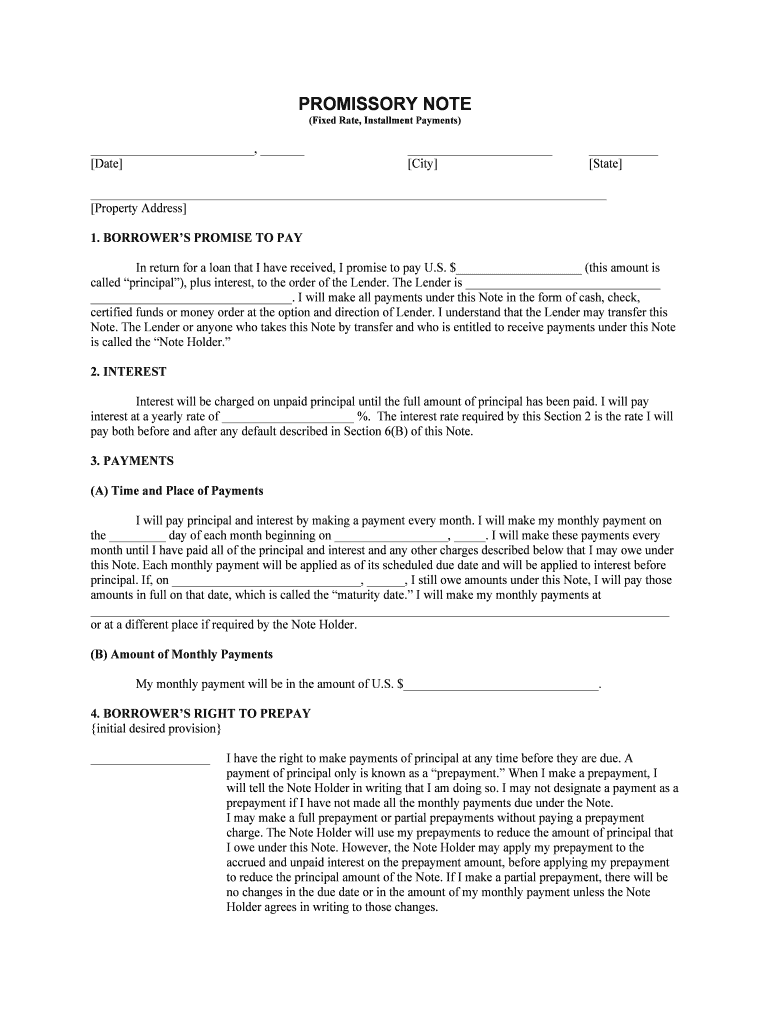

The Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan secured by residential property. This form is essential for transactions involving real estate financing, where the lender requires assurance that the loan will be repaid according to specified terms. The document details the loan amount, interest rate, repayment schedule, and the consequences of default. It serves to protect both the lender's and borrower's interests by clearly defining the obligations and rights associated with the loan.

How to use the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Using the Colorado Colorado Installments Fixed Rate Promissory Note involves several steps to ensure that all parties understand their commitments. First, both the borrower and lender should review the terms of the note carefully. It is advisable to consult with a legal professional to ensure compliance with state laws. Once both parties agree on the terms, they can fill out the document, ensuring all required fields are completed accurately. After signing, the lender should securely store the original document, while the borrower should retain a copy for their records.

Steps to complete the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Completing the Colorado Colorado Installments Fixed Rate Promissory Note involves a systematic approach:

- Gather all necessary information, including borrower and lender details, loan amount, and property information.

- Fill in the terms of the loan, including the interest rate and repayment schedule.

- Include any clauses related to default or prepayment penalties.

- Both parties should review the document to ensure accuracy and mutual understanding.

- Sign the document in the presence of a notary public, if required.

- Distribute copies to all parties involved for their records.

Legal use of the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate

The legal use of the Colorado Colorado Installments Fixed Rate Promissory Note is governed by state laws, which dictate how such documents must be executed to be enforceable. For the note to be legally binding, it must include essential elements such as the names of the parties, the loan amount, interest rate, and repayment terms. Additionally, the note must be signed by the borrower and, in some cases, witnessed or notarized. Compliance with these legal requirements ensures that the document can be upheld in a court of law if disputes arise.

Key elements of the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Several key elements must be present in the Colorado Colorado Installments Fixed Rate Promissory Note to ensure its validity:

- Borrower and Lender Information: Full names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate applied to the loan.

- Repayment Schedule: Detailed timeline for payments, including due dates.

- Default Terms: Conditions under which the borrower may be considered in default.

- Signatures: Signatures of both parties, indicating agreement to the terms.

State-specific rules for the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Each state has specific rules governing the use of promissory notes, including those secured by real estate. In Colorado, for instance, the document must comply with state laws regarding interest rates and disclosure requirements. Additionally, the note may need to be recorded with the county clerk and recorder if it is secured by real property. Understanding these state-specific rules is crucial for ensuring the note's enforceability and protecting the interests of both the borrower and lender.

Quick guide on how to complete colorado colorado installments fixed rate promissory note secured by residential real estate

Effortlessly prepare Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate on any platform using the airSlate SignNow apps for Android or iOS, and streamline any document-related task today.

The simplest method to edit and electronically sign Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate with ease

- Find Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate to ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

A Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a loan agreement secured by real property in Colorado. This type of promissory note includes specific terms for repayments over time at a fixed interest rate. It is often used in real estate transactions to ensure secure financing.

-

What are the key benefits of using a Colorado Colorado Installments Fixed Rate Promissory Note?

The primary benefits of a Colorado Colorado Installments Fixed Rate Promissory Note include predictable payment schedules and stable interest rates over the life of the loan. This provides borrowers with financial clarity and ensures lenders are secured by tangible assets. Moreover, it often simplifies the loan process in real estate transactions.

-

How does pricing work for a Colorado Colorado Installments Fixed Rate Promissory Note?

Pricing for a Colorado Colorado Installments Fixed Rate Promissory Note typically involves an interest rate that is agreed upon by both the borrower and lender. The total cost will include principal and interest, calculated based on the total amount financed and the repayment term. It's essential to review all terms before finalizing the note.

-

Are there any integrations available for managing a Colorado Colorado Installments Fixed Rate Promissory Note?

Yes, airSlate SignNow offers integrations with various financial and real estate software to help manage your Colorado Colorado Installments Fixed Rate Promissory Note efficiently. These integrations streamline document workflows, improve collaboration, and enhance compliance. Depending on your needs, you can connect with popular applications for a smoother process.

-

What features does airSlate SignNow provide for signing a Colorado Colorado Installments Fixed Rate Promissory Note?

airSlate SignNow provides a user-friendly interface that allows for easy electronic signing of a Colorado Colorado Installments Fixed Rate Promissory Note. Features include customizable templates, multi-party signing, secure storage, and audit trails to ensure documents are handled correctly. These tools make the execution process smooth for all parties involved.

-

Is legal assistance needed when preparing a Colorado Colorado Installments Fixed Rate Promissory Note?

While a Colorado Colorado Installments Fixed Rate Promissory Note can be drafted without legal assistance, it is advisable to consult with a legal professional. They can ensure that all terms comply with state laws and that the document adequately protects both the borrower and lender. This can help prevent disputes in the future.

-

What should I consider before entering into a Colorado Colorado Installments Fixed Rate Promissory Note?

Before entering into a Colorado Colorado Installments Fixed Rate Promissory Note, consider the total amount of the loan, the interest rate, and the repayment period. Additionally, assess your financial situation to ensure that you can meet the terms of the note. Understanding the risks and benefits can help you make an informed decision.

Get more for Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Cca 0023 clerk of the circuit court of cook county form

- Affidavit of person making placement clerk of the circuit court form

- Rev 62502 ccco 0603 in the circuit court of cook form

- Order denying petition for correction and sealing justia form

- In the circuit court of cook county illinois the people form

- Expungement and sealing packet clerk of the circuit court form

- How to expunge your record cook county ilcheckr help form

- Criminal department clerk of the circuit court form

Find out other Colorado Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple