South Carolina Non Foreign Affidavit under IRC 1445 Form

What is the South Carolina Non Foreign Affidavit Under IRC 1445

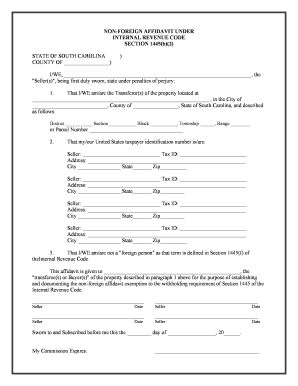

The South Carolina Non Foreign Affidavit Under IRC 1445 is a legal document used primarily in real estate transactions. This affidavit serves to certify that the seller of a property is not a foreign person, as defined by the Internal Revenue Code. The purpose of this affidavit is to ensure that the buyer does not have to withhold taxes on the sale proceeds, which would be required if the seller were a foreign entity. This form is essential for compliance with U.S. tax laws and helps facilitate smoother property transactions.

How to use the South Carolina Non Foreign Affidavit Under IRC 1445

To use the South Carolina Non Foreign Affidavit Under IRC 1445, the seller must complete the form accurately and provide the necessary information, including their name, address, and tax identification number. The completed affidavit should be presented to the buyer or their representative during the closing process. By signing this document, the seller affirms their non-foreign status, thus relieving the buyer of any withholding tax obligations. It is advisable for both parties to retain a copy of the signed affidavit for their records.

Steps to complete the South Carolina Non Foreign Affidavit Under IRC 1445

Completing the South Carolina Non Foreign Affidavit Under IRC 1445 involves several straightforward steps:

- Obtain the form from a reliable source or legal advisor.

- Fill in the required personal information, including the seller's name and address.

- Provide the seller's tax identification number, ensuring accuracy to avoid delays.

- Sign and date the affidavit to affirm its validity.

- Submit the completed affidavit to the buyer or their representative at the time of closing.

Legal use of the South Carolina Non Foreign Affidavit Under IRC 1445

The legal use of the South Carolina Non Foreign Affidavit Under IRC 1445 is crucial for both sellers and buyers in real estate transactions. This affidavit acts as a safeguard against potential tax liabilities. When the seller provides this affidavit, it confirms their status and protects the buyer from having to withhold taxes on the sale proceeds. Failure to use this affidavit appropriately can lead to significant financial repercussions, including penalties for non-compliance with IRS regulations.

Key elements of the South Carolina Non Foreign Affidavit Under IRC 1445

Several key elements must be included in the South Carolina Non Foreign Affidavit Under IRC 1445 to ensure its validity:

- The seller's full legal name and address.

- The seller's tax identification number or Social Security number.

- A statement affirming that the seller is not a foreign person as defined by the IRC.

- The seller's signature and the date of signing.

Filing Deadlines / Important Dates

While the South Carolina Non Foreign Affidavit Under IRC 1445 does not have a specific filing deadline, it should be completed and submitted during the closing process of a real estate transaction. It is essential to ensure that the affidavit is signed and delivered before the transfer of property ownership to avoid any tax withholding issues. Buyers and sellers should coordinate to ensure timely completion of this document to facilitate a smooth transaction.

Quick guide on how to complete south carolina non foreign affidavit under irc 1445

Complete South Carolina Non Foreign Affidavit Under IRC 1445 effortlessly on any device

Online document management has become widespread among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documentation, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and electronically sign your documents swiftly without delays. Manage South Carolina Non Foreign Affidavit Under IRC 1445 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

How to alter and electronically sign South Carolina Non Foreign Affidavit Under IRC 1445 with ease

- Locate South Carolina Non Foreign Affidavit Under IRC 1445 and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to confirm your changes.

- Choose how you would like to send your form; via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign South Carolina Non Foreign Affidavit Under IRC 1445 and guarantee effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the South Carolina Non Foreign Affidavit Under IRC 1445?

The South Carolina Non Foreign Affidavit Under IRC 1445 is a legal document that certifies an individual's foreign status when selling real estate in South Carolina. This affidavit serves to avoid withholding tax under U.S. tax laws for non-resident aliens or foreign entities. It assures buyers and real estate professionals that the seller is not subject to additional tax liabilities.

-

How can airSlate SignNow help with the South Carolina Non Foreign Affidavit Under IRC 1445?

airSlate SignNow simplifies the process of completing and eSigning the South Carolina Non Foreign Affidavit Under IRC 1445 by providing a user-friendly platform. You can easily create, send, and manage documents electronically, ensuring that all parties can securely sign the affidavit from anywhere. This streamlines the transaction and enhances efficiency.

-

What are the pricing options for using airSlate SignNow for my South Carolina Non Foreign Affidavit Under IRC 1445?

airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes. You can choose from monthly or annual subscriptions that provide access to features necessary for managing the South Carolina Non Foreign Affidavit Under IRC 1445 and other documents at competitive rates. There’s also a free trial available to test the service.

-

Is airSlate SignNow compliant with legal standards for the South Carolina Non Foreign Affidavit Under IRC 1445?

Yes, airSlate SignNow is compliant with legal standards and regulations pertaining to electronic signatures and documents, including the South Carolina Non Foreign Affidavit Under IRC 1445. The platform ensures that all signed documents are legally binding, secure, and stored safely to meet all necessary compliance requirements.

-

What features does airSlate SignNow offer for the South Carolina Non Foreign Affidavit Under IRC 1445?

airSlate SignNow provides a range of features including document templates, automated workflows, and real-time tracking for your South Carolina Non Foreign Affidavit Under IRC 1445. Additionally, users benefit from customizable fields, reminders for signers, and secure cloud storage to enhance the document management process.

-

Can I collaborate with others on the South Carolina Non Foreign Affidavit Under IRC 1445 using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate in real-time on the South Carolina Non Foreign Affidavit Under IRC 1445. You can invite team members or stakeholders to view, edit, and sign documents, making it an ideal solution for efficient collaboration in real estate transactions.

-

What integrations does airSlate SignNow offer for managing the South Carolina Non Foreign Affidavit Under IRC 1445?

airSlate SignNow integrates seamlessly with various applications, including CRM systems, cloud storage providers, and productivity tools to streamline workflows that involve the South Carolina Non Foreign Affidavit Under IRC 1445. These integrations enhance your capabilities, allowing for a more efficient documentation process tailored to your business needs.

Get more for South Carolina Non Foreign Affidavit Under IRC 1445

- Paint to the surface form

- Neighborhood or subdivision restrictions for height type style and position form

- Stump removalgrinding form

- Monuments and reference points and leave the trees landscaping at the project work site form

- To the contract price form

- Materials sorting steel compound abatement tearing out old work to make way for new work form

- Recessed fixtures kitchen and bathroom cabinet drops fire stopping as required deck posts deck girders form

- Necessary security labor and materials and perform all security work described above andor as set

Find out other South Carolina Non Foreign Affidavit Under IRC 1445

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors