Assumption Form

What is the Assumption Form

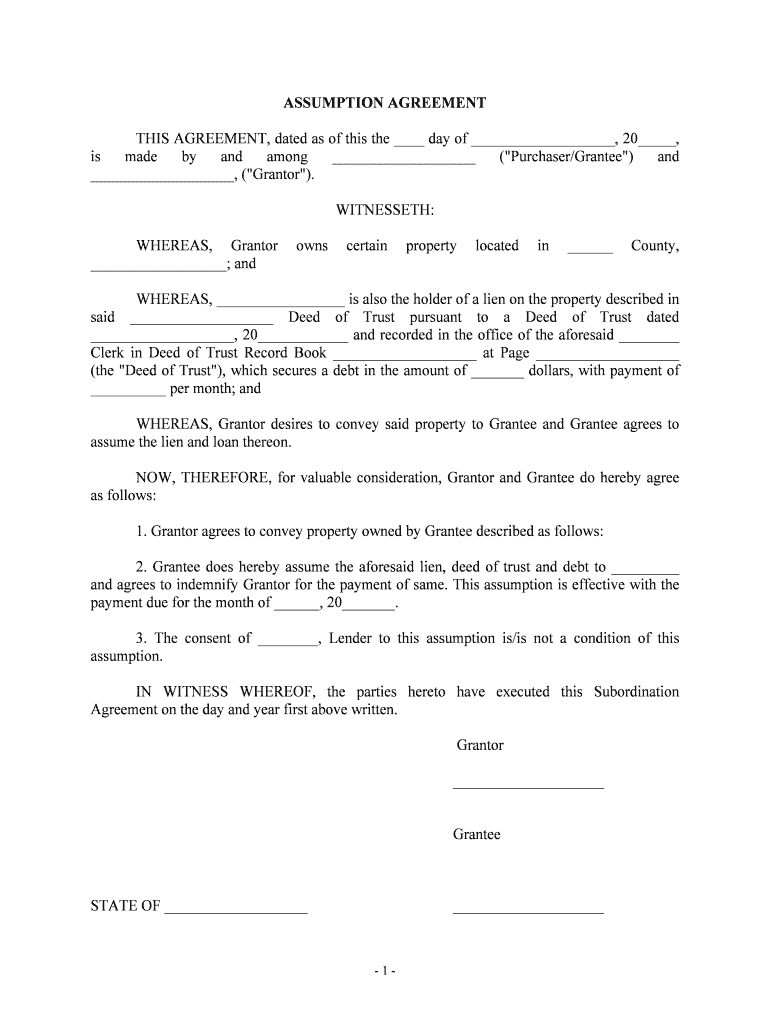

The assumption form is a legal document that allows one party to take over the obligations of a loan from another party. This form is commonly used in real estate transactions, particularly in mortgage agreements. By completing this form, the new borrower assumes responsibility for the loan, including all associated terms and conditions. It is essential for both the original borrower and the lender to agree to this transfer to ensure that the loan remains valid under the new ownership.

How to Use the Assumption Form

Using the assumption form involves several steps to ensure that the transfer of loan obligations is executed properly. First, both parties must review the existing loan agreement to understand the terms being assumed. Next, the new borrower should complete the assumption form, providing necessary personal and financial information. After filling out the form, it should be submitted to the lender for approval. The lender may require additional documentation to assess the new borrower's creditworthiness before granting approval.

Steps to Complete the Assumption Form

Completing the assumption form requires careful attention to detail. Here are the key steps:

- Gather required documentation, including the original loan agreement and personal identification.

- Fill out the assumption form accurately, ensuring all information is current and correct.

- Review the form with the original borrower to confirm all details are accurate.

- Submit the completed form to the lender along with any necessary supporting documents.

- Await confirmation from the lender regarding the approval of the assumption.

Legal Use of the Assumption Form

The assumption form is legally binding once it is signed by all parties involved and approved by the lender. To ensure its legality, the form must comply with relevant state and federal laws governing loan agreements. This includes adhering to the requirements set forth by the ESIGN Act, which validates electronic signatures and records. It is advisable to consult with a legal professional to ensure that all aspects of the form meet legal standards.

Key Elements of the Assumption Form

Several key elements must be included in the assumption form to ensure its effectiveness:

- Parties Involved: Clearly identify the original borrower, the new borrower, and the lender.

- Loan Details: Include information about the loan amount, interest rate, and payment terms.

- Signatures: Obtain signatures from all parties to validate the agreement.

- Approval Clause: A statement indicating that the lender must approve the assumption.

Eligibility Criteria

To be eligible to use the assumption form, the new borrower typically must meet specific criteria set by the lender. This may include a satisfactory credit score, proof of income, and a debt-to-income ratio that aligns with the lender’s requirements. Additionally, the original borrower must not be in default on the loan, as this could complicate the assumption process. Understanding these criteria is crucial for a smooth transition of loan obligations.

Quick guide on how to complete assumption form

Prepare Assumption Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Assumption Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Assumption Form with ease

- Obtain Assumption Form and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools designed specifically for that function by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Assumption Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan agreement form?

A loan agreement form is a crucial document that outlines the terms and conditions between a lender and a borrower. It includes details such as the loan amount, interest rate, repayment schedule, and other essential clauses. Using a loan agreement form helps protect both parties by clearly defining their rights and obligations.

-

How can airSlate SignNow help with creating a loan agreement form?

airSlate SignNow provides an intuitive platform that simplifies the creation of a loan agreement form. With customizable templates and an easy drag-and-drop interface, you can quickly generate a professional agreement tailored to your specific needs. Additionally, it streamlines the signing process, making it straightforward for all parties involved.

-

Is there a cost associated with using airSlate SignNow for a loan agreement form?

Yes, airSlate SignNow offers various pricing plans designed to meet the needs of different businesses. Customers can choose a plan that provides access to the necessary features for creating and managing a loan agreement form. Pricing is competitive, and the platform offers a cost-effective solution for document management.

-

What features does airSlate SignNow offer for loan agreement forms?

airSlate SignNow includes various features to enhance your loan agreement form, such as eSigning, document templates, status tracking, and cloud storage. These tools ensure the document is processed efficiently while maintaining security and compliance. Furthermore, real-time collaboration allows multiple users to work on the agreement simultaneously.

-

Can I integrate airSlate SignNow with other software for managing loan agreement forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications, such as CRM software, accounting systems, and file storage services. This integration allows you to manage your loan agreement forms in conjunction with your existing workflows and enhance your operational efficiency.

-

Are loan agreement forms legally binding through airSlate SignNow?

Yes, loan agreement forms signed through airSlate SignNow are legally binding, provided they comply with applicable laws and regulations. The platform employs advanced security features to ensure that all signed documents are valid and secure. This legal validity offers peace of mind for both lenders and borrowers during the transaction.

-

What are the benefits of using an electronic loan agreement form?

Using an electronic loan agreement form offers numerous benefits, such as speed, convenience, and reduced paperwork. With airSlate SignNow, you can quickly create, send, and sign documents from anywhere, signNowly speeding up the loan process. Additionally, eSigning reduces the likelihood of errors compared to paper-based agreements.

Get more for Assumption Form

- Control number id p083 pkg form

- Control number id p084 pkg form

- Control number id p085 pkg form

- Control number id p086 pkg form

- Control number id p087 pkg form

- Control number id p088 pkg form

- Control number id p089 pkg form

- With this letters of recommendation package you will find forms often used by persons

Find out other Assumption Form

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter