Nd Satisfaction Mortgage Form

What is the Nd Satisfaction Mortgage

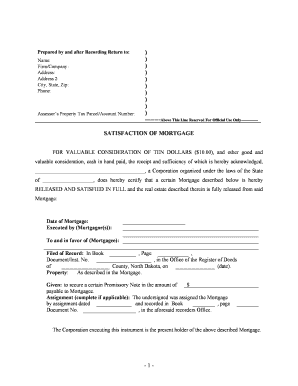

The Nd Satisfaction Mortgage is a legal document used in North Dakota to acknowledge the satisfaction of a mortgage obligation. This form serves as proof that a borrower has fulfilled their financial obligations to the lender, thereby releasing the lien on the property. It is essential for homeowners who have paid off their mortgage, as it formally clears the title of the property, allowing for future transactions without encumbrances.

How to use the Nd Satisfaction Mortgage

To utilize the Nd Satisfaction Mortgage, a borrower must first ensure that all mortgage payments have been made in full. Once confirmed, the lender will prepare the satisfaction mortgage document. The borrower should then review the document for accuracy, sign it, and ensure it is filed with the appropriate county recorder's office. This process officially updates the public record, indicating that the mortgage has been satisfied.

Steps to complete the Nd Satisfaction Mortgage

Completing the Nd Satisfaction Mortgage involves several key steps:

- Confirm that the mortgage is fully paid off.

- Request the satisfaction document from the lender.

- Review the document for any errors or omissions.

- Sign the document to acknowledge its accuracy.

- File the signed document with the county recorder's office.

Following these steps ensures that the mortgage is officially satisfied and the property title is clear.

Legal use of the Nd Satisfaction Mortgage

The legal use of the Nd Satisfaction Mortgage is governed by state laws in North Dakota. It is crucial that the document is executed properly to ensure it holds up in legal contexts. The satisfaction mortgage must be signed by the lender and, in some cases, the borrower, and filed with the county recorder to be legally binding. This process protects the rights of property owners and ensures transparency in real estate transactions.

Key elements of the Nd Satisfaction Mortgage

Several key elements must be included in the Nd Satisfaction Mortgage to ensure its validity:

- The name of the borrower and lender.

- The legal description of the property.

- The date the mortgage was originally executed.

- A statement confirming that the mortgage has been satisfied.

- Signatures of the lender and, if required, the borrower.

These components are essential for the document to be recognized by legal authorities and to effectively release the mortgage lien.

State-specific rules for the Nd Satisfaction Mortgage

In North Dakota, there are specific rules governing the Nd Satisfaction Mortgage. It is required that the satisfaction document be recorded within a certain timeframe after the mortgage is paid off, typically within thirty days. Additionally, the document must comply with state regulations regarding notarization and filing fees. Understanding these rules is vital for ensuring that the satisfaction is legally recognized and that property rights are preserved.

Required Documents

To complete the Nd Satisfaction Mortgage, several documents are typically required:

- The original mortgage agreement.

- Proof of payment, such as a final statement from the lender.

- The satisfaction mortgage form itself, prepared by the lender.

- Identification for all parties involved, if necessary.

Having these documents ready will streamline the process and ensure compliance with legal requirements.

Quick guide on how to complete nd satisfaction mortgage

Easily Prepare Nd Satisfaction Mortgage on Any Device

The management of online documents has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Nd Satisfaction Mortgage on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Nd Satisfaction Mortgage Effortlessly

- Find Nd Satisfaction Mortgage and click Get Form to begin.

- Utilize our tools to complete your document.

- Highlight pertinent sections of the documents or conceal sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal significance as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Nd Satisfaction Mortgage to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the nd satisfaction mortgage feature in airSlate SignNow?

The nd satisfaction mortgage feature in airSlate SignNow allows users to efficiently manage and eSign critical mortgage documents. This feature ensures that all necessary agreements are completed swiftly, reducing paperwork and enhancing customer satisfaction. With our user-friendly interface, you can easily navigate and execute mortgage tasks.

-

How does airSlate SignNow streamline the nd satisfaction mortgage process?

AirSlate SignNow streamlines the nd satisfaction mortgage process by enabling electronic signatures and document management. This digital approach eliminates the hassle of printing and mailing documents, allowing for faster turnaround times. Businesses can quickly obtain necessary signatures, optimizing their workflow and improving customer experience.

-

What pricing plans are available for the nd satisfaction mortgage feature?

AirSlate SignNow offers various pricing plans tailored to different business needs including the nd satisfaction mortgage feature. Our plans are designed to be cost-effective and scalable, ensuring that as your business grows, your document management solution can grow with it. You can choose a plan that best fits your volume and feature requirements.

-

Can I integrate airSlate SignNow with other tools for my nd satisfaction mortgage needs?

Yes, airSlate SignNow can seamlessly integrate with other popular business tools to enhance your nd satisfaction mortgage processes. By connecting with CRM systems, project management apps, and cloud storage services, you can centralize your document management. This integration ensures that all your mortgage documentation is organized and easily accessible.

-

What are the benefits of using airSlate SignNow for nd satisfaction mortgage documents?

Using airSlate SignNow for nd satisfaction mortgage documents offers multiple benefits, including increased speed, efficiency, and accuracy. Electronic signatures reduce the time spent on document processing, allowing you to focus more on customer satisfaction. Moreover, our secure platform ensures that all transactions are protected, giving you peace of mind.

-

Is airSlate SignNow compliant with regulations relevant to nd satisfaction mortgage documentation?

Absolutely, airSlate SignNow adheres to all relevant regulatory standards for nd satisfaction mortgage documentation. Our platform complies with eSignature laws and regulations such as ESIGN and UETA. This compliance guarantees that your electronic signatures are legally binding and accepted by financial institutions.

-

How does airSlate SignNow enhance customer satisfaction for nd satisfaction mortgages?

AirSlate SignNow enhances customer satisfaction for nd satisfaction mortgages by providing a fast and hassle-free signing experience. Clients can sign documents anytime and anywhere, which increases convenience and reduces delays. Happier clients translate to improved relationships and repeat business, essential for any mortgage provider.

Get more for Nd Satisfaction Mortgage

Find out other Nd Satisfaction Mortgage

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament