Creditor Debt Form

Understanding Creditor Debt

Creditor debt refers to the amount owed by a debtor to a creditor. This financial obligation arises when a debtor borrows money or receives goods and services on credit. Understanding the nature of creditor debt is crucial for both parties involved, as it outlines the responsibilities and rights concerning repayment. In the United States, creditor debt can encompass various forms, including credit card debt, personal loans, and lines of credit. Each type of creditor debt may have specific terms and conditions that govern repayment, interest rates, and potential penalties for non-compliance.

Steps to Complete the Creditor Debt Form

Completing the creditor debt form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including statements that detail the amount owed and any relevant agreements. Next, fill out the form with precise information regarding the debtor's financial status, including income, assets, and liabilities. It's essential to provide clear and honest information, as inaccuracies can lead to complications. After completing the form, review all entries for correctness before submitting it to the appropriate creditor or financial institution.

Legal Use of the Creditor Debt Form

The legal use of the creditor debt form is vital in establishing a formal record of the debt and the terms of repayment. This form serves as a binding agreement between the debtor and creditor, outlining the obligations of both parties. In the United States, it is essential to comply with federal and state regulations regarding creditor debt documentation. This compliance ensures that the form is legally enforceable in case of disputes. Additionally, understanding the legal implications of the creditor debt form can help protect the rights of both the debtor and creditor throughout the debt repayment process.

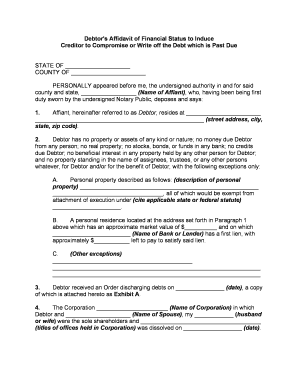

Key Elements of the Creditor Debt Form

The creditor debt form should include several key elements to be effective and legally binding. These elements typically consist of:

- Debtor Information: Full name, address, and contact details of the debtor.

- Creditor Information: Name and contact details of the creditor or lending institution.

- Debt Amount: Total amount owed, including principal and any accrued interest.

- Payment Terms: Details regarding repayment schedules, interest rates, and any penalties for late payments.

- Signatures: Signatures of both the debtor and creditor to validate the agreement.

Examples of Using the Creditor Debt Form

Examples of using the creditor debt form can help clarify its practical applications. For instance, a small business owner may use the form to document a loan taken from a bank to finance operations. Similarly, an individual may utilize the creditor debt form to formalize a personal loan agreement with a friend or family member. In both cases, the form serves to outline the terms of repayment and protect the interests of both parties involved. These examples highlight the versatility of the creditor debt form in various financial situations.

Required Documents for Creditor Debt

When preparing to complete the creditor debt form, certain documents are typically required to provide a comprehensive overview of the debtor's financial situation. These documents may include:

- Recent bank statements to verify income and expenses.

- Tax returns from the previous year to assess financial stability.

- Documentation of any existing debts, such as credit card statements or loan agreements.

- Proof of assets, including property deeds or vehicle titles.

Having these documents on hand can facilitate the completion of the creditor debt form and ensure that all information is accurate and up to date.

Filing Deadlines and Important Dates

Understanding the filing deadlines and important dates related to creditor debt is crucial for maintaining compliance and avoiding penalties. Generally, creditors may set specific deadlines for repayment or for submitting documentation related to the debt. It is essential for debtors to be aware of these dates to ensure timely payments and avoid additional fees. Additionally, certain legal actions, such as bankruptcy filings or debt settlements, may also have strict deadlines that must be adhered to. Keeping a calendar of these important dates can help manage creditor debt effectively.

Quick guide on how to complete creditor debt

Prepare Creditor Debt effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Creditor Debt on any platform with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Creditor Debt with ease

- Obtain Creditor Debt and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Creditor Debt and ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help with creditor past documentation?

airSlate SignNow is a user-friendly eSignature solution designed to streamline document management. It allows businesses to send and eSign important documents, ensuring that transactions related to creditor past activities are completed quickly and efficiently.

-

How does airSlate SignNow ensure security for creditor past agreements?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption standards to protect your documents, making it safe to manage creditor past agreements without the risk of unauthorized access or data bsignNowes.

-

What features does airSlate SignNow offer for handling creditor past transactions?

airSlate SignNow offers features such as customizable templates, in-document comments, and real-time tracking. These tools simplify the process of managing creditor past transactions and enhance overall efficiency.

-

Is airSlate SignNow suitable for small businesses dealing with creditor past issues?

Yes, airSlate SignNow is particularly suited for small businesses. Its cost-effective pricing and easy implementation make it ideal for those looking to manage creditor past documentation without large overhead costs.

-

Can airSlate SignNow integrate with other software for creditor past management?

Absolutely! airSlate SignNow integrates seamlessly with various CRM systems, accounting software, and cloud storage solutions. This capability enhances your workflow when dealing with creditor past tasks by keeping all your tools connected.

-

What is the pricing structure for airSlate SignNow, specifically for creditor past solutions?

airSlate SignNow offers flexible pricing plans that cater to different needs. Whether you're a startup handling occasional creditor past transactions or a larger enterprise with frequent agreements, there's a plan tailored for you.

-

How can airSlate SignNow improve efficiency for creditor past document workflows?

By minimizing manual processes and providing a digital solution for document signing, airSlate SignNow signNowly enhances efficiency. Users can complete creditor past workflows in a fraction of the time, allowing businesses to focus on their core activities.

Get more for Creditor Debt

- Form 425 stonemor partners lp filed by stonemor gp

- 055 certificate of merger of a delaware limited partnership and a delaware form

- Agreement of limited partnership of american secgov form

- Carlyle group lp s 1a general form for registration of

- First amended and restated agreement of limited secgov form

- Certificate of limited partnership delaware code form

- Metropolitan bank holding corp form s 1 received 1004

- Alcatel lucent form 20 f

Find out other Creditor Debt

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement