California California Installments Fixed Rate Promissory Note Secured by Personal Property Form

What is the California California Installments Fixed Rate Promissory Note Secured By Personal Property

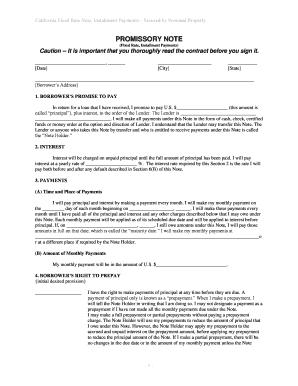

The California California Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document that outlines a borrower's promise to repay a loan in fixed installments over a specified period. This note is secured by personal property, meaning that the lender has a claim on the borrower's assets in case of default. The document ensures that both parties understand the terms of the loan, including the interest rate, payment schedule, and consequences of non-payment. It serves as a binding agreement that protects the interests of both the lender and the borrower.

Key Elements of the California California Installments Fixed Rate Promissory Note Secured By Personal Property

This promissory note includes several critical components:

- Principal Amount: The total amount borrowed by the borrower.

- Interest Rate: The fixed rate at which interest will accrue on the principal amount.

- Payment Schedule: Details on how often payments are due, typically monthly or quarterly.

- Collateral Description: A clear description of the personal property securing the loan.

- Default Clauses: Conditions under which the lender can take action if the borrower fails to meet payment obligations.

- Signatures: The borrower and lender must sign the document to make it legally binding.

Steps to Complete the California California Installments Fixed Rate Promissory Note Secured By Personal Property

Completing this promissory note involves several steps:

- Gather Information: Collect all necessary details about the loan, including amounts, interest rates, and collateral.

- Fill Out the Document: Enter the required information into the promissory note template, ensuring accuracy.

- Review Terms: Both parties should carefully review the terms to ensure mutual understanding.

- Sign the Document: Both the borrower and lender must sign the note, either in person or electronically.

- Store Safely: Keep copies of the signed document in a secure location for future reference.

Legal Use of the California California Installments Fixed Rate Promissory Note Secured By Personal Property

This promissory note is legally recognized in California, provided it meets certain requirements. It must be in writing, signed by both parties, and include all essential elements. The note is enforceable in a court of law, allowing the lender to pursue legal action if the borrower defaults on the loan. It is important for both parties to understand their rights and obligations under this agreement to avoid potential legal disputes.

How to Use the California California Installments Fixed Rate Promissory Note Secured By Personal Property

The promissory note can be used in various scenarios, such as personal loans, business financing, or securing loans against personal property. To effectively use this document, the lender should clearly communicate the terms to the borrower, ensuring that both parties agree on the repayment schedule and conditions. It is advisable to consult with a legal professional to ensure that the document complies with state laws and adequately protects both parties' interests.

State-Specific Rules for the California California Installments Fixed Rate Promissory Note Secured By Personal Property

In California, specific regulations govern the use of promissory notes. These include adherence to state laws regarding interest rates, which may not exceed certain limits, and requirements for written agreements. Additionally, the note must comply with the Uniform Commercial Code (UCC) provisions related to secured transactions. Understanding these state-specific rules is crucial for both lenders and borrowers to ensure the legality and enforceability of the promissory note.

Quick guide on how to complete california california installments fixed rate promissory note secured by personal property

Effortlessly Complete California California Installments Fixed Rate Promissory Note Secured By Personal Property on Any Device

Digital document management has gained traction among enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily access the required form and securely save it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle California California Installments Fixed Rate Promissory Note Secured By Personal Property on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to Edit and eSign California California Installments Fixed Rate Promissory Note Secured By Personal Property with Ease

- Obtain California California Installments Fixed Rate Promissory Note Secured By Personal Property and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and eSign California California Installments Fixed Rate Promissory Note Secured By Personal Property to ensure effective communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a California California Installments Fixed Rate Promissory Note Secured By Personal Property?

A California California Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document that outlines the terms of a loan, which is secured by personal property. This financial instrument provides a consistent repayment schedule with fixed interest rates, protecting both the lender and the borrower. It is an effective tool for financing and asset management in California.

-

What are the benefits of using a California California Installments Fixed Rate Promissory Note Secured By Personal Property?

Using a California California Installments Fixed Rate Promissory Note Secured By Personal Property can help ensure predictable payments over time, making financial planning easier. Additionally, it provides security for the lender while giving borrowers the ability to secure funding without extensive background checks. Such a note can enhance trust between both parties in a financial transaction.

-

How do I create a California California Installments Fixed Rate Promissory Note Secured By Personal Property?

To create a California California Installments Fixed Rate Promissory Note Secured By Personal Property, you can utilize an online document solution like airSlate SignNow. The platform allows you to easily customize your agreement, ensuring all necessary details like interest rates and payment schedules are included. This process is straightforward and eliminates the need for complicated legal jargon.

-

What features does airSlate SignNow offer for managing my California California Installments Fixed Rate Promissory Note Secured By Personal Property?

airSlate SignNow offers features like eSignature capabilities, document tracking, and templates specifically for creating a California California Installments Fixed Rate Promissory Note Secured By Personal Property. These tools help you manage the document lifecycle efficiently, allowing for secure storage and easy access for both parties. This streamlines the entire process from inception to execution.

-

Is it cost-effective to use airSlate SignNow for my California California Installments Fixed Rate Promissory Note?

Yes, using airSlate SignNow for your California California Installments Fixed Rate Promissory Note is cost-effective. The platform offers competitive pricing plans that cater to different business needs, allowing you to save on legal fees while ensuring compliance. With affordable subscription options, businesses can handle multiple documents efficiently without breaking the bank.

-

How can I ensure the security of my California California Installments Fixed Rate Promissory Note?

When using airSlate SignNow for your California California Installments Fixed Rate Promissory Note, you can rely on bank-grade security features to ensure your documents are safe. The platform includes encryption, secure user authentication, and data protection measures that comply with industry standards. This gives peace of mind to both lenders and borrowers regarding the confidentiality of their agreements.

-

Can I integrate airSlate SignNow with my existing financial software for California California Installments Fixed Rate Promissory Notes?

Absolutely! airSlate SignNow seamlessly integrates with a variety of financial and business software tools, enhancing your workflow for creating California California Installments Fixed Rate Promissory Notes. Popular integrations include accounting software and CRM systems, allowing for better data management and streamlined processes. This makes it easier to keep track of all your financial documents in one place.

Get more for California California Installments Fixed Rate Promissory Note Secured By Personal Property

- The initial registered office of the corporation is form

- A south carolina corporation form

- Fillable online sc articles of incorporation department of south form

- Free articles of organization 33 44 203 state of sou form

- South carolinas supreme court clarifies the requirements form

- Wife as joint tenants with rights of survivorship hereinafter grantees the following lands and form

- Grantor does grant bargain sell and release and by these presents do grant bargain sell and release form

- Release and by these presents do grant bargain sell and release unto and form

Find out other California California Installments Fixed Rate Promissory Note Secured By Personal Property

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors