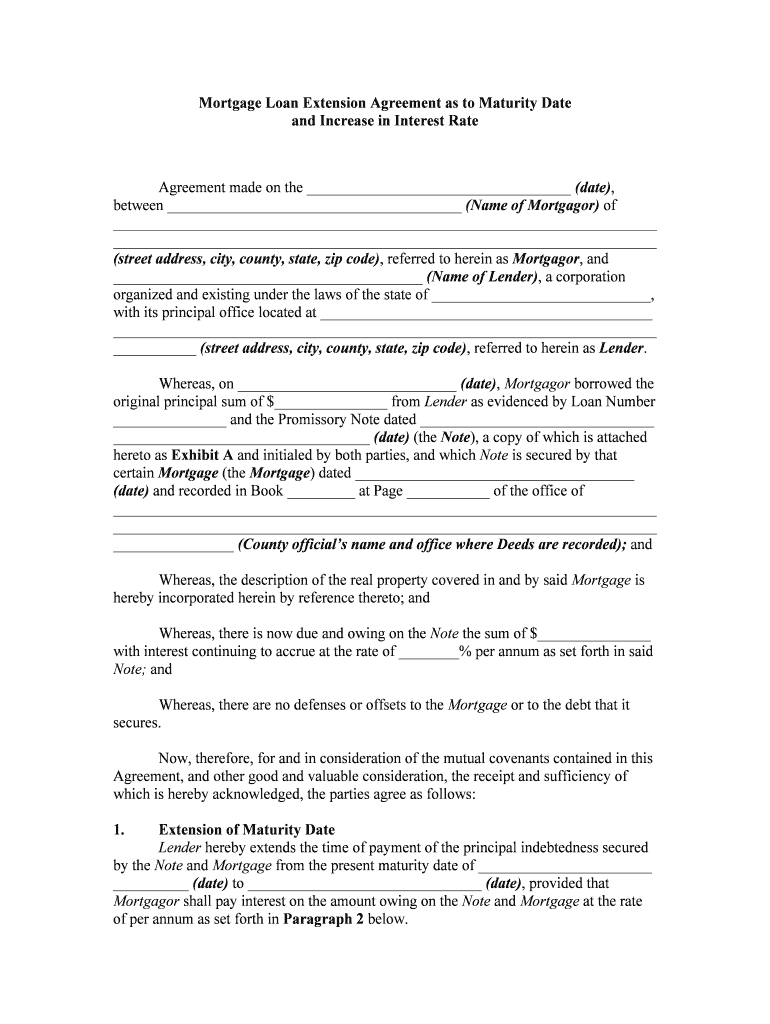

Mortgage Loan Form

What is the loan agreement?

A loan agreement is a formal contract between a borrower and a lender that outlines the terms of a loan. This document specifies the amount borrowed, the interest rate, repayment schedule, and any collateral required. It serves as a legal safeguard for both parties, ensuring that the lender's rights are protected while also detailing the obligations of the borrower. Understanding the components of a loan agreement is essential for anyone seeking to borrow money, whether for personal use or business purposes.

Key elements of the loan agreement

Several critical elements must be included in a loan agreement to ensure clarity and legality. These elements typically include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the principal amount, which can be fixed or variable.

- Repayment Terms: The schedule for repaying the loan, including the frequency of payments and the duration of the loan.

- Collateral: Any assets pledged to secure the loan, which the lender can claim if the borrower defaults.

- Default Conditions: The circumstances under which the lender can declare the loan in default and pursue collection actions.

Steps to complete the loan agreement

Completing a loan agreement involves several steps to ensure that it is legally binding and meets the needs of both parties. Here is a general process to follow:

- Identify the Parties: Clearly state the names and contact information of the borrower and lender.

- Define Loan Details: Specify the loan amount, interest rate, repayment schedule, and any collateral involved.

- Draft the Agreement: Write the loan agreement, ensuring all terms are clear and unambiguous.

- Review the Document: Both parties should review the agreement to confirm understanding and agreement on all terms.

