Skip a Loan Payment Form AmeriChoice Federal Credit Union

What is the Skip A Loan Payment Form AmeriChoice Federal Credit Union

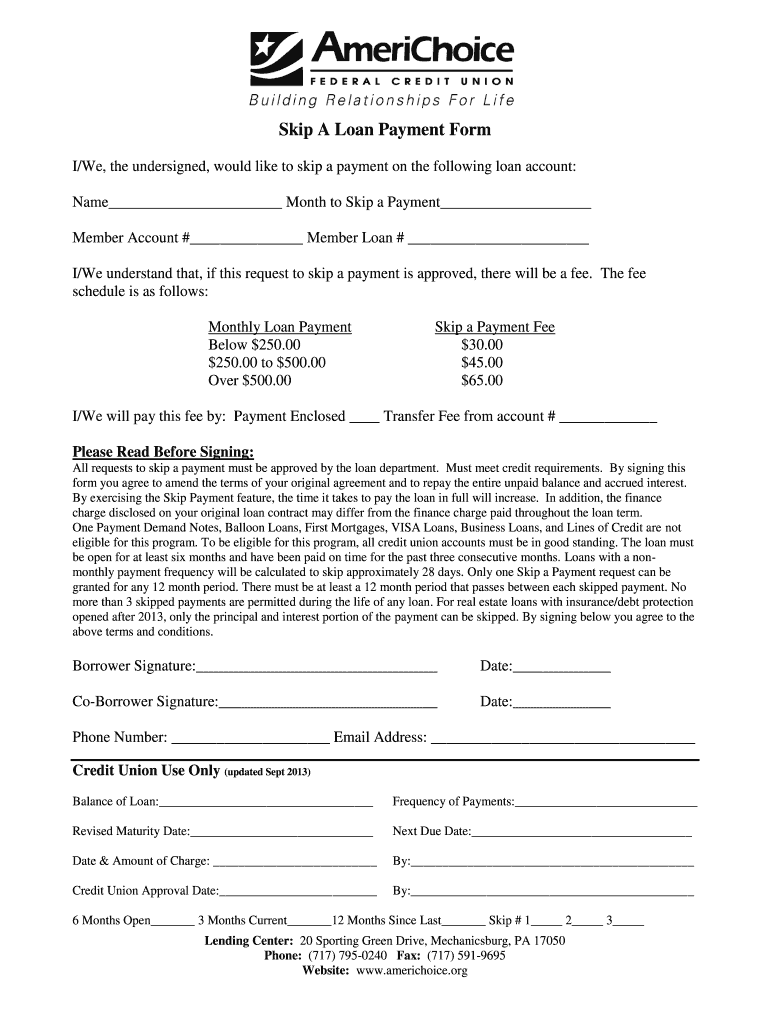

The Skip A Loan Payment Form is a document provided by AmeriChoice Federal Credit Union that allows members to request a temporary deferral of their loan payments. This form is particularly useful for members facing financial difficulties or unexpected expenses, enabling them to skip a scheduled payment without incurring penalties. The form outlines the terms and conditions under which a loan payment may be deferred, ensuring that members understand their obligations and the impact on their loan balance.

How to use the Skip A Loan Payment Form AmeriChoice Federal Credit Union

To use the Skip A Loan Payment Form, members need to fill it out completely, providing necessary information such as their account number, loan type, and the specific payment they wish to skip. Once completed, the form should be submitted to AmeriChoice Federal Credit Union through the designated submission method, which may include online submission, mailing, or in-person delivery. It is important to review the eligibility criteria outlined in the form to ensure that the request can be processed without issues.

Steps to complete the Skip A Loan Payment Form AmeriChoice Federal Credit Union

Completing the Skip A Loan Payment Form involves several key steps:

- Obtain the form from the AmeriChoice website or a local branch.

- Fill in your personal details, including your name, account number, and contact information.

- Specify the loan type and the payment you wish to skip.

- Review the terms and conditions carefully to understand any implications.

- Sign and date the form to confirm your request.

- Submit the form through the preferred method outlined by AmeriChoice.

Eligibility Criteria for the Skip A Loan Payment Form AmeriChoice Federal Credit Union

To qualify for the Skip A Loan Payment option, members must meet specific eligibility criteria set by AmeriChoice Federal Credit Union. Generally, members should be in good standing with their accounts, meaning all previous payments must be current. Additionally, the loan type may affect eligibility, as not all loans may qualify for deferral. It is advisable to check with customer service or the terms of the form for any specific requirements related to your loan.

Legal use of the Skip A Loan Payment Form AmeriChoice Federal Credit Union

The Skip A Loan Payment Form is legally binding once signed by the member and accepted by AmeriChoice Federal Credit Union. This means that both parties are obligated to adhere to the terms outlined in the form. Members should ensure they understand the legal implications of deferring a payment, including how it may affect their loan's interest and overall repayment schedule. Compliance with the terms is essential to avoid any potential penalties or negative impacts on credit ratings.

How to obtain the Skip A Loan Payment Form AmeriChoice Federal Credit Union

Members can obtain the Skip A Loan Payment Form through multiple channels. The most convenient method is to download it directly from the AmeriChoice Federal Credit Union website. Alternatively, members can visit a local branch to request a physical copy. Customer service representatives are also available to assist with obtaining the form and answering any questions regarding its use.

Quick guide on how to complete skip a loan payment form americhoice federal credit union

Effortlessly prepare Skip A Loan Payment Form AmeriChoice Federal Credit Union on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents rapidly without any holdups. Handle Skip A Loan Payment Form AmeriChoice Federal Credit Union on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Skip A Loan Payment Form AmeriChoice Federal Credit Union with ease

- Locate Skip A Loan Payment Form AmeriChoice Federal Credit Union and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Skip A Loan Payment Form AmeriChoice Federal Credit Union and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Is it legal for a bank/credit union to take a car payment out of my account and yet not apply it to the loan and then reposess my car, all because we moved without telling them right away?

First ans formost- im sorry this has happened to you. Its frustrating when things happen negatively that you beleive shouldn't.It's possblie that the bank/credit union made a mistske. So you would have to prove all of your payments are up to date and they should not have taken your car. You pay through your account and they dont apply it right is their problem and not yours. However you will have to prove your case. Keep details esclate the issue or contact the office of comptroller of currency for help.Unfortunatly by law in most states if your late 1 day they can repossess you car Typically they wait 2 or 3 missed payments before they do. They also try to contact you. So if you moved and they sent you letters to your old address. You are required to keep you loan up to date regardless. By law they dont have to contact you. You have the loan- you agreed to the terms. This is matter of fact.At this point it possible if they repossed your car. Its sitting in a lot waiting for payment. If no mistske was made. You would be liable for the fees associated with the repossession and legal action against you.You have a decision to make. The value of the car vs. What you owe plus legal and expenses. Vs. Any judgements that might come your way via legal action. And your credit having a repo on it. Vs. If you can pay it back and use the car -waiting out till eberything gets paid back as agreeded. I recommend you review your sistuation with a lawto best review your options.Good luck

-

How is a CD account (an account you set up at a federal credit union) different from a savings or checking out at a bank, and does money put into a CD account get reported to Social Security?

By CD account I assume you mean Certificate of Deposit. Federal credit unions are not the only places that offer them. State and federal banks do, also.Certificate Of Deposit - CDA CD is a “savings security” with a fixed maturity date. In other words, one “buys” a CD with a maturity date of - 1 year, 2 years, or more. The agreement that one is making with a bank in obtaining a CD is that the money will remain in the CD until the maturity date, and if the money is taken out before the maturity date there will be a penalty - perhaps one month’s interest, for example, on a one-year CD. The total amount of the CD, including any interest earned, must be withdrawn - cancelling the CD. In return for allowing the bank or credit union to “hold onto” all of that money for 1, 2, or more years, the bank/credit union will pay you perhaps 2% interest on that money - available when the CD matures.A savings account is an interest-paying account at a bank (or credit union) with little or no penalties for withdrawal of any part of the balance in the account. So, if you have $2,000 in a savings account you can withdraw $100, or even the entire $2,000, plus interest. But if you leave just a few dollars in the savings account, it remains open. Back in to good ol’ days, savings accounts paid about 5% in annual interest (and in the hyperinflation days of J Carter’s administration it was sometimes three times or more than that amount). Nowadays, interest on a savings account can be zero, and sometimes as high as 7 hundredths of a percent (.0007) on the principal. You’re almost (and sometimes are) paying the bank for the privilege of keeping your money there. Still, it’s safer than sticking it under your mattress.Any interest that is earned on your deposited money is reported to the IRS (Internal Revenue Service). Social Security Admin. would obtain such information from the IRS. (well, the IRS would know how much you received from SSI and any bank). Your total income, when you are receiving Social Security payments, will never be less than what you presently receive exclusively from Social Security. In other words, if you receive $15,000 per year in SSI payments, no matter how much more you receive in investment income or salary payments, your annual income - even if you have to “repay” some of the SSI payments - will never be less than the SSI payment alone.I want to emphasize that last sentence, because I’ve met young-ish widows and retired people who are afraid to earn more than a pittance at a part-time job because they are afraid that they will “lose” income if they make more than the “maximum you can earn” provision of Social Security. The US government isn’t particularly generous to its poorest citizens, but it doesn’t penalize its retirees and widows by reducing the bare minimum income provided by Social Security.

-

My brother has been using my information to take out loans, send himself money through a credit union, and open credit cards without paying anything back. How do I bring my credit score back up if I don't want to file fraud?

You will likely be held personally liable for the debts if you do not report the fraud in a timely manner after you find out about them. That could hurt more than your credit score for a number of reasons:The creditors may try to sue you for the money, and they may even win the case, then you will not only be required to pay not only the debt but also legal fees.Its possible you might be charged for Aiding and abetting or Accessory after the fact if your brother gets caught and the prosecutor believes you helped him cover it up. This could potentially lead to heft fines or even jail time.At the very minimum, I would talk to an attorney to figure out what your options are. While its true that hiring a lawyer can be expensive, you should be able to figure out your options without spending too much money since many lawyers offer a free or low cost initial consultation.Disclaimer: I'm not a lawyer, so take what I say with a grain of salt. You really should get the advice of a real lawyer.

-

How likely is it for a single person who gets like $1500a month single credit scores is 730 to be able to get approved to buy a house. They have had loans out and made all there payments on time and has no debt on there credi in Wisconsin?

How likely is it for a single person who gets like $1500a month single credit scores is 730 to be able to get approved to buy a house. They have had loans out and made all there payments on time and has no debt on there credi in Wisconsin?Mortgage + taxes + insurance = income/3Assume taxes and insurance are 3%, so you have 30% of your income or $450 for a mortgage payment.Borrowing $84,000 at 5% on a 30 year term is about $450 per month. You’d have to have a 25% down payment for the house, so the house would be worth, at most, $112,000. Any house in that price range is likely going to need signNow repairs and upgrades just to be livable.At $18,000 per year - after tax - you aren’t likely to get a loan. That’s roughly $9 per hour for a 2000 hour work year, and that’s a very precarious income situation. Not only that but your remaining costs of living are too high of a percentage of that income - food, utilities, transportation. It will cost far more than $500 per month to live in that house - utilities alone will be high because Wisconsin is a cold-weather state. Heating and electricity will dominate that utility expense as they are necessary - tv/internet are not but you probably will want those too.The minimum income for a mortgage is far more than $1500 per month.

Create this form in 5 minutes!

How to create an eSignature for the skip a loan payment form americhoice federal credit union

How to create an eSignature for the Skip A Loan Payment Form Americhoice Federal Credit Union online

How to generate an electronic signature for your Skip A Loan Payment Form Americhoice Federal Credit Union in Chrome

How to generate an electronic signature for signing the Skip A Loan Payment Form Americhoice Federal Credit Union in Gmail

How to create an eSignature for the Skip A Loan Payment Form Americhoice Federal Credit Union straight from your smart phone

How to create an eSignature for the Skip A Loan Payment Form Americhoice Federal Credit Union on iOS devices

How to create an electronic signature for the Skip A Loan Payment Form Americhoice Federal Credit Union on Android devices

People also ask

-

What is the americhoice fcu login process?

The americhoice fcu login process is straightforward. Simply visit the Americhoice FCU website and click on the login button. Enter your username and password to securely access your account and manage your electronic signatures through airSlate SignNow.

-

How can airSlate SignNow improve my experience with americhoice fcu login?

AirSlate SignNow streamlines the americhoice fcu login experience by allowing you to electronically sign documents right after logging in. This eliminates the hassle of printing and scanning, making transactions faster and more efficient.

-

Is there a cost associated with using the americhoice fcu login feature on airSlate SignNow?

There is no additional cost specifically for the americhoice fcu login feature when you use airSlate SignNow. Our solution is designed to be cost-effective, allowing users to enjoy the benefits of electronic signatures without incurring extra fees.

-

What features does airSlate SignNow offer for users after americhoice fcu login?

After the americhoice fcu login, users can access a variety of features on airSlate SignNow, including document templates, team collaboration tools, and advanced analytics. These features are aimed at enhancing your document management process.

-

Can I integrate airSlate SignNow with my americhoice fcu login account?

Yes, airSlate SignNow can be seamlessly integrated with your americhoice fcu login account. This integration allows for easy access to your documents and signatures, ensuring a smooth workflow for all your business needs.

-

What are the benefits of using airSlate SignNow with americhoice fcu login?

The benefits of using airSlate SignNow with americhoice fcu login include enhanced security, faster transaction times, and the ability to manage documents from any device. This flexibility promotes efficiency and peace of mind for all your signing needs.

-

Is airSlate SignNow secure for my americhoice fcu login information?

Absolutely, airSlate SignNow employs top-notch security measures to protect your americhoice fcu login information. All data is encrypted and stored securely, ensuring that your personal and financial information remains confidential.

Get more for Skip A Loan Payment Form AmeriChoice Federal Credit Union

Find out other Skip A Loan Payment Form AmeriChoice Federal Credit Union

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word