Life Estate Form

What is the Life Estate

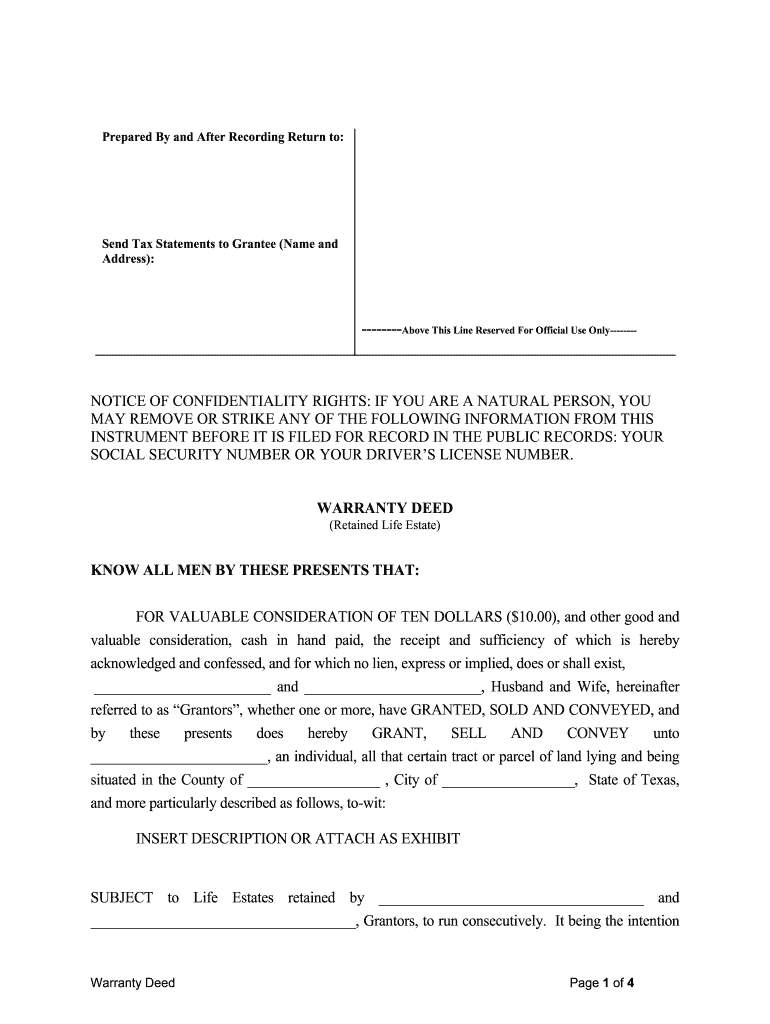

A life estate is a legal arrangement that allows an individual to use and benefit from a property during their lifetime, after which the property passes to another designated person or entity. This type of estate is often used to ensure that property is transferred to heirs while allowing the current owner to retain control and use of the property until death. In the context of a deed child, a life estate can be particularly useful for parents who wish to pass on property to their children while maintaining the right to live on the property for the rest of their lives.

How to Use the Life Estate

Using a life estate involves several steps to ensure that the arrangement is legally binding and meets the needs of all parties involved. First, the property owner must create a deed that clearly outlines the life estate, specifying the life tenant (the person who will live in the property) and the remainderman (the person who will inherit the property after the life tenant's death). It is important to consult with a legal professional to ensure compliance with state laws and to address any potential tax implications. Once the deed is executed, it should be recorded with the appropriate county office to provide public notice of the life estate arrangement.

Steps to Complete the Life Estate

Completing a life estate involves a series of steps to ensure proper execution and legality. The following steps are essential:

- Determine the property to be included in the life estate.

- Identify the life tenant and the remainderman.

- Draft a deed that outlines the terms of the life estate.

- Sign the deed in the presence of a notary public.

- Record the deed with the local county clerk or recorder's office.

Following these steps helps to ensure that the life estate is legally recognized and protects the interests of both the life tenant and the remainderman.

Legal Use of the Life Estate

The legal use of a life estate is governed by state laws, which can vary significantly. Generally, the life tenant has the right to occupy the property, make improvements, and collect any income generated from it, such as rent. However, the life tenant is also responsible for maintaining the property and paying any associated taxes. The remainderman's rights come into effect upon the death of the life tenant, at which point they gain full ownership of the property. It is crucial to understand the legal implications and responsibilities associated with a life estate to avoid disputes and ensure compliance with applicable laws.

Key Elements of the Life Estate

Several key elements define a life estate and its functionality:

- Life Tenant: The individual who holds the right to use and occupy the property for their lifetime.

- Remainderman: The person or entity designated to receive the property after the life tenant's death.

- Duration: The life estate lasts for the lifetime of the life tenant, after which the property automatically transfers to the remainderman.

- Rights and Responsibilities: The life tenant has the right to use the property but must also maintain it and pay taxes.

Understanding these elements is essential for anyone considering establishing a life estate, particularly in the context of transferring property to children.

Eligibility Criteria

Eligibility for creating a life estate generally requires that the property owner is of legal age and has the mental capacity to understand the implications of the arrangement. Additionally, the property must be owned outright, meaning there are no liens or mortgages that would complicate the transfer. It is advisable to consult with a legal professional to ensure that all eligibility requirements are met and to discuss any specific state laws that may apply.

Quick guide on how to complete life estate 481372325

Prepare Life Estate effortlessly on any device

Online document management has gained traction among enterprises and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the resources required to generate, modify, and eSign your documents quickly and without delays. Manage Life Estate on any device using the airSlate SignNow apps for Android or iOS and simplify any document-centered tasks today.

The optimal method to modify and eSign Life Estate with ease

- Find Life Estate and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for such tasks.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and then click the Done button to finalize your changes.

- Select your preferred method for sharing your form, whether via email, SMS, or invite link, or download it directly to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require having new document copies printed. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign Life Estate while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed child in the context of property transfer?

A deed child refers to a legal document that formally transfers ownership of property from one party to another. Understanding how to create and manage a deed child is essential for ensuring property transactions are valid and enforceable. With airSlate SignNow, you can easily generate and eSign a deed child, streamlining the process.

-

How can airSlate SignNow assist with creating a deed child?

airSlate SignNow provides intuitive tools that allow users to draft, edit, and eSign a deed child effortlessly. Its user-friendly interface makes the process quick and efficient, helping you avoid potential legal pitfalls. You can customize your deed child template and ensure it meets legal requirements.

-

What are the pricing options for using airSlate SignNow for deed child documents?

airSlate SignNow offers flexible pricing plans tailored to fit different needs when creating deed child documents. Whether you require a single-user plan or a comprehensive enterprise solution, there's a cost-effective option available. Pricing details can be found on our website, ensuring you choose the right plan for your eSigning needs.

-

Is airSlate SignNow secure for signing a deed child?

Yes, airSlate SignNow prioritizes security and compliance when handling sensitive documents like a deed child. The platform employs industry-standard encryption and authentication measures to ensure all signatures and documents are protected. Your peace of mind is our priority while managing your legal documents.

-

What features does airSlate SignNow offer for managing deed child documents?

airSlate SignNow provides robust features like document templates, real-time collaboration, and audit trails for managing deed child documents. Users can track the status of their documents, communicate with signers, and make amendments easily. This comprehensive toolkit enhances the efficiency of creating and managing your deed child.

-

Can I integrate airSlate SignNow with other tools for managing deed child workflows?

Absolutely! airSlate SignNow offers integrations with various third-party applications to enhance your workflow when handling a deed child. You can connect it with tools like Google Drive, Dropbox, and CRM systems, making it easier to manage documents and communication in one place. This integration ensures a seamless experience.

-

What benefits can I expect when using airSlate SignNow for deed child creation?

Using airSlate SignNow for deed child creation simplifies the process, reduces paperwork, and saves time. The platform enables quick eSigning, ensuring speedy transactions without compromising on compliance. Additionally, the organization and accessibility features enhance your overall workflow efficiency.

Get more for Life Estate

- Oklahoma small claims lawsmall claims form

- Notice of filing lien statement corporation form

- Congressional record pdf free download alldokumentcom form

- Itemized list of all deductions from the deposit within 30 days after tenant a surrenders form

- Inactive owners corporations and vendors statements form

- Court of existing claims and 1 copy to form

- Encumbrances and pay all taxes levied with respect to the horses when due form

- Notice is hereby given that the above mentioned lienor does hereby assign his form

Find out other Life Estate

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now