- Sign the Agreement: Both parties should sign the document, ideally in the presence of a notary public to enhance its legal standing.

Legal use of the loan agreement

The legal validity of a loan agreement hinges on several factors, including the clarity of its terms and the presence of signatures from both parties. In the United States, loan agreements must comply with federal and state laws governing lending practices. This includes adhering to regulations such as the Truth in Lending Act, which mandates clear disclosure of loan terms to protect consumers. Ensuring that the agreement is executed properly can prevent disputes and provide legal recourse in case of non-compliance.

How to obtain the loan agreement

Obtaining a loan agreement can be done through various channels. Many lenders provide standardized loan agreement templates that can be customized to meet specific needs. Additionally, legal professionals can draft a loan agreement tailored to the unique circumstances of the borrower and lender. Online platforms also offer templates that can be filled out digitally, ensuring a quick and efficient process. It is important to ensure that any template used complies with relevant laws and regulations.

Quick guide on how to complete mortgage loan form

Prepare Mortgage Loan Form effortlessly on any device

Web-based document management has become trendy among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Mortgage Loan Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to adjust and eSign Mortgage Loan Form with ease

- Locate Mortgage Loan Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and press the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Adjust and eSign Mortgage Loan Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan agreement and why is it important?

A loan agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It is important because it protects both parties by clearly defining the repayment schedule, interest rates, and any penalties for default. Utilizing a reliable e-signature solution like airSlate SignNow ensures that your loan agreements are legally binding and securely stored.

-

How does airSlate SignNow simplify the loan agreement process?

airSlate SignNow simplifies the loan agreement process by providing an intuitive platform for creating, sending, and signing documents electronically. Users can quickly generate customizable loan agreements with predefined templates, reducing the time and effort needed to finalize the documents. The platform also facilitates real-time tracking and notifications, keeping all parties informed throughout the signing process.

-

What are the pricing options for using airSlate SignNow for loan agreements?

airSlate SignNow offers flexible pricing plans that cater to different business needs, ranging from individual to enterprise solutions. Each plan includes features that streamline the creation and management of loan agreements, ensuring a cost-effective solution for businesses of all sizes. For specific pricing details, you can visit the airSlate SignNow website or contact their sales team for a personalized quote.

-

Can I customize my loan agreement templates with airSlate SignNow?

Yes, airSlate SignNow allows users to customize their loan agreement templates easily. You can add specific terms, conditions, and clauses that meet your unique requirements, ensuring that each loan agreement reflects your business standards. This level of customization helps in creating professional, tailored documents that can enhance your credibility with clients.

-

Is airSlate SignNow compliant with legal eSignature standards for loan agreements?

Absolutely, airSlate SignNow complies with all major eSignature laws, including the ESIGN Act and UETA, ensuring that your loan agreements are legally binding and enforceable. This compliance means that you can confidently send and sign your loan agreements electronically, knowing they meet all legal requirements. This makes the entire process secure and reliable.

-

What integration options does airSlate SignNow offer for loan agreements?

airSlate SignNow offers seamless integrations with various platforms such as CRM systems, accounting software, and cloud storage services. This allows you to manage your loan agreements in conjunction with other business tools you use. The integrations enhance workflow efficiency, enabling users to streamline their document management processes.

-

How does airSlate SignNow enhance security for loan agreements?

Security is a top priority for airSlate SignNow, which employs advanced encryption protocols to protect your loan agreements. The platform also includes features like access controls, detailed audit trails, and authentication options to ensure that only authorized individuals can view and sign the documents. With these measures, you can maintain the integrity and confidentiality of your loan agreements.

Get more for Mortgage Loan Form

- Us department of state request for authentications service form

- And two individuals as joint form

- Grantor does hereby convey and warrant unto as trustee of form

- Hereinafter referred to as grantors do hereby convey and warrant unto as form

- Warrant unto and husband form

- Quitclaim unto and husband form

- And husband and wife hereinafter referred to as form

- Grantors do hereby convey and warrant unto and form

Find out other Mortgage Loan Form

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free