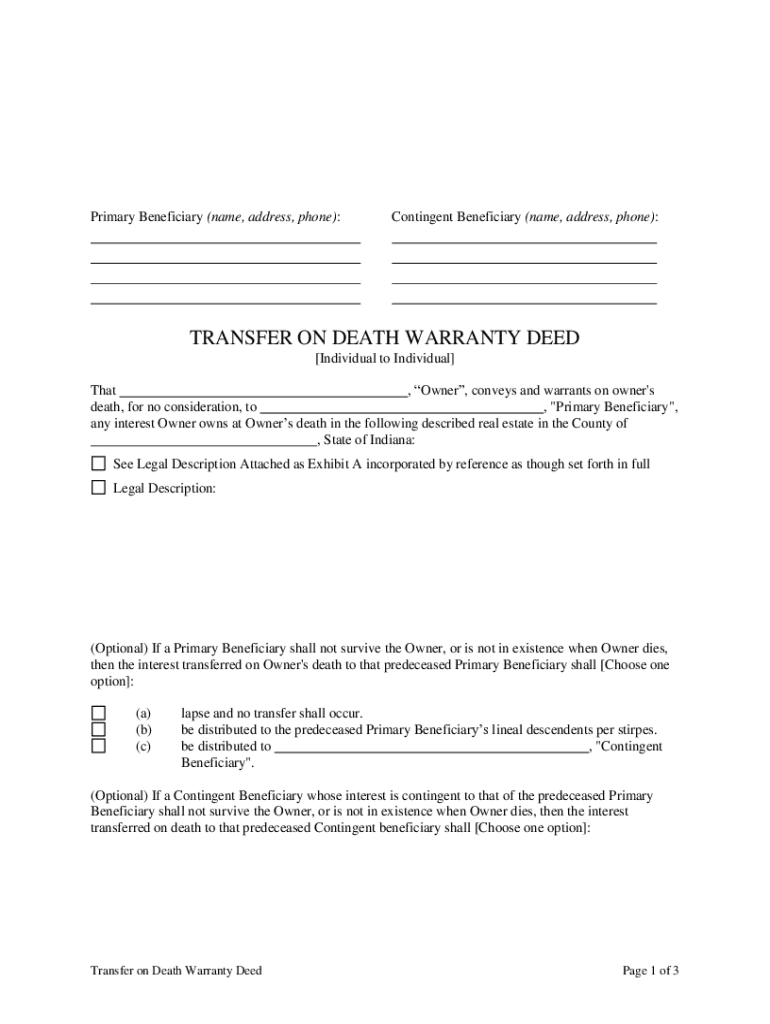

Indiana Death Deed Form

What is the Indiana Death Deed

The Indiana Death Deed, also known as a beneficiary deed, is a legal document that allows property owners in Indiana to transfer their real estate to designated beneficiaries upon their death. This type of deed is particularly useful for avoiding probate, as the property passes directly to the beneficiaries without going through the court system. It is important to note that the transfer only occurs after the death of the property owner, ensuring that they retain full control of the property during their lifetime.

How to use the Indiana Death Deed

To use the Indiana Death Deed effectively, property owners must first complete the form with accurate information regarding the property and the designated beneficiaries. It is essential to clearly identify the beneficiaries to avoid any confusion or disputes in the future. Once the form is filled out, it must be signed in the presence of a notary public to ensure its legal validity. After notarization, the deed should be recorded with the county recorder's office where the property is located to make the transfer official.

Steps to complete the Indiana Death Deed

Completing the Indiana Death Deed involves several key steps:

- Obtain the Indiana Death Deed form from a reliable source.

- Fill in the property details, including the legal description and address.

- Identify the beneficiaries clearly, including their full names and relationship to the property owner.

- Sign the form in front of a notary public to ensure it is legally binding.

- File the completed deed with the county recorder's office to finalize the process.

Legal use of the Indiana Death Deed

The Indiana Death Deed is legally recognized under Indiana law, provided it meets specific requirements. To be valid, the deed must be signed by the property owner and notarized. Additionally, it must be recorded with the appropriate county office. This legal framework ensures that the transfer of property is enforceable and that beneficiaries can claim ownership without complications after the owner's death.

Key elements of the Indiana Death Deed

Several key elements are crucial for the Indiana Death Deed to be effective:

- Property Description: A clear legal description of the property being transferred.

- Beneficiary Information: Full names and details of the beneficiaries receiving the property.

- Signature and Notarization: The property owner's signature must be notarized to validate the deed.

- Recording: The deed must be recorded with the county recorder's office to be enforceable.

State-specific rules for the Indiana Death Deed

Indiana has specific rules governing the use of the Death Deed. These include requirements for notarization and recording, as well as stipulations regarding the eligibility of beneficiaries. It is essential for property owners to understand these rules to ensure the deed is executed correctly and legally. For instance, beneficiaries must be individuals or entities capable of holding property, and the deed must comply with state laws to avoid any legal issues in the future.

Quick guide on how to complete indiana death deed

Easily Prepare Indiana Death Deed on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Indiana Death Deed on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Modify and eSign Indiana Death Deed Effortlessly

- Find Indiana Death Deed and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and eSign Indiana Death Deed and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a beneficiary deed form?

A beneficiary deed form is a legal document that allows property owners to transfer their property to a designated beneficiary upon their passing, avoiding probate. This form is effective and straightforward, making it a popular choice for estate planning. With airSlate SignNow, you can easily create and eSign your beneficiary deed form online.

-

How does airSlate SignNow assist with beneficiary deed forms?

airSlate SignNow streamlines the process of creating and signing beneficiary deed forms. Our user-friendly platform allows you to customize your documents, ensuring they meet legal requirements. By using airSlate SignNow, you can quickly prepare and eSign your beneficiary deed form hassle-free.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers affordable pricing plans to suit various needs, including those who frequently use beneficiary deed forms. Our plans are competitive and provide access to a host of features, including document templates and unlimited eSignatures. You can choose a plan that best aligns with your document signing requirements.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for managing beneficiary deed forms. You can connect it with popular platforms like Google Drive, Salesforce, and more. This flexibility allows for easier document storage and access.

-

What benefits does a beneficiary deed form offer?

The primary benefit of a beneficiary deed form is that it allows for a smooth transfer of property without the complications of probate. This ensures that your heirs receive their inheritance quickly and efficiently. Using airSlate SignNow makes the process of executing a beneficiary deed form even easier, simplifying your estate planning.

-

Is the beneficiary deed form valid in all states?

Not all states recognize the beneficiary deed form, as its legality varies by jurisdiction. It’s important to check local laws to ensure that this form is valid for your situation. With airSlate SignNow, you can consult experts for guidance and ensure your beneficiary deed form meets your state's legal requirements.

-

How secure is my information when using airSlate SignNow for a beneficiary deed form?

airSlate SignNow prioritizes your security by employing advanced encryption protocols to protect your information. When you create and eSign your beneficiary deed form, you can trust that your data remains confidential and secure. We comply with industry standards to ensure your peace of mind while using our service.

Get more for Indiana Death Deed

- Fillable online civ 575 writ of assistance civil forms fax

- Civ 620 affidavit of service by certified mail 11 10 civil forms

- Fillable online courts alaska civ 622 affidavit of attempted form

- Forms by topic ampamp number alaska court system state of

- Affidavit to register a foreign child courtsalaskagov form

- In the superior court for the state of alaska at petitioner form

- Civil rule 5g2 civil rule 77b4 form

- In the superior court for the state of alaska state of form

Find out other Indiana Death Deed

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now