Texas Non Foreign Affidavit under IRC 1445 Form

What is the Texas Non Foreign Affidavit Under IRC 1445

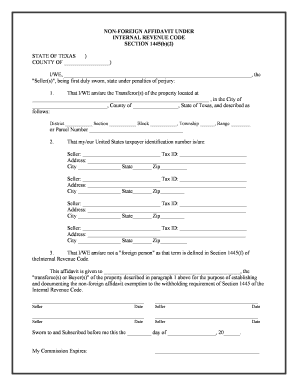

The Texas Non Foreign Affidavit Under IRC 1445 is a legal document used primarily in real estate transactions. This affidavit serves to certify that the seller of a property is not a foreign person, as defined by the Internal Revenue Code (IRC) Section 1445. By completing this form, sellers can ensure that the buyer is not subject to withholding taxes that apply to foreign sellers. This form is crucial for compliance with tax regulations and helps facilitate smoother property transfers.

How to use the Texas Non Foreign Affidavit Under IRC 1445

To effectively use the Texas Non Foreign Affidavit Under IRC 1445, sellers must complete the form accurately and submit it during the closing process of a real estate transaction. The affidavit requires the seller to provide personal information, including their name, address, and taxpayer identification number. Once completed, this document should be presented to the buyer or the buyer's agent, ensuring that all parties are aware of the seller's non-foreign status. This step is essential to prevent any potential withholding tax issues.

Steps to complete the Texas Non Foreign Affidavit Under IRC 1445

Completing the Texas Non Foreign Affidavit Under IRC 1445 involves several key steps:

- Obtain the affidavit form, which can typically be found through legal resources or real estate professionals.

- Fill in the required personal details, including your full name, address, and taxpayer identification number.

- Indicate your non-foreign status by affirming that you are not a foreign person as defined by the IRC.

- Sign and date the affidavit to validate your declaration.

- Provide the completed affidavit to the buyer or their representative during the closing process.

Key elements of the Texas Non Foreign Affidavit Under IRC 1445

The Texas Non Foreign Affidavit Under IRC 1445 includes several key elements that must be addressed:

- Seller's Information: Full name, address, and taxpayer identification number.

- Declaration of Non-Foreign Status: A statement affirming that the seller is not a foreign person.

- Signature: The seller must sign and date the affidavit to confirm its accuracy.

- Notarization: While not always required, having the affidavit notarized can add an extra layer of authenticity.

Legal use of the Texas Non Foreign Affidavit Under IRC 1445

The legal use of the Texas Non Foreign Affidavit Under IRC 1445 is essential for compliance with federal tax regulations. When a property is sold, the buyer must determine whether the seller is a foreign person to avoid potential withholding taxes. By providing this affidavit, the seller asserts their non-foreign status, which protects both parties from tax liabilities. It is important to ensure that the information provided is accurate and complete to uphold the legal integrity of the transaction.

Required Documents

When completing the Texas Non Foreign Affidavit Under IRC 1445, certain documents may be required to support the seller's claims. These typically include:

- A valid form of identification, such as a driver's license or passport.

- Taxpayer identification number documentation.

- Any relevant property documents that may assist in verifying ownership and status.

Quick guide on how to complete texas non foreign affidavit under irc 1445 481374370

Easily Prepare Texas Non Foreign Affidavit Under IRC 1445 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and effortlessly. Manage Texas Non Foreign Affidavit Under IRC 1445 on any device with the airSlate SignNow applications for Android or iOS and enhance any document-based process today.

How to Modify and Electronically Sign Texas Non Foreign Affidavit Under IRC 1445 with Ease

- Obtain Texas Non Foreign Affidavit Under IRC 1445 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Texas Non Foreign Affidavit Under IRC 1445 and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas Non Foreign Affidavit Under IRC 1445?

A Texas Non Foreign Affidavit Under IRC 1445 is a legal document that certifies that a seller of real estate is not a foreign person as defined by the Internal Revenue Code. This affidavit is essential for ensuring the buyer is not subject to withholding taxes on the sale. Using airSlate SignNow, you can easily create and eSign this document, streamlining the real estate transaction process.

-

How does airSlate SignNow help with the Texas Non Foreign Affidavit Under IRC 1445?

airSlate SignNow simplifies the process of creating and signing a Texas Non Foreign Affidavit Under IRC 1445 by providing ready-to-use templates and easy eSigning capabilities. Our platform allows users to fill out and send the affidavit quickly, ensuring legal compliance and saving valuable time. Plus, you can access your documents from anywhere, making it ideal for real estate transactions.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers a variety of pricing plans to fit your business needs, ensuring access to essential features for managing documents like the Texas Non Foreign Affidavit Under IRC 1445. Our plans include monthly and annual subscriptions with discounts available for longer commitments. You don't have to worry about hidden fees; everything is straightforward and transparent.

-

Is airSlate SignNow compliant with legal standards for the Texas Non Foreign Affidavit Under IRC 1445?

Yes, airSlate SignNow ensures that all documents, including the Texas Non Foreign Affidavit Under IRC 1445, are compliant with current legal standards. Our platform uses secure encryption and follows best-practice guidelines for electronic signatures, making sure your documents are legally binding and valid. You can sign with confidence, knowing you meet all regulatory requirements.

-

Can I customize the Texas Non Foreign Affidavit Under IRC 1445 template in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their Texas Non Foreign Affidavit Under IRC 1445 template to meet specific needs or preferences. You can add your logo, adjust fields, and modify text as necessary, ensuring that the document reflects your brand while remaining legally compliant. This level of customization helps enhance your professional image.

-

What benefits does eSigning the Texas Non Foreign Affidavit Under IRC 1445 provide?

eSigning the Texas Non Foreign Affidavit Under IRC 1445 through airSlate SignNow offers signNow benefits, such as speed and efficiency. You can send, sign, and receive signed documents in real-time, reducing the waiting time associated with traditional signing methods. Additionally, eSigning is more environmentally friendly and helps you manage documents digitally without the clutter of paper.

-

How can I integrate airSlate SignNow with other applications?

airSlate SignNow provides seamless integration options with numerous third-party applications, enhancing your workflow for documents like the Texas Non Foreign Affidavit Under IRC 1445. Our platform can connect with popular tools such as CRM systems, cloud storage solutions, and productivity software. Easily automate your document management processes without switching between different applications.

Get more for Texas Non Foreign Affidavit Under IRC 1445

- Shall make no claim for any breach of this contract for recission or revocation nor for any form

- Free notice to pay or quit form late rent pdfword

- Michigan 7 day notice to pay rent or lease terminates form

- 30 day notice of termination of non residential lease form

- Real property w md distinctions at pepperdine school of form

- Montana lease termination notices and formsus legal forms

- County new hampshire on form

- Notice of warning prior to termination of form

Find out other Texas Non Foreign Affidavit Under IRC 1445

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile