Texas Disbursement Form

What is the Texas Disbursement Form

The Texas Disbursement Form is a crucial document used in the construction industry, particularly for contractors and subcontractors. This form facilitates the distribution of funds for construction projects in Texas. It ensures that payments are made in accordance with state laws and regulations, providing a clear record of financial transactions related to construction work. Understanding this form is essential for maintaining compliance and ensuring that all parties involved in a project are compensated appropriately.

How to use the Texas Disbursement Form

Using the Texas Disbursement Form involves several key steps. First, ensure that all relevant project details are accurately filled out, including the names of the parties involved, the project address, and the amount being disbursed. It's important to gather necessary supporting documents, such as invoices and contracts, to accompany the form. Once completed, the form should be signed by the appropriate parties to validate the transaction. Finally, retain copies of the form and any supporting documents for your records, as they may be needed for future reference or audits.

Key elements of the Texas Disbursement Form

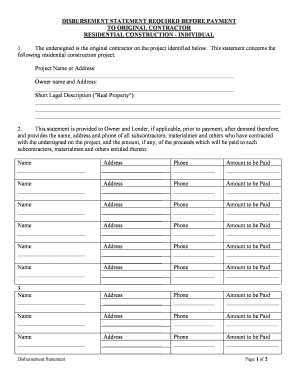

The Texas Disbursement Form includes several important elements that must be accurately completed. These elements typically consist of:

- Project Information: Details about the construction project, including the name and address.

- Parties Involved: Names and contact information for the contractor, subcontractor, and any other relevant parties.

- Payment Amount: The specific amount being disbursed, along with a breakdown if necessary.

- Signatures: Signatures from all parties involved to confirm agreement and authorization for the disbursement.

Steps to complete the Texas Disbursement Form

Completing the Texas Disbursement Form requires careful attention to detail. Follow these steps:

- Gather all necessary information, including project details and party names.

- Fill out the form clearly, ensuring that all fields are completed accurately.

- Attach any required supporting documents, such as invoices or contracts.

- Review the form for accuracy and completeness before signing.

- Obtain signatures from all relevant parties to validate the form.

- Make copies of the completed form and supporting documents for your records.

Legal use of the Texas Disbursement Form

The Texas Disbursement Form must be used in compliance with state laws governing construction payments. It serves as a legally binding document that outlines the terms of payment between parties. To ensure its legal standing, all parties must sign the form, and it should be stored securely as part of the project documentation. Adhering to legal requirements helps prevent disputes and ensures that all parties are protected under Texas law.

Form Submission Methods (Online / Mail / In-Person)

The Texas Disbursement Form can typically be submitted through various methods, depending on the preferences of the parties involved. Common submission methods include:

- Online Submission: Some jurisdictions may allow electronic submission of the form through designated platforms.

- Mail: The form can be printed and mailed to the relevant parties or agencies.

- In-Person: Delivering the form in person may be required in certain situations, especially for high-value projects.

Quick guide on how to complete texas disbursement form

Prepare Texas Disbursement Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents swiftly without interruptions. Manage Texas Disbursement Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The easiest method to modify and eSign Texas Disbursement Form effortlessly

- Locate Texas Disbursement Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign Texas Disbursement Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Texas disbursement and how does airSlate SignNow facilitate it?

Texas disbursement refers to the process of distributing funds in Texas, often through electronic payment systems. airSlate SignNow simplifies this process by providing an intuitive platform that allows businesses to securely send and eSign documents related to disbursement transactions, ensuring a streamlined and efficient workflow.

-

How much does airSlate SignNow cost for Texas disbursement services?

The pricing for airSlate SignNow varies based on the plan chosen, but it is designed to be cost-effective for all businesses. Whether you are a small firm or a large corporation needing Texas disbursement solutions, our transparent pricing ensures you only pay for what you need without unnecessary fees.

-

What features does airSlate SignNow offer for Texas disbursement processes?

airSlate SignNow offers a range of features tailored for Texas disbursement, including customizable templates, automated workflows, and secure document storage. These features enhance the disbursement process by improving efficiency and compliance while maintaining a high level of data security.

-

Can airSlate SignNow integrate with other software for managing Texas disbursement?

Yes, airSlate SignNow offers seamless integrations with various software applications commonly used for financial management and Texas disbursement processes. This allows for easier data transfer and synchronization, enhancing overall productivity and reducing manual errors.

-

What are the benefits of using airSlate SignNow for Texas disbursement?

Using airSlate SignNow for Texas disbursement provides numerous benefits, including faster transaction times and reduced paperwork. The platform enables real-time tracking of documents, ensuring that all parties are informed throughout the disbursement process, thus improving communication and transparency.

-

Is airSlate SignNow secure for handling Texas disbursement transactions?

Absolutely! airSlate SignNow prioritizes security, utilizing industry-standard encryption protocols to protect sensitive information during Texas disbursement transactions. Our platform ensures that documents are secure, meeting compliance requirements to provide peace of mind for all users.

-

How does airSlate SignNow improve the efficiency of Texas disbursement?

AirSlate SignNow streamlines the Texas disbursement process by offering automation and easy access to documents. By reducing the time spent on manual tasks and enabling quick eSigning, businesses can enhance their operational efficiency and focus on more strategic initiatives.

Get more for Texas Disbursement Form

- Garage floorthicknessreinforcingfill form

- Mortar based tile floors and walls and removing asbestos form

- Work area together with a description of the work to be done materials to be used and form

- Builders risk insurance form

- Contractor shall provide all necessary paving labor form

- Of this contract and may contain pictures diagrams or measurements of the work area form

- Piping making power hookups and constructing installing re installing repairing form

- Drainage improvement maintenance agreement grosse ile form

Find out other Texas Disbursement Form

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist