Nevada Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Aka Lan Form

What is the Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

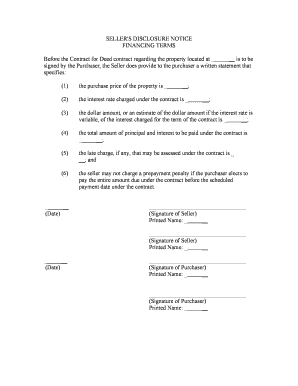

The Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with a contract or agreement for deed, commonly known as a land contract, is a legal document that outlines the financing terms agreed upon by the buyer and seller. This disclosure is essential for ensuring transparency in real estate transactions, particularly when a property is sold under a land contract arrangement. It provides crucial information regarding payment schedules, interest rates, and any additional fees associated with the financing of the property.

This document serves to protect both parties by clearly defining the terms of the agreement, thereby reducing the likelihood of disputes. Sellers are required to provide this disclosure to potential buyers, ensuring that all financing terms are communicated upfront.

Steps to Complete the Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

Completing the Nevada Seller's Disclosure of Financing Terms involves several key steps to ensure accuracy and compliance with state regulations. The following steps outline the process:

- Gather necessary information, including the property address, seller and buyer details, and specific financing terms.

- Clearly outline the payment structure, including the total purchase price, down payment amount, and payment schedule.

- Detail any interest rates applicable to the financing, including whether they are fixed or variable.

- Include any additional costs, such as closing costs or fees related to the financing.

- Review the completed document for accuracy and completeness to ensure all required information is included.

- Have both parties sign and date the disclosure to validate the agreement.

Legal Use of the Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

The legal use of the Nevada Seller's Disclosure of Financing Terms is critical in real estate transactions. This document is legally binding once signed by both the buyer and seller, meaning that the terms outlined within it must be adhered to by both parties. It helps to establish the rights and obligations of each party concerning the financing of the property.

Failure to provide this disclosure can lead to legal consequences for the seller, including potential disputes or claims of misrepresentation. Therefore, it is essential to ensure that this document is completed accurately and provided to the buyer before finalizing the sale.

Key Elements of the Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

Several key elements must be included in the Nevada Seller's Disclosure of Financing Terms to ensure it meets legal requirements and serves its purpose effectively:

- Property Information: The address and legal description of the property being sold.

- Seller and Buyer Information: Names and contact details of both the seller and buyer.

- Financing Terms: Detailed breakdown of the purchase price, down payment, interest rates, and payment schedules.

- Additional Costs: Any fees or costs associated with the financing, such as closing costs or late payment penalties.

- Signatures: Signatures of both parties to validate the agreement and acknowledge understanding of the terms.

How to Obtain the Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

Obtaining the Nevada Seller's Disclosure of Financing Terms can be done through several channels. Typically, real estate agents or brokers involved in the transaction will provide this document as part of the sales process. Additionally, sellers can access templates or forms through legal resources or real estate websites that offer state-specific documentation.

It is advisable for sellers to consult with a legal professional or a real estate expert to ensure that they are using the correct and most current version of the disclosure. This helps to ensure compliance with Nevada state laws and regulations regarding real estate transactions.

State-Specific Rules for the Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

Nevada has specific rules governing the Seller's Disclosure of Financing Terms that must be adhered to in order to ensure compliance with state laws. These rules include requirements for the information that must be disclosed, timelines for providing the disclosure, and the necessity for both parties to sign the document.

Additionally, Nevada law mandates that sellers provide this disclosure prior to entering into a binding agreement with the buyer. Understanding these state-specific rules is crucial for both sellers and buyers to protect their rights and ensure a smooth transaction process.

Quick guide on how to complete nevada sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka

Prepare Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Lan effortlessly on any device

Web-based document administration has become prevalent among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow supplies all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Lan on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and eSign Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Lan with ease

- Obtain Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Lan and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Mark essential sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Lan and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Nevada Seller's Disclosure Of Financing Terms For Residential Property?

The Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract is a crucial document that outlines the financing terms involved in real estate transactions. This disclosure ensures transparency between buyers and sellers, providing necessary details about payment conditions, interest rates, and other financing arrangements.

-

How does airSlate SignNow simplify the process of creating a Nevada Seller's Disclosure?

airSlate SignNow simplifies the creation of a Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract through its intuitive platform. Users can easily fill out templates, customize documents, and ensure that all necessary information is included, making the process efficient and straightforward.

-

Are there any costs associated with using airSlate SignNow for creating Nevada Seller's Disclosures?

Yes, while airSlate SignNow offers a cost-effective solution for eSigning and document management, there are subscription plans available that cater to different needs. Investing in these plans enables users to streamline the process of preparing Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract and other essential documents efficiently.

-

What features does airSlate SignNow offer to enhance the eSigning experience?

airSlate SignNow includes features such as secure cloud storage, template creation, and real-time collaboration, which greatly enhance the eSigning experience. These features are particularly beneficial for managing documents like the Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract, ensuring that all parties can access and sign documents seamlessly.

-

Can airSlate SignNow integrate with other software for real estate transactions?

Yes, airSlate SignNow offers integrations with various software systems that are commonly used in real estate transactions. This compatibility ensures that documents such as the Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract can easily flow between systems, promoting an efficient workflow.

-

How does the Nevada Seller's Disclosure protect both buyers and sellers?

The Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract plays an essential role in protecting both buyers and sellers. By detailing the financial terms of the transaction, it minimizes misunderstandings and provides a clear framework for the responsibilities of each party involved.

-

What are the benefits of using airSlate SignNow for eSigning Nevada Seller's Disclosures?

Using airSlate SignNow for eSigning the Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract provides numerous benefits, such as quick document turnaround, legal compliance, and enhanced security. The platform also reduces paperwork, making the signing process faster and more efficient.

Get more for Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Lan

- Corporate governance chubb limited investor relations form

- Xidex corporation form

- Sec filing consolidated edison inc form

- Gilbert associates inc form

- Regulations establishing and governing federal register form

- What decisions need approval from your board of directors form

- Ay irra m ay 1 american radio history form

- Wwwtimefordemocracycom form

Find out other Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Lan

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form