Credit Promissory Note Form

What is the Credit Promissory Note

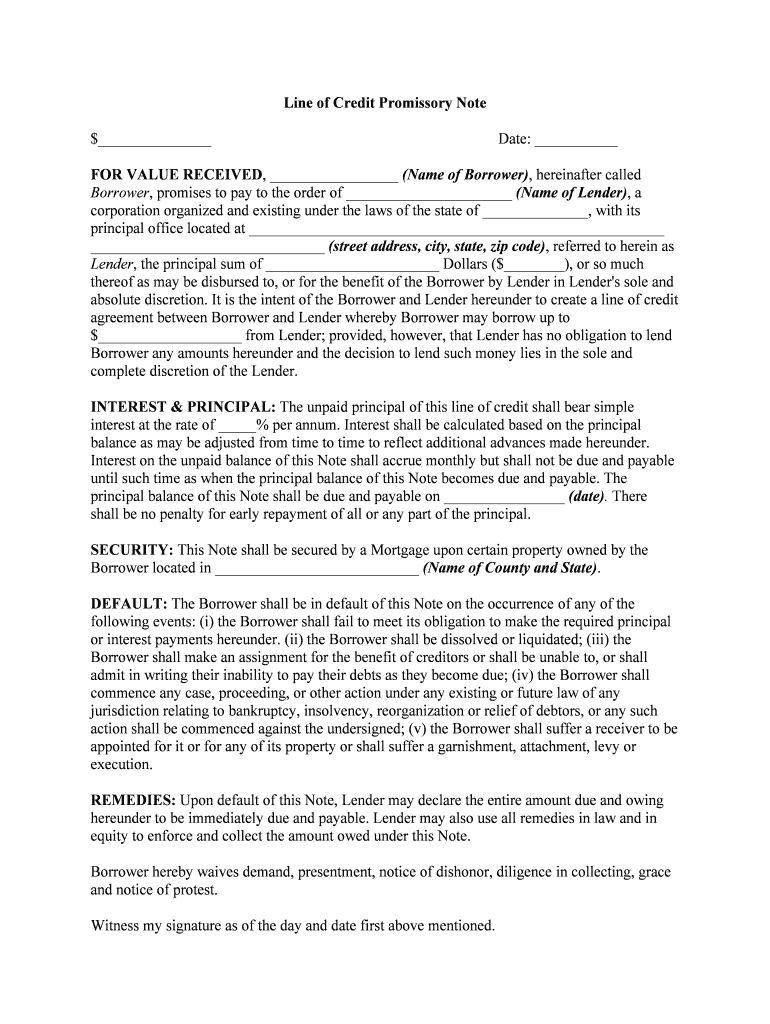

A credit promissory note is a legal document that outlines a borrower's promise to repay a specified sum of money to a lender under agreed-upon terms. This note typically includes details such as the loan amount, interest rate, repayment schedule, and maturity date. It serves as a formal acknowledgment of the debt and provides a framework for the lender to claim repayment if necessary. Understanding the components of this document is essential for both borrowers and lenders to ensure clarity and legal compliance.

How to use the Credit Promissory Note

Using a credit promissory note involves several steps to ensure that both parties understand their rights and obligations. First, the borrower should carefully review the terms outlined in the note, ensuring they are feasible and clear. Next, both parties should sign the document, which can be done digitally for convenience and security. After signing, it is advisable to keep copies of the note for personal records. This document can be used in various situations, such as personal loans, business financing, or informal agreements between friends or family.

Steps to complete the Credit Promissory Note

Completing a credit promissory note involves a systematic approach to ensure all necessary information is accurately captured. Start by entering the names and addresses of both the borrower and lender. Next, specify the loan amount and the interest rate, if applicable. Include the repayment schedule, detailing when payments are due and the total duration of the loan. Finally, both parties should sign and date the document. Utilizing a digital platform like signNow can streamline this process, making it easier to fill out and sign the document securely.

