South Carolina South Carolina Dissolution Package to Dissolve Limited Liability Company LLC Form

What is the South Carolina dissolution package to dissolve a limited liability company (LLC)?

The South Carolina dissolution package is a set of official documents required to legally dissolve a limited liability company (LLC) in the state. This package typically includes the Articles of Dissolution, which formally notify the state of the LLC's decision to cease operations. The dissolution package ensures that all legal obligations are fulfilled, allowing the LLC to wind down its affairs properly and avoid future liabilities. Understanding this package is crucial for business owners looking to dissolve their LLC in compliance with state laws.

Steps to complete the South Carolina dissolution package to dissolve a limited liability company (LLC)

Completing the South Carolina dissolution package involves several key steps:

- Hold a meeting with LLC members to agree on the dissolution.

- Prepare the Articles of Dissolution, ensuring all required information is included, such as the LLC's name and the date of dissolution.

- Obtain necessary approvals, which may include signatures from all members.

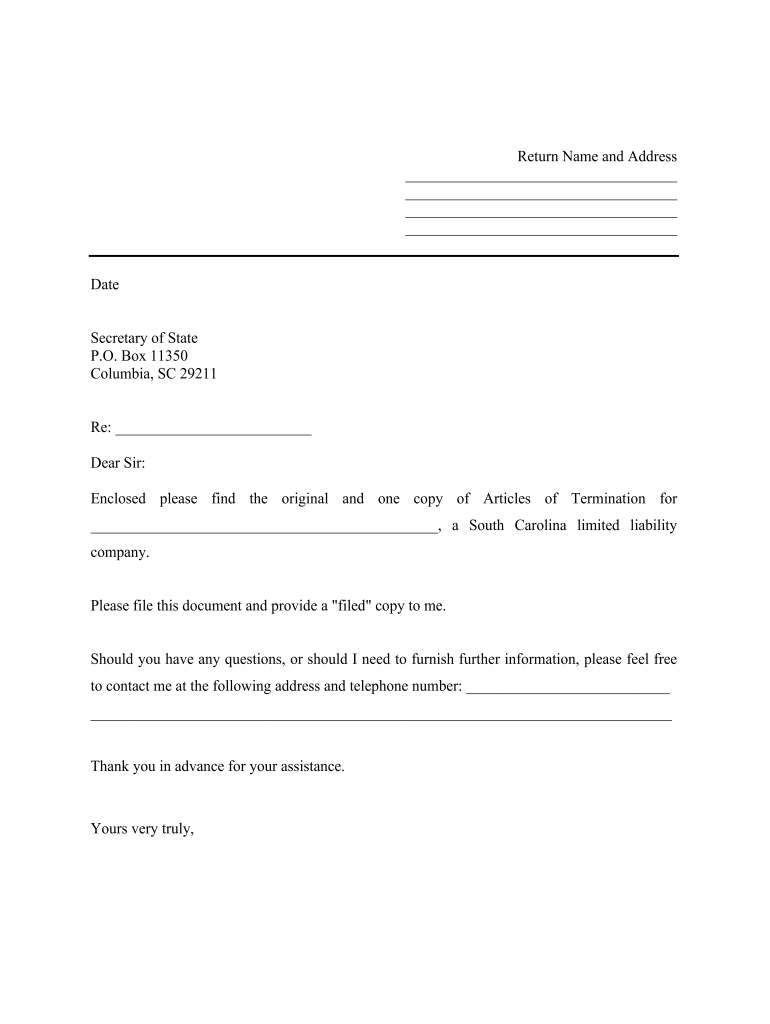

- File the Articles of Dissolution with the South Carolina Secretary of State, either online or by mail.

- Pay any applicable filing fees associated with the dissolution process.

- Notify creditors and settle any outstanding debts or obligations.

- Distribute remaining assets among members as per the operating agreement.

Required documents for the South Carolina dissolution package to dissolve a limited liability company (LLC)

To successfully dissolve an LLC in South Carolina, specific documents are required:

- Articles of Dissolution: This is the primary document that must be filed with the Secretary of State.

- Operating Agreement: If applicable, this document outlines how the LLC should handle the dissolution process.

- Meeting Minutes: Documentation of the meeting where members voted on the dissolution.

- Final Tax Returns: Ensure that all tax obligations are settled before dissolution.

Legal use of the South Carolina dissolution package to dissolve a limited liability company (LLC)

The legal use of the South Carolina dissolution package is essential for ensuring that the dissolution is recognized by the state. Filing the Articles of Dissolution formally ends the LLC's legal existence. This process protects members from future liabilities and ensures compliance with state regulations. It is important to follow all legal requirements to avoid complications, such as penalties or personal liability for business debts.

