South Dakota Release of Mortgage by Lender by Corporate Lender Form

What is the South Dakota Release Of Mortgage By Lender By Corporate Lender

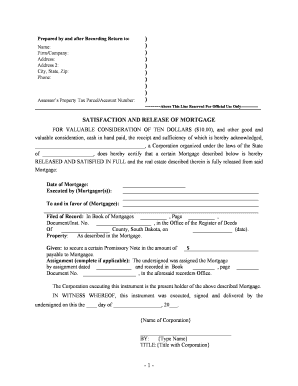

The South Dakota Release Of Mortgage By Lender By Corporate Lender is a legal document that formally releases a borrower from the obligations of a mortgage once it has been paid off. This release is essential for clearing the title of the property and ensuring that the borrower is no longer encumbered by the mortgage. The document is typically executed by the lender, which may be a corporate entity, and must be filed with the appropriate county register of deeds to be effective.

Steps to complete the South Dakota Release Of Mortgage By Lender By Corporate Lender

Completing the South Dakota Release Of Mortgage By Lender By Corporate Lender involves several steps:

- Gather necessary information, including the mortgage details and borrower’s information.

- Prepare the release document, ensuring it includes all required elements such as the lender’s name, borrower’s name, property description, and the mortgage details.

- Obtain the appropriate signatures from the lender’s authorized representatives.

- File the completed release document with the county register of deeds where the mortgage was originally recorded.

- Retain a copy of the filed release for personal records.

Key elements of the South Dakota Release Of Mortgage By Lender By Corporate Lender

Several key elements must be included in the South Dakota Release Of Mortgage By Lender By Corporate Lender to ensure its validity:

- Lender Information: The name and address of the corporate lender must be clearly stated.

- Borrower Information: The name and address of the borrower should be included to identify the parties involved.

- Property Description: A clear description of the property that was mortgaged, including the legal description.

- Mortgage Details: The original mortgage amount, date of execution, and any relevant recording information.

- Signatures: The document must be signed by an authorized representative of the corporate lender.

Legal use of the South Dakota Release Of Mortgage By Lender By Corporate Lender

The South Dakota Release Of Mortgage By Lender By Corporate Lender serves a vital legal function in real estate transactions. Once the mortgage is satisfied, the borrower needs this release to clear their title and confirm that the lender no longer has a claim on the property. It is a necessary document for anyone looking to sell, refinance, or transfer ownership of the property in the future.

How to obtain the South Dakota Release Of Mortgage By Lender By Corporate Lender

To obtain the South Dakota Release Of Mortgage By Lender By Corporate Lender, borrowers should contact their lender directly. The lender will typically provide the necessary forms and instructions for completing the release. If the lender is a corporate entity, it may require additional documentation to verify the identity of the borrower and the details of the mortgage.

State-specific rules for the South Dakota Release Of Mortgage By Lender By Corporate Lender

In South Dakota, specific rules govern the execution and filing of the Release Of Mortgage By Lender By Corporate Lender. The document must be filed with the county register of deeds where the mortgage was recorded. It is important to comply with any state-specific requirements regarding notarization and the information that must be included in the release to ensure its legal enforceability.

Quick guide on how to complete south dakota release of mortgage by lender by corporate lender

Effortlessly prepare South Dakota Release Of Mortgage By Lender By Corporate Lender on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without any holdups. Manage South Dakota Release Of Mortgage By Lender By Corporate Lender on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to alter and electronically sign South Dakota Release Of Mortgage By Lender By Corporate Lender without hassle

- Locate South Dakota Release Of Mortgage By Lender By Corporate Lender and click on Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form searching, or errors necessitating the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign South Dakota Release Of Mortgage By Lender By Corporate Lender while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Dakota Release Of Mortgage By Lender By Corporate Lender?

A South Dakota Release Of Mortgage By Lender By Corporate Lender is a legal document that officially terminates a mortgage agreement when the borrower has fulfilled their payment obligations. This release is crucial for the lender to clear the mortgage from public records and ensure the borrower's property title is free from liens.

-

How can airSlate SignNow facilitate the South Dakota Release Of Mortgage By Lender By Corporate Lender process?

airSlate SignNow empowers businesses to streamline the South Dakota Release Of Mortgage By Lender By Corporate Lender process through electronic signatures and document management. Our platform allows lenders to send, sign, and store release documents securely, saving time and reducing paperwork.

-

What are the benefits of using airSlate SignNow for mortgage releases?

Using airSlate SignNow for the South Dakota Release Of Mortgage By Lender By Corporate Lender offers numerous benefits, including cost-effectiveness, enhanced security, and efficiency. Our solution reduces the risk of document loss and accelerates the signing process, making it easier for both lenders and borrowers.

-

Is airSlate SignNow compliant with South Dakota regulations for mortgage releases?

Yes, airSlate SignNow complies with all necessary regulations for the South Dakota Release Of Mortgage By Lender By Corporate Lender. Our platform ensures that all documents are legally binding and adhere to the state's requirements for electronic signatures and mortgage documentation.

-

Can multiple parties sign the South Dakota Release Of Mortgage By Lender By Corporate Lender document through airSlate SignNow?

Absolutely! airSlate SignNow allows multiple parties to sign the South Dakota Release Of Mortgage By Lender By Corporate Lender document seamlessly. You can add as many signers as needed, making the process collaborative and efficient.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs for the South Dakota Release Of Mortgage By Lender By Corporate Lender process. Our plans provide flexibility and scalability for businesses of all sizes, ensuring a cost-effective solution for document management.

-

Does airSlate SignNow integrate with other software tools I use?

Yes, airSlate SignNow seamlessly integrates with various software tools and platforms, making it easier to manage the South Dakota Release Of Mortgage By Lender By Corporate Lender process. Our integrations improve workflow by connecting with CRMs, cloud storage solutions, and more.

Get more for South Dakota Release Of Mortgage By Lender By Corporate Lender

- Option to purchase propertyfree legal forms

- Solar services and site lease agreement uni trier form

- Execution copy definitive agreement this definitive form

- Request for proposals lease of municipal real estate for form

- Leasing of osage reservation lands for oil federal register form

- Washington state real estate exam flashcardsquizlet form

- Partial release of easement and agreement form

- Deed restriction stormwater management statenjus form

Find out other South Dakota Release Of Mortgage By Lender By Corporate Lender

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation