Washington Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Form

What is the Washington Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children

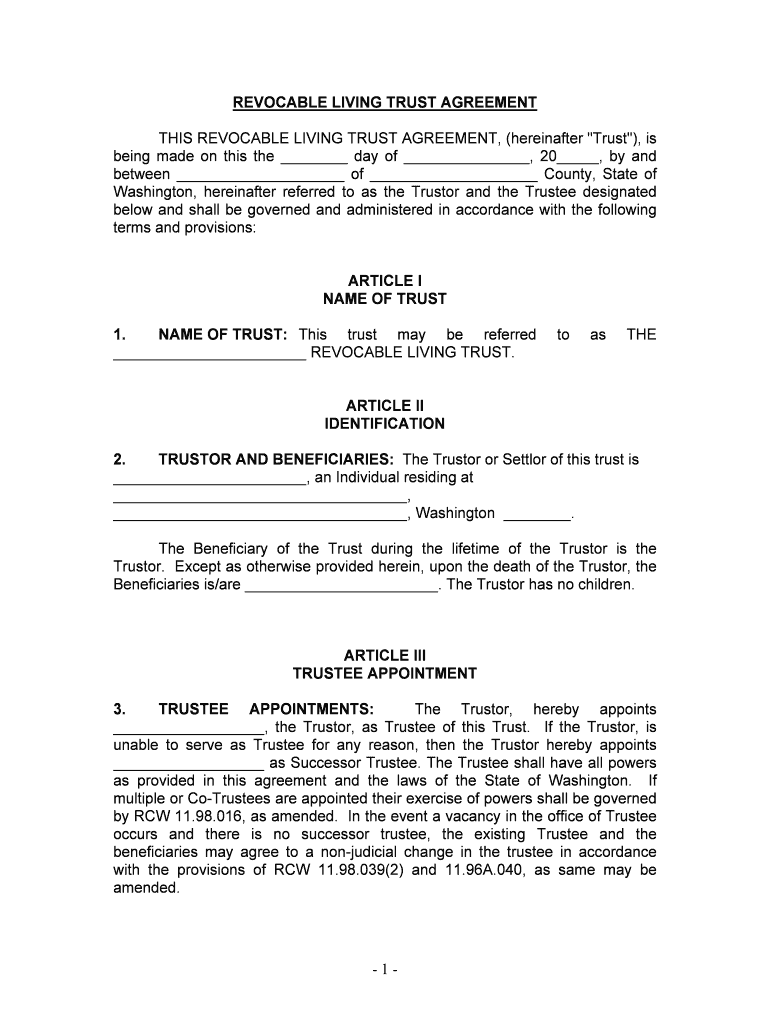

The Washington Living Trust for individuals who are single, divorced, or widowed without children is a legal document that allows a person to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust is particularly useful for individuals without children, as it provides a clear framework for asset distribution, avoiding the complexities of probate. The trust can hold various types of assets, including real estate, bank accounts, and investments, ensuring that the individual’s wishes are honored without unnecessary legal complications.

Steps to Complete the Washington Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children

Completing a Washington Living Trust involves several key steps:

- Determine your assets: List all assets you want to include in the trust, such as property, bank accounts, and investments.

- Choose a trustee: Select a trusted individual or institution to manage the trust according to your wishes.

- Draft the trust document: Create a legal document outlining the terms of the trust, including asset distribution and trustee responsibilities.

- Sign the document: Sign the trust in accordance with Washington state laws, which may require witnesses or notarization.

- Fund the trust: Transfer ownership of your assets into the trust, ensuring they are legally held by the trust.

Legal Use of the Washington Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children

The legal use of a Washington Living Trust is to provide a clear and enforceable plan for asset management and distribution. This trust allows individuals to specify how their assets should be handled during their lifetime and after death. It can help avoid probate, which is the legal process of validating a will and distributing assets. By establishing this trust, individuals can ensure that their wishes are respected, and they can designate beneficiaries who will receive their assets, even if they do not have children.

Key Elements of the Washington Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children

Several key elements define a Washington Living Trust:

- Trustee: The individual or entity responsible for managing the trust.

- Beneficiaries: Individuals or organizations designated to receive the trust assets after the trustor's death.

- Trust terms: Specific instructions regarding how assets should be managed and distributed.

- Revocability: Most living trusts are revocable, allowing the trustor to modify or dissolve the trust during their lifetime.

State-Specific Rules for the Washington Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children

In Washington, specific rules govern the creation and execution of living trusts. The trust must be written and signed by the trustor, and it may require notarization or witnesses to be legally binding. Washington law allows for revocable living trusts, which can be altered or revoked at any time before the trustor's death. Additionally, the trust must comply with state laws regarding asset transfer to ensure that all assets are properly funded into the trust.

How to Use the Washington Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children

Using a Washington Living Trust involves managing your assets according to the terms outlined in the trust document. The trustee will oversee the assets, ensuring they are managed responsibly and in line with the trustor's wishes. Individuals can access their assets during their lifetime, and upon their death, the trustee will distribute the assets to the designated beneficiaries without the need for probate. This streamlined process helps reduce legal complexities and ensures that the trustor's intentions are fulfilled efficiently.

Quick guide on how to complete washington living trust for individual who is single divorced or widow or widower with no children

Easily Set Up Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and without holdups. Manage Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and eSign Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children effortlessly

- Obtain Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children and then click Get Form to initiate.

- Use the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive data with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs with just a few clicks from any chosen device. Modify and eSign Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

A Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed upon your passing. This type of trust helps simplify the estate process and ensures your wishes are carried out without the need for probate.

-

How can a Washington Living Trust benefit me as someone who is single, divorced, or a widow/widower without children?

Creating a Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children can provide peace of mind, knowing your assets will be handled according to your preferences. It can also protect your estate from potential disputes and ensure that your wishes are respected without the complexities of probate.

-

What are the costs associated with setting up a Washington Living Trust?

The costs for establishing a Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children can vary depending on the complexity of your assets and the legal services you choose. Generally, it may range from a few hundred to several thousand dollars, but investing in a trust can save you money in the long run by avoiding probate fees.

-

Is it difficult to integrate a Washington Living Trust with existing estate planning documents?

No, integrating a Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children with existing estate planning documents is typically straightforward. It usually involves updating titles and designating the trust as the beneficiary for specific accounts, ensuring your overall estate strategy aligns with your wishes.

-

What features should I look for in a Washington Living Trust service?

When selecting a service for a Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children, look for features such as comprehensive guidance from legal professionals, customizable templates, and online accessibility. Additionally, ensure they offer customer support to help you navigate the process smoothly.

-

Can I change my Washington Living Trust if my circumstances change?

Yes, one of the key benefits of a Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children is that it is revocable, meaning you can update or amend it as your circumstances change. This flexibility allows you to modify beneficiaries, asset distribution, and other important details whenever necessary.

-

How does a Washington Living Trust impact taxes for individuals without children?

A Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children itself does not directly impact your taxes, as assets in the trust are still considered part of your estate for tax purposes. However, by avoiding probate, you may reduce certain administrative costs and complications that can sometimes arise during the tax process.

Get more for Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children

- Property owners liability during winter weather form

- 06 premises liability leased premises latent defects form

- A liability insurance primer for the business and real form

- Compare auto insurance quotes for top rates top car form

- 00 contracts form

- A guide to contract interpretation reed smith llp form

- Impossibility of performance as a defense to breach of

- Securities registration business investors hub form

Find out other Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template