Filing deadlines and important dates for the South Carolina dissolution package to dissolve a limited liability company (LLC)

When dissolving an LLC in South Carolina, it is important to be aware of key deadlines:

- Filing the Articles of Dissolution: This should be done as soon as the decision to dissolve is made and approved by members.

- Final Tax Returns: These must be filed by the due date to avoid penalties.

- Notice to Creditors: Notify creditors promptly to settle any outstanding debts before dissolution.

State-specific rules for the South Carolina dissolution package to dissolve a limited liability company (LLC)

South Carolina has specific rules governing the dissolution of LLCs. It is essential to adhere to these regulations to ensure a smooth process:

- The decision to dissolve must be made according to the operating agreement or by a majority vote of the members.

- All outstanding debts and obligations must be settled before filing for dissolution.

- Failure to comply with state laws may result in personal liability for members regarding business debts.

Quick guide on how to complete south carolina south carolina dissolution package to dissolve limited liability company llc

Effortlessly Prepare South Carolina South Carolina Dissolution Package To Dissolve Limited Liability Company LLC on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It presents a seamless environmentally friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle South Carolina South Carolina Dissolution Package To Dissolve Limited Liability Company LLC on any device using the airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

Edit and eSign South Carolina South Carolina Dissolution Package To Dissolve Limited Liability Company LLC with Ease

- Find South Carolina South Carolina Dissolution Package To Dissolve Limited Liability Company LLC and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Focus on pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a standard wet ink signature.

- Review all information and then click on the Done button to save your changes.

- Select how you wish to send your form, either by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign South Carolina South Carolina Dissolution Package To Dissolve Limited Liability Company LLC to maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process of how to dissolve an LLC in South Carolina?

Dissolving an LLC in South Carolina involves filing Articles of Dissolution with the Secretary of State. You must ensure all debts are settled and taxes are paid before submitting the necessary paperwork. This process legally terminates the existence of your LLC in the state.

-

How much does it cost to dissolve an LLC in South Carolina?

The filing fee for dissolving an LLC in South Carolina is generally a nominal amount, typically around $25. However, you may incur additional costs if you need to settle outstanding debts or legal fees. It's important to review all potential costs involved when considering how to dissolve an LLC in South Carolina.

-

Can airSlate SignNow help with the dissolution process?

Yes, airSlate SignNow can assist you in managing and eSigning documents related to the dissolution of your LLC. Our platform provides an easy-to-use interface that simplifies the paperwork needed when looking into how to dissolve an LLC in South Carolina. This can save you time and ensure compliance with state requirements.

-

What happens after I file for LLC dissolution in South Carolina?

After filing for LLC dissolution in South Carolina, you’ll receive confirmation from the Secretary of State. Your LLC will no longer be active, but you must ensure all assets are distributed, debts paid, and final tax returns are filed. This is a critical part of understanding how to dissolve an LLC in South Carolina.

-

Are there any benefits of using airSlate SignNow for LLC dissolution?

Using airSlate SignNow provides a streamlined approach to managing your LLC dissolution documents. Our secure platform allows for easy collaboration and eSigning, which is crucial in understanding how to dissolve an LLC in South Carolina efficiently. This can potentially reduce the time and stress involved in the process.

-

Is eSigning legally accepted for LLC dissolution documents in South Carolina?

Yes, eSigning is legally accepted for LLC dissolution documents in South Carolina, provided that both parties consent to use electronic signatures. This means you can use airSlate SignNow to ensure your documents are executed properly when figuring out how to dissolve an LLC in South Carolina.

-

What types of documents do I need to dissolve an LLC in South Carolina?

To dissolve an LLC in South Carolina, you typically need to prepare and file the Articles of Dissolution and potentially other documentation regarding the settlement of debts and distribution of assets. Having all the necessary documents organized is essential for understanding how to dissolve an LLC in South Carolina successfully.

Get more for South Carolina South Carolina Dissolution Package To Dissolve Limited Liability Company LLC

- Claimants petition for review of decision of form

- Notice of controversion form

- Local rules of the eighteenth circuit court district form

- Comes now the claimant form

- Request for production of documents to carrier form

- Article i in generalcode of ordinancesholts form

- By joint complaint form

- Located on the premises and shall also pay all privilege excise and other taxes duly form

Find out other South Carolina South Carolina Dissolution Package To Dissolve Limited Liability Company LLC

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later