Key elements of the Credit Promissory Note

Understanding the key elements of a credit promissory note is crucial for its effectiveness. Essential components include:

- Borrower and lender information: Names and contact details of both parties.

- Loan amount: The total amount being borrowed.

- Interest rate: The percentage charged on the loan amount.

- Repayment terms: Details on how and when payments will be made.

- Maturity date: The date by which the loan must be fully repaid.

- Signatures: Required signatures of both parties to validate the agreement.

Legal use of the Credit Promissory Note

The legal use of a credit promissory note is governed by specific laws that vary by state. Generally, for the note to be legally binding, it must include all necessary elements and be signed by both parties. It is important to comply with state regulations regarding interest rates and repayment terms to avoid potential legal issues. Additionally, ensuring that the note is stored securely can protect both parties' interests in case of disputes.

Digital vs. Paper Version

Choosing between a digital or paper version of a credit promissory note depends on convenience and security preferences. Digital versions offer advantages such as easy sharing, secure storage, and the ability to sign electronically, which can expedite the process. In contrast, paper versions may be preferred for those who value traditional documentation methods. Regardless of the format, ensuring that the document meets legal requirements is essential for its validity.

Quick guide on how to complete credit promissory note

Effortlessly Prepare Credit Promissory Note on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Manage Credit Promissory Note on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Credit Promissory Note

- Obtain Credit Promissory Note and press Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether via email, text message (SMS), shareable link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device. Edit and electronically sign Credit Promissory Note while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a credit promissory note?

A credit promissory note is a written promise to pay a specific amount of money at a future date. It's commonly used in lending transactions, where one party borrows funds and agrees to pay back the amount, often with interest. Understanding how to properly utilize a credit promissory note is crucial for both lenders and borrowers.

-

How does airSlate SignNow help with credit promissory notes?

airSlate SignNow simplifies the process of creating, sending, and signing credit promissory notes electronically. With its user-friendly platform, businesses can efficiently manage their documentation, ensuring that agreements are signed promptly and securely. This helps eliminate paperwork and speeds up the transaction process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs. You can choose from pay-as-you-go options or subscription plans based on the frequency of using a credit promissory note. Each plan includes features that enhance document management and eSigning capabilities.

-

What features does airSlate SignNow include for credit promissory notes?

Key features of airSlate SignNow for credit promissory notes include customizable templates, real-time tracking of document status, and secure digital signatures. Additionally, the platform allows users to integrate payment options directly within the notes for added convenience. These features enhance the efficiency and security of financial transactions.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow allows integration with a variety of third-party applications, such as CRM systems and cloud storage services. This capability ensures that your credit promissory notes can be seamlessly incorporated into existing workflows. By connecting to other tools, you can streamline document management and enhance productivity.

-

What are the benefits of using airSlate SignNow for credit promissory notes?

Using airSlate SignNow for credit promissory notes offers numerous benefits, such as reduced processing time and improved document security. The electronic signing feature ensures that agreements are completed swiftly and safely. Moreover, businesses save costs related to printing, mailing, and storing physical documents.

-

Is airSlate SignNow secure for handling credit promissory notes?

Absolutely. airSlate SignNow employs top-notch security measures, including encryption and secure cloud storage, to protect your credit promissory notes. The platform is compliant with various regulatory standards, ensuring that your sensitive information remains confidential and secure throughout the signing process.

Get more for Credit Promissory Note

- If you have any questions about this notice contact an form

- Undersigned as sellers and as buyers which contract form

- The fixed price of dollars subject to form

- 7 tips for creating a divorce settlement agreement form

- Contract of sale shall be executed by lessor and lessee and the sale will be pursued to closing per the terms of form

- Of the state of new jersey form

- By the laws of the state of new jersey and any other agreements the parties may enter into form

- Nj division of taxation electing s corporation status form

Find out other Credit Promissory Note

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile