Life Estate Form

What is the life estate?

A life estate is a legal arrangement that allows an individual to use and benefit from a property during their lifetime, after which the property passes to another designated individual or entity. This type of ownership is often used in estate planning to ensure that property is transferred to heirs or beneficiaries without going through probate. The person who holds the life estate is known as the life tenant, while the individual or entity that receives the property after the life tenant's death is referred to as the remainderman.

Key elements of the life estate

The life estate includes several important components that define its structure and function:

- Life Tenant: The individual who holds the life estate and has the right to use and enjoy the property during their lifetime.

- Remainderman: The person or entity who will receive the property after the life tenant passes away.

- Duration: The life estate lasts for the lifetime of the life tenant, after which ownership transfers to the remainderman.

- Restrictions: The life tenant cannot sell or transfer the property without the consent of the remainderman, and they must maintain the property in good condition.

Steps to complete the life estate

Establishing a life estate involves several key steps to ensure that the arrangement is legally binding and effective:

- Determine the parties involved: Identify the life tenant and the remainderman.

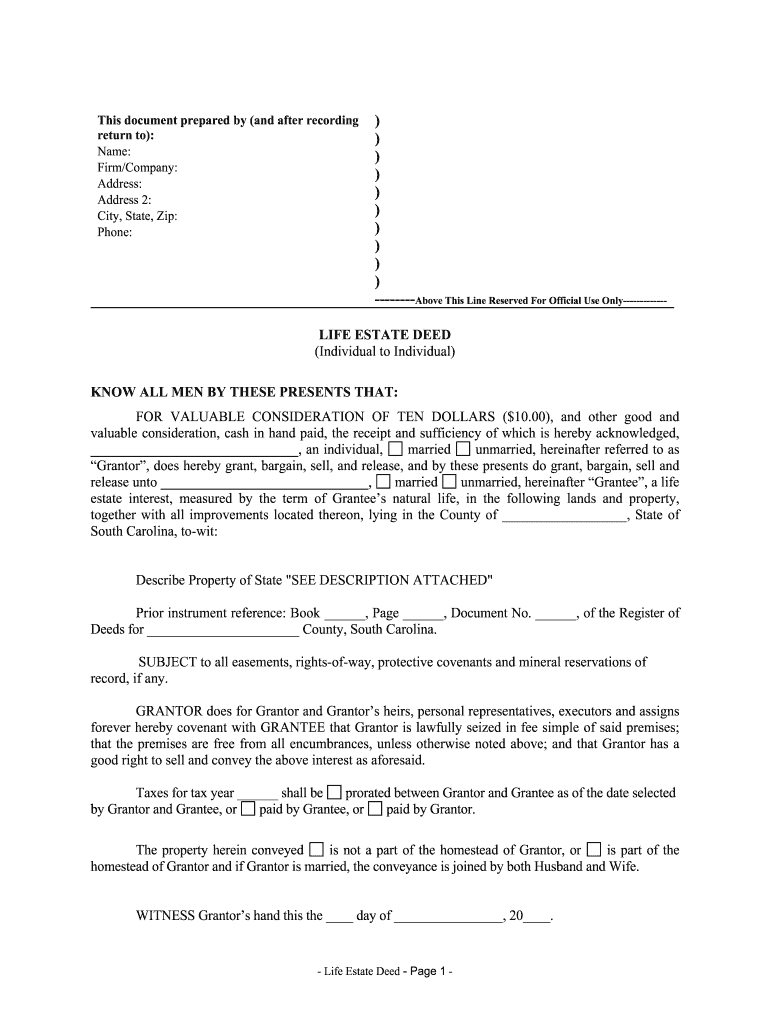

- Draft the life estate deed: This legal document outlines the terms of the life estate, including the rights and responsibilities of both parties.

- Sign the deed: Both the life tenant and the remainderman must sign the deed in the presence of a notary public.

- Record the deed: File the signed life estate deed with the appropriate county office to ensure it is officially recognized.

Legal use of the life estate

The life estate is recognized under U.S. law and can be used for various purposes, including estate planning, asset protection, and tax benefits. It allows individuals to retain control over their property while ensuring that it passes to their chosen beneficiaries after their death. However, it is essential to comply with state-specific regulations and ensure that the deed is executed correctly to avoid potential legal issues.

State-specific rules for the life estate

Each state in the U.S. may have unique laws and regulations governing life estates. It is crucial for individuals to understand their state's requirements, including how to create, modify, or terminate a life estate. Consulting with a legal professional familiar with local laws can help ensure compliance and protect the interests of both the life tenant and the remainderman.

Examples of using the life estate

Life estates can be utilized in various scenarios, such as:

- A parent establishing a life estate in their home, allowing them to live there while ensuring that the property passes to their children upon their death.

- Creating a life estate for a family member with special needs, ensuring they have a place to live while protecting the property from being sold or transferred without consent.

- Utilizing a life estate as part of a larger estate plan to minimize estate taxes and avoid probate for the property.

Quick guide on how to complete life estate 481370318

Effortlessly Prepare Life Estate on Any Device

The management of online documents has become increasingly popular among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Life Estate on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Life Estate with Ease

- Obtain Life Estate and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides for this specific purpose.

- Generate your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign Life Estate and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a life estate and how does it work?

A life estate is a legal arrangement that allows a person to occupy and use a property for the duration of their lifetime. Upon the individual's death, the property automatically transfers to designated beneficiaries, offering a seamless transition of ownership. Understanding how a life estate operates is critical for estate planning and asset management.

-

How can airSlate SignNow help with life estate documents?

airSlate SignNow simplifies the creation, signing, and management of life estate documents through its user-friendly platform. You can easily prepare essential legal forms, obtain eSignatures, and securely store your documents in one place. This makes it easier to handle the life estate process efficiently, reducing the need for physical paperwork.

-

What are the benefits of using airSlate SignNow for life estate transactions?

Using airSlate SignNow for your life estate transactions provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that your documents are signed quickly and stored securely, making it ideal for handling important legal matters. Additionally, you can track the status of your life estate documents in real-time.

-

Are there any specific pricing plans for managing life estate documents with airSlate SignNow?

airSlate SignNow offers flexible pricing plans suited for individuals and businesses needing to manage life estate documents. Users can select from a range of subscription options based on their document volume and feature requirements. This cost-effective approach makes it accessible for anyone looking to handle life estate arrangements efficiently.

-

Can airSlate SignNow integrate with other software for managing life estate documents?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing life estate documents. By connecting with tools like CRM systems and document management platforms, you can streamline your processes and ensure that all related documents are seamlessly coordinated. This integration capability is essential for comprehensive estate planning.

-

Is it easy to customize life estate documents with airSlate SignNow?

Absolutely! airSlate SignNow provides customizable templates that allow you to tailor your life estate documents to your specific needs. You can modify text, add clauses, and adjust formatting, ensuring your documents meet legal requirements while reflecting your personal preferences. Customization helps in making your life estate documents as precise as possible.

-

How secure is airSlate SignNow for handling life estate documents?

airSlate SignNow prioritizes document security, especially for sensitive life estate transactions. Our platform employs industry-standard encryption and authentication methods to protect your data. By using airSlate SignNow, you can confidently manage your life estate documents knowing they are secure and compliant with legal regulations.

Get more for Life Estate

- Landlord tenant guide state of michigan form

- 14 day notice of termination of form

- Residential week to week lease form

- Please take notice landlord has decided to terminate the lease form

- Please take notice tenant has decided to terminate the lease form

- Handling a tenants abandoned property in virginia nolo form

- 10 day notice of termination for failure to provide possession form

- 20 day notice to landlord of material non compliance with lease form

Find out other Life Estate

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple