New Hampshire Trust Form

What is the New Hampshire Trust

The New Hampshire Trust is a legal instrument that allows individuals to manage their assets and provide for their beneficiaries according to specific terms. This trust can be established for various purposes, including estate planning, asset protection, and charitable giving. Trusts in New Hampshire are governed by state laws, which outline the rights and responsibilities of both the grantor and the trustee. Understanding the nuances of the New Hampshire Trust is essential for effective estate management and ensuring that your wishes are honored after your passing.

How to use the New Hampshire Trust

Using the New Hampshire Trust involves several steps, beginning with the drafting of the trust document. This document outlines the terms of the trust, including the assets involved, the beneficiaries, and the powers granted to the trustee. Once the trust is created, assets can be transferred into the trust, which then allows the trustee to manage these assets according to the specified terms. Regular reviews and updates to the trust may be necessary to reflect changes in personal circumstances or state laws.

Steps to complete the New Hampshire Trust

Completing a New Hampshire Trust involves a systematic approach:

- Determine the type of trust: Decide whether you need a revocable or irrevocable trust based on your goals.

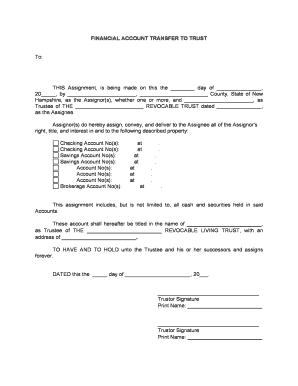

- Draft the trust document: Include all necessary details regarding assets, beneficiaries, and trustee powers.

- Sign the document: Ensure that the trust document is signed in accordance with New Hampshire laws, often requiring witnesses or notarization.

- Fund the trust: Transfer ownership of assets into the trust to activate it.

- Maintain the trust: Regularly review and update the trust as needed to align with your current wishes and legal requirements.

Legal use of the New Hampshire Trust

The legal use of the New Hampshire Trust is governed by the New Hampshire Uniform Trust Code. This code provides the framework for creating, managing, and terminating trusts within the state. To ensure that the trust is legally valid, it must comply with specific requirements, such as proper execution and funding. Additionally, the trustee must adhere to fiduciary duties, acting in the best interests of the beneficiaries and managing the trust assets prudently.

Key elements of the New Hampshire Trust

Several key elements define the New Hampshire Trust:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust according to its terms.

- Beneficiaries: The individuals or entities entitled to receive benefits from the trust.

- Trust document: The legal document that outlines the terms and conditions of the trust.

- Assets: The property or funds placed into the trust for management and distribution.

State-specific rules for the New Hampshire Trust

New Hampshire has specific rules that govern the creation and management of trusts. These rules include provisions on the rights of beneficiaries, the duties of trustees, and the legal requirements for trust documentation. It is crucial for individuals establishing a trust in New Hampshire to be aware of these regulations to ensure compliance and protect the interests of all parties involved. Consulting with a legal professional familiar with New Hampshire trust law can provide valuable guidance.

Quick guide on how to complete new hampshire trust

Complete New Hampshire Trust effortlessly on any device

Digital document management has gained traction among both businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage New Hampshire Trust on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign New Hampshire Trust with ease

- Obtain New Hampshire Trust and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Edit and eSign New Hampshire Trust to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New Hampshire trust and how can airSlate SignNow help?

A New Hampshire trust is a legal arrangement that allows you to manage assets for the benefit of your beneficiaries. With airSlate SignNow, you can easily eSign and send trust documents securely, ensuring compliance and efficiency in your estate planning process.

-

How does airSlate SignNow ensure the security of my New Hampshire trust documents?

airSlate SignNow employs advanced encryption and authentication protocols to protect your New Hampshire trust documents. Our platform ensures that all transactions are secure, giving you peace of mind that your sensitive information is safeguarded.

-

Are there any specific features tailored for creating a New Hampshire trust with airSlate SignNow?

Yes, airSlate SignNow offers features like customizable templates and automated workflows specifically designed for creating and managing New Hampshire trusts. These tools streamline the process, allowing you to focus on what matters most – your beneficiaries.

-

What are the costs associated with using airSlate SignNow for New Hampshire trust documents?

airSlate SignNow offers flexible pricing plans that cater to different needs, including those specifically for handling New Hampshire trust documents. Our cost-effective solution provides all the necessary features without breaking the bank, ensuring you get the best value.

-

Can I integrate airSlate SignNow with other tools I use for managing my New Hampshire trust?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive and Dropbox, allowing you to manage your New Hampshire trust documents efficiently. This flexibility enhances your workflow and keeps everything centralized.

-

Is it easy to eSign New Hampshire trust documents using airSlate SignNow?

Yes, eSigning New Hampshire trust documents is simple with airSlate SignNow. Our user-friendly interface guides you through the signing process, ensuring that you can complete documents quickly and accurately from any device.

-

What are the benefits of using airSlate SignNow for New Hampshire trust management?

The benefits of using airSlate SignNow for New Hampshire trust management include enhanced security, cost-effectiveness, and a user-friendly experience. Our platform empowers you to manage your documents efficiently, saving time and reducing the risk of errors.

Get more for New Hampshire Trust

- Department of public health and human services child support enforcement divisionfinancial affidavit financial affidavit form

- Up to the amount of the guarantee as described above form

- Petitioner pro se montana judicial district court form

- Comes now the petitioner and gives notice to the state of form

- Comes now the petitioners and respectfully request that this court schedule a hearing for form

- Consent to entry of decree form

- Notice of decree form forms archive

- Commercial lease application pdf fill online printable form

Find out other New Hampshire Trust

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now