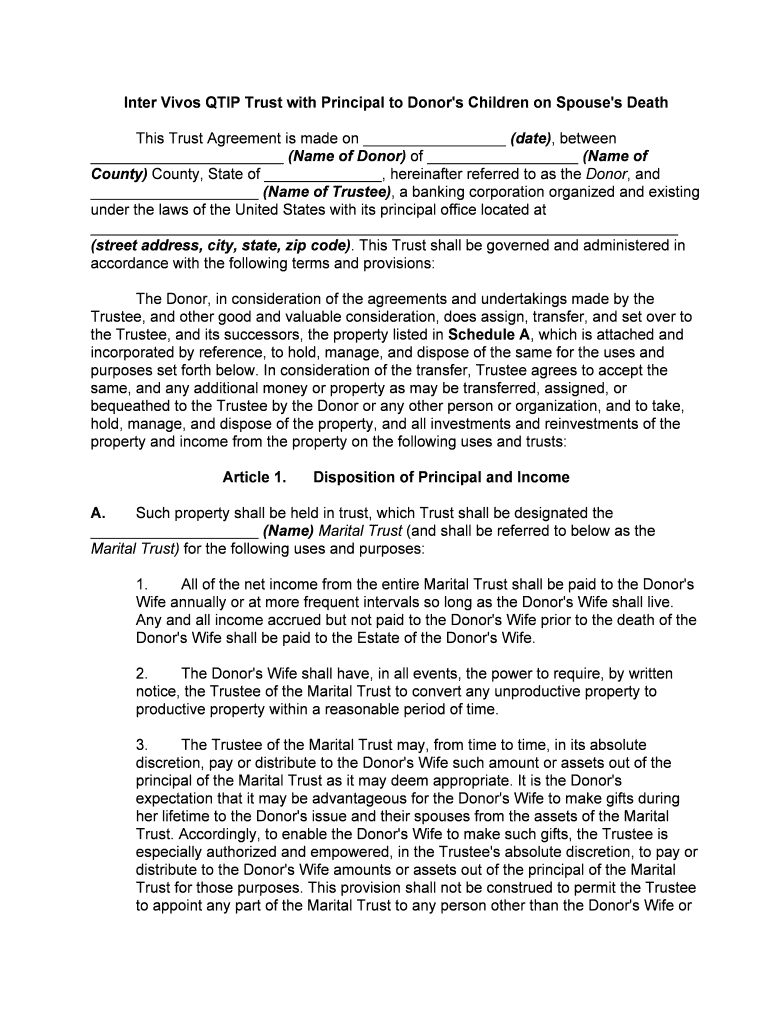

Qtip Trust Form

What is the QTIP Trust?

A QTIP trust, or Qualified Terminable Interest Property trust, is a legal arrangement that allows a trustor to provide for a surviving spouse while also controlling the distribution of the trust's assets after the spouse's death. This type of trust is particularly useful in estate planning, as it enables the trustor to ensure that the assets are ultimately passed to designated beneficiaries, often children from a previous marriage. The income generated from the trust assets is paid to the surviving spouse during their lifetime, while the principal is preserved for future distribution.

Steps to Complete the QTIP Trust

Filling out a QTIP trust form involves several important steps to ensure that the trust is established correctly. Here are the key steps:

- Gather necessary information: Collect details about the trustor, beneficiaries, and the assets to be included in the trust.

- Draft the trust document: Include specific language that meets QTIP requirements, ensuring it outlines the income distribution to the surviving spouse and the final beneficiaries.

- Sign the document: Both the trustor and witnesses must sign the trust document, adhering to state laws regarding notarization.

- Fund the trust: Transfer ownership of the designated assets into the trust to ensure they are managed according to the trustor's wishes.

Key Elements of the QTIP Trust

Understanding the key elements of a QTIP trust is essential for effective estate planning. The main components include:

- Surviving spouse's rights: The surviving spouse receives all income generated by the trust during their lifetime.

- Principal control: The trustor retains control over the distribution of the principal after the surviving spouse's death, ensuring that it goes to the intended beneficiaries.

- Tax benefits: A QTIP trust qualifies for the marital deduction, allowing assets to pass to the surviving spouse without immediate estate tax implications.

Legal Use of the QTIP Trust

The QTIP trust is recognized under U.S. law and is subject to specific regulations that govern its use. It is crucial for the trustor to ensure that the trust is established in compliance with both federal and state laws. This includes adhering to requirements for trust language, asset titling, and tax implications. Proper legal guidance is recommended to navigate these regulations effectively.

Examples of Using the QTIP Trust

QTIP trusts can be utilized in various scenarios, particularly in blended families. For example:

- A trustor with children from a previous marriage can set up a QTIP trust to provide for a new spouse while ensuring that their children receive the trust assets after the spouse's death.

- A QTIP trust can also be beneficial for individuals who wish to support a surviving spouse financially without relinquishing control over their estate's final distribution.

Required Documents

To establish a QTIP trust, several documents are typically required. These may include:

- Trust agreement: The primary document outlining the terms and conditions of the trust.

- Asset documentation: Records of the assets being transferred into the trust, including titles and deeds.

- Identification documents: Personal identification for the trustor, beneficiaries, and witnesses.

Quick guide on how to complete qtip trust

Effortlessly Prepare Qtip Trust on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Qtip Trust on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Qtip Trust effortlessly

- Find Qtip Trust and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign Qtip Trust to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a QTIP trust example?

A QTIP trust, or Qualified Terminable Interest Property trust, is a legal arrangement allowing a person to provide income for a surviving spouse while preserving the principal for other beneficiaries. For instance, in a QTIP trust example, the grantor can designate that the surviving spouse receives income generated from the trust during their lifetime, ultimately passing the remainder to children or other heirs, which can provide tax benefits.

-

How does using airSlate SignNow help with QTIP trust documents?

Using airSlate SignNow streamlines the process of signing and managing QTIP trust documents. The platform offers a user-friendly interface that allows you to easily send, receive, and eSign important documents securely, saving time and ensuring compliance with legal requirements. This is especially useful for complex agreements like QTIP trusts that require clarity and precision.

-

Are there any specific features in airSlate SignNow for creating QTIP trust examples?

Yes, airSlate SignNow includes features designed to assist users in drafting and finalizing QTIP trust examples. The template library and drag-and-drop editor enable you to create customized trust documents efficiently. Additionally, the ability to integrate with document storage solutions facilitates easy access to your legal files.

-

What are the benefits of using airSlate SignNow for trusts like QTIP?

Using airSlate SignNow for trusts such as QTIP provides several advantages, including enhanced document security through encryption, improved collaboration features for multiple signers, and mobile accessibility. These benefits make it easier for estate planners and families to manage trust documents effectively.

-

Can airSlate SignNow integrate with other legal software for QTIP trust management?

Absolutely! airSlate SignNow seamlessly integrates with various legal and document management software, enhancing your workflow when managing QTIP trusts. This integration allows users to pull in data from other sources, ensuring that your QTIP trust examples are up-to-date and compliant with current laws.

-

Is there a trial period for airSlate SignNow to manage QTIP trusts?

Yes, airSlate SignNow offers a free trial period that allows users to explore its features for managing QTIP trusts without any commitment. This trial will give you the opportunity to understand how the platform meets your specific needs, including eSigning and document sharing related to your trust.

-

What pricing plans does airSlate SignNow offer for QTIP trust management?

airSlate SignNow provides flexible pricing plans tailored to various user needs, including individual and team options. Each plan includes features that can help streamline your QTIP trust management, making it an affordable choice for both personal and professional use.

Get more for Qtip Trust

- You are hereby notified that attorneys name has been retained as attorney for form

- Please take notice that the findings of fact conclusions of law order for form

- Local rules harris county district courts form

- To claim attorney fees form

- Respondent above named and hisher form

- Notice of entry of form

- Notice of intent to enter and docket judgment form

- You will please take notice that at a hearing to be held before a judge of the form

Find out other Qtip Trust

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free