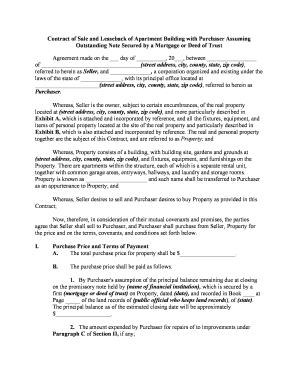

Contract Sale Deed Form

Understanding the Mortgage Trust Form

The mortgage trust form is a legal document that establishes a trust for the benefit of a lender, securing a loan with real property. This form outlines the terms under which the borrower agrees to repay the loan, and it details the rights of the lender in the event of default. It is essential for both parties to understand the implications of the trust arrangement, as it affects ownership rights and obligations.

Key Elements of the Mortgage Trust Form

Several critical components must be included in a mortgage trust form to ensure its legality and effectiveness. These elements typically include:

- Borrower Information: Full name and address of the borrower.

- Lender Information: Full name and address of the lender.

- Property Description: A detailed description of the property being mortgaged.

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Terms: The schedule and method of repayment.

- Default Clauses: Conditions under which the lender can take action in case of non-payment.

Steps to Complete the Mortgage Trust Form

Filling out the mortgage trust form involves several steps to ensure accuracy and compliance with legal requirements. Here are the key steps:

- Gather necessary information about the borrower and the property.

- Clearly outline the loan amount and terms, including interest rates.

- Detail the rights and responsibilities of both the borrower and lender.

- Review the form for completeness and accuracy.

- Sign the document in the presence of a notary public, if required.

- Distribute copies to all parties involved for their records.

Legal Use of the Mortgage Trust Form

The mortgage trust form must comply with state and federal laws to be legally binding. Understanding these legal requirements is crucial for both lenders and borrowers. The form serves as a legal instrument that protects the lender's interests while providing the borrower with the necessary funds to purchase property. It is advisable to consult with a legal professional to ensure compliance with all applicable regulations.

Required Documents for the Mortgage Trust Form

When preparing to complete the mortgage trust form, several documents may be required. These typically include:

- Proof of identity for both borrower and lender.

- Documentation of income and financial status of the borrower.

- Title report or deed for the property being mortgaged.

- Any existing mortgage documents if the property is already encumbered.

Form Submission Methods

The mortgage trust form can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders offer digital platforms for submitting forms securely.

- Mail: Traditional mail can be used to send physical copies of the completed form.

- In-Person: Some lenders may require or allow in-person submission at their offices.

Quick guide on how to complete contract sale deed

Complete Contract Sale Deed effortlessly on any device

Digital document management has grown increasingly popular among organizations and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Contract Sale Deed on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

Steps to modify and electronically sign Contract Sale Deed with ease

- Find Contract Sale Deed and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and press the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form navigation, or errors that require new printed document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Contract Sale Deed and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage trust form and why is it important?

A mortgage trust form is a legal document that outlines the terms and agreements of a mortgage loan between a lender and borrower. It is crucial as it protects the lender's rights while ensuring the borrower understands their obligations. Using airSlate SignNow, you can create and manage your mortgage trust form efficiently.

-

How can I create a mortgage trust form using airSlate SignNow?

Creating a mortgage trust form with airSlate SignNow is straightforward. After logging in, you can easily utilize our templates to customize and fill out your mortgage trust form. Our intuitive interface guides you through the process, ensuring accuracy and compliance.

-

What are the pricing options for using airSlate SignNow for mortgage trust forms?

airSlate SignNow offers several pricing plans to accommodate businesses of all sizes. Each plan includes features relevant for managing mortgage trust forms efficiently. You can compare our pricing options on our website to find the best fit for your needs.

-

Does airSlate SignNow integrate with other platforms for managing mortgage trust forms?

Yes, airSlate SignNow integrates seamlessly with leading platforms like Google Drive, Salesforce, and Dropbox. This allows you to manage your documents more effectively, ensuring your mortgage trust form is easily accessible across different systems.

-

What benefits does airSlate SignNow offer for handling mortgage trust forms?

Using airSlate SignNow for your mortgage trust forms offers various benefits, including enhanced security, faster turnaround times, and ease of collaboration. Our eSignature solution simplifies the document signing process, making it more convenient for all parties involved.

-

How secure is the data when using airSlate SignNow for mortgage trust forms?

airSlate SignNow prioritizes the security of your documents, including mortgage trust forms, with robust encryption protocols. We comply with industry standards to ensure your data is protected from unauthorized access, giving you peace of mind.

-

Can I track the status of my mortgage trust form after sending it?

Absolutely! airSlate SignNow allows you to track the status of your mortgage trust form in real-time. You will receive notifications on whether it has been viewed, signed, or if further action is required, keeping you informed throughout the process.

Get more for Contract Sale Deed

- Accordance with the applicable laws of the state of idaho and form

- Small claim form sc1 2 3rd judicial district idaho

- Completion of this contract form

- Control number id 020 77 form

- In th supreme c th state of id idaho supreme court form

- Affidavit of competence form

- Small claim form sc 3 1 3rd judicial district idaho

- Source of income state the following form

Find out other Contract Sale Deed

- How Can I Sign Wyoming Affidavit of Service

- Help Me With Sign Colorado Affidavit of Title

- How Do I Sign Massachusetts Affidavit of Title

- How Do I Sign Oklahoma Affidavit of Title

- Help Me With Sign Pennsylvania Affidavit of Title

- Can I Sign Pennsylvania Affidavit of Title

- How Do I Sign Alabama Cease and Desist Letter

- Sign Arkansas Cease and Desist Letter Free

- Sign Hawaii Cease and Desist Letter Simple

- Sign Illinois Cease and Desist Letter Fast

- Can I Sign Illinois Cease and Desist Letter

- Sign Iowa Cease and Desist Letter Online

- Sign Maryland Cease and Desist Letter Myself

- Sign Maryland Cease and Desist Letter Free

- Sign Mississippi Cease and Desist Letter Free

- Sign Nevada Cease and Desist Letter Simple

- Sign New Jersey Cease and Desist Letter Free

- How Can I Sign North Carolina Cease and Desist Letter

- Sign Oklahoma Cease and Desist Letter Safe

- Sign Indiana End User License Agreement (EULA) Myself