Self Employed Contractor Form

What is the Self Employed Contractor Form

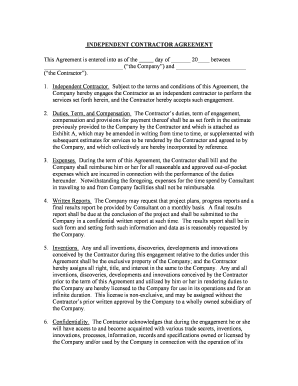

The Self Employed Contractor Form, often referred to as the independent contractor form agreement, is a crucial document that outlines the terms of engagement between a contractor and a client. This form serves to clarify the nature of the working relationship, detailing responsibilities, payment terms, and timelines. It helps protect both parties by establishing clear expectations and legal obligations.

How to use the Self Employed Contractor Form

Using the Self Employed Contractor Form involves several straightforward steps. First, both parties should review the form to ensure all necessary information is included. This includes the contractor's name, contact details, and the scope of work. Next, both parties should sign the document, either physically or digitally, to validate the agreement. Utilizing a platform like signNow simplifies this process by allowing for secure digital signatures, ensuring compliance with legal standards.

Key elements of the Self Employed Contractor Form

Several key elements are essential to include in the Self Employed Contractor Form. These elements typically cover:

- Scope of Work: A detailed description of the services to be provided.

- Payment Terms: Information on how and when the contractor will be compensated.

- Duration of Agreement: The start and end dates of the contract.

- Confidentiality Clauses: Provisions to protect sensitive information shared during the engagement.

- Termination Conditions: Guidelines on how either party can terminate the agreement.

Steps to complete the Self Employed Contractor Form

Completing the Self Employed Contractor Form involves a series of steps to ensure accuracy and compliance. Begin by filling out the contractor's details, including name and contact information. Next, outline the scope of work clearly, specifying tasks and deliverables. After that, include payment terms, detailing the amount, payment schedule, and method. Finally, both parties should review the completed form for accuracy before signing it, either digitally or in print.

Legal use of the Self Employed Contractor Form

The legal use of the Self Employed Contractor Form is vital for establishing a binding agreement. To ensure legality, both parties must sign the document, and it should comply with relevant laws such as the ESIGN Act and UETA. Digital signatures provided through secure platforms like signNow are recognized as legally binding, provided they meet the necessary criteria for authentication and security.

Required Documents

When preparing the Self Employed Contractor Form, certain documents may be required to support the agreement. These can include:

- Identification: A government-issued ID to verify the contractor's identity.

- Tax Information: Forms such as the W-9 for tax reporting purposes.

- Proof of Insurance: Documentation showing liability coverage, if applicable.

Quick guide on how to complete self employed contractor form

Prepare Self Employed Contractor Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily find the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and effortlessly. Manage Self Employed Contractor Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Self Employed Contractor Form without effort

- Locate Self Employed Contractor Form and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Self Employed Contractor Form and guarantee outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an independent contractor form agreement?

An independent contractor form agreement is a legal document that outlines the terms of work between a business and an independent contractor. This agreement typically covers payment details, project scope, deliverables, and deadlines. Utilizing airSlate SignNow, you can easily create and manage your independent contractor form agreements digitally.

-

How can airSlate SignNow help in creating an independent contractor form agreement?

airSlate SignNow offers customizable templates to streamline the creation of your independent contractor form agreement. The platform allows you to add specific terms, upload necessary documents, and ensure all parties can eSign effortlessly. This helps save time and ensures compliance with industry standards.

-

Is there a cost associated with using airSlate SignNow for independent contractor form agreements?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of businesses, including options for individuals and teams. Each plan provides access to features necessary for managing your independent contractor form agreements efficiently. You can choose a plan that best fits your budget and business requirements.

-

What features does airSlate SignNow provide for managing independent contractor form agreements?

airSlate SignNow provides several features, including customizable templates, eSignature capabilities, document tracking, and cloud storage. These features make it easy to create, send, and sign independent contractor form agreements securely. Additionally, the platform integrates with other applications to enhance your workflow.

-

Are independent contractor form agreements legally binding when signed electronically with airSlate SignNow?

Yes, independent contractor form agreements signed electronically through airSlate SignNow are legally binding. The platform complies with eSignature laws, ensuring that your agreements are valid and enforceable. This allows you to confidently manage contracts without the need for physical paperwork.

-

Can I integrate airSlate SignNow with other tools for managing independent contractor form agreements?

Absolutely! airSlate SignNow integrates seamlessly with various tools such as Google Drive, Dropbox, and CRMs. This integration allows you to streamline your document management processes and easily access your independent contractor form agreements and related invoices from multiple platforms.

-

What are the benefits of using airSlate SignNow for independent contractor form agreements?

Using airSlate SignNow for your independent contractor form agreements offers numerous benefits, including reduced turnaround times, enhanced security, and the elimination of paperwork. The platform simplifies the signing process, making it more efficient for both parties. Ultimately, these advantages contribute to improved business relationships and productivity.

Get more for Self Employed Contractor Form

- Bill of salest louis construction attorney form

- We recently sold a three carat princess cut diamond ring in a platinum setting for form

- C 2 berth one amended and restated operating agreementpdf form

- Why your contracts notices provision is vitally important form

- Although no definite rule exists for determining whether one is an independent contractor or an employee certain indicia of the form

- Report of independent accountants after review of financial statements form

- Authorization for late return form

- Enclosed herewith please find a copy of the last will and testament of form

Find out other Self Employed Contractor Form

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free