Louisiana Mortgage Form

What is the Louisiana Mortgage Form

The Louisiana mortgage form is a legal document used in real estate transactions to secure a loan against a property. This form outlines the terms of the mortgage agreement between the borrower and the lender, including the loan amount, interest rate, repayment schedule, and any applicable fees. It serves as a binding contract that protects the lender's interest in the property until the loan is fully repaid. Understanding the specifics of this form is crucial for both parties involved in the transaction.

How to use the Louisiana Mortgage Form

Using the Louisiana mortgage form involves several steps to ensure that it is filled out correctly and legally binding. First, both the borrower and lender should review the terms of the mortgage agreement. Once agreed upon, the borrower must provide accurate information, including personal details, property information, and financial data. After completing the form, both parties must sign it in the presence of a notary public to validate the document. Utilizing digital tools for eSigning can streamline this process, making it more efficient and secure.

Steps to complete the Louisiana Mortgage Form

Completing the Louisiana mortgage form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as proof of income, credit history, and property details.

- Fill in personal information, including the borrower's name, address, and Social Security number.

- Specify the loan amount and terms, including interest rates and repayment schedule.

- Review the form for accuracy and completeness.

- Sign the document in the presence of a notary public to ensure legal validity.

Legal use of the Louisiana Mortgage Form

The legal use of the Louisiana mortgage form is governed by state laws and regulations. To ensure that the form is legally binding, it must meet specific requirements, including proper signatures and notarization. Additionally, the form must comply with federal laws regarding mortgage lending practices. Understanding these legal aspects is essential for both borrowers and lenders to protect their rights and interests in the transaction.

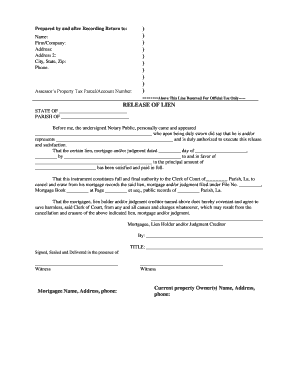

Key elements of the Louisiana Mortgage Form

Several key elements are essential to include in the Louisiana mortgage form to ensure its effectiveness and legality. These elements include:

- Borrower Information: Full name, address, and identification details of the borrower.

- Lender Information: Name and contact information of the lending institution.

- Loan Details: Amount borrowed, interest rate, and repayment terms.

- Property Description: Legal description of the property being mortgaged.

- Signatures: Signatures of both the borrower and lender, along with notarization.

State-specific rules for the Louisiana Mortgage Form

When using the Louisiana mortgage form, it is important to be aware of state-specific rules that may affect the document. Louisiana law requires that all mortgage agreements be recorded in the parish where the property is located. Additionally, certain disclosures may be mandated by state regulations, such as information regarding the borrower's rights and responsibilities. Familiarity with these rules can help prevent legal issues and ensure compliance throughout the mortgage process.

Quick guide on how to complete louisiana mortgage form

Effortlessly Prepare Louisiana Mortgage Form on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any delays. Manage Louisiana Mortgage Form on any platform using airSlate SignNow's Android or iOS applications, and enhance every document-centric task today.

The Easiest Way to Edit and Electronically Sign Louisiana Mortgage Form Seamlessly

- Locate Louisiana Mortgage Form and click on Get Form to commence.

- Utilize the resources we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, such as email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Louisiana Mortgage Form and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Louisiana mortgage form?

A Louisiana mortgage form is a legal document used to outline the terms and conditions of a mortgage agreement in the state of Louisiana. It details the obligations of both the borrower and lender, ensuring that all parties understand their rights. Using airSlate SignNow, you can easily create, send, and eSign these forms securely.

-

How can airSlate SignNow help me with Louisiana mortgage forms?

airSlate SignNow simplifies the process of managing Louisiana mortgage forms by providing a user-friendly platform to create, share, and eSign documents. It allows you to automate workflows and track the status of forms, ensuring a swift and efficient mortgage process. This ensures you can focus on closing deals rather than getting bogged down in paperwork.

-

Are there any fees associated with using airSlate SignNow for Louisiana mortgage forms?

Yes, airSlate SignNow offers various pricing plans to meet your business needs when working with Louisiana mortgage forms. Each plan provides access to different features, such as unlimited eSignatures or advanced document management. You can choose the one that fits your budget and requirements best.

-

Is airSlate SignNow easy to integrate with other tools I use?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, making it easy to incorporate Louisiana mortgage forms into your existing workflow. Whether you're using CRM software or document management tools, you can enhance productivity by streamlining how you manage your mortgage documentation.

-

What are the benefits of using airSlate SignNow for Louisiana mortgage forms?

The benefits of using airSlate SignNow for Louisiana mortgage forms include increased efficiency, faster turnaround times, and enhanced security. You can eSign documents from anywhere, reducing delays in the mortgage process. Additionally, our platform ensures compliance with legal standards, protecting both parties involved.

-

Can I customize my Louisiana mortgage form using airSlate SignNow?

Yes, customization is one of the key features of airSlate SignNow when working with Louisiana mortgage forms. You can modify document templates to suit your specific needs, including adding company branding or unique clauses. This enhances professionalism and ensures that all necessary terms are covered in your mortgage agreements.

-

How does airSlate SignNow ensure the security of my Louisiana mortgage forms?

airSlate SignNow prioritizes the security of your Louisiana mortgage forms by employing robust encryption methods and secure storage solutions. We adhere to industry standards to protect sensitive information, ensuring that only authorized users have access to your documents. Your data's confidentiality and integrity are our top concerns.

Get more for Louisiana Mortgage Form

- State of louisiana court of appeal second circuit form

- By original mortgage form

- Jesse lee white form

- Expungements forms index

- Be it known that on this day of 20 before me the undersigned form

- Edwin peavy petitioner appellant v united states of form

- Confirmation of preliminary default without hearing in open court form

- Motion and order for return of child form

Find out other Louisiana Mortgage Form

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online