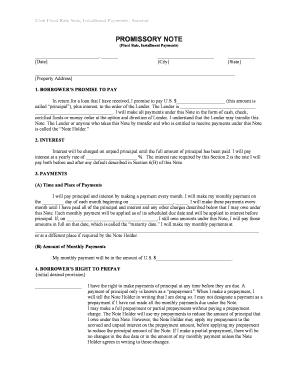

Utah Utah Installments Fixed Rate Promissory Note Secured by Residential Real Estate Form

What is the Utah promissory note?

A Utah promissory note is a legally binding document in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) under agreed-upon terms. This note outlines the loan amount, interest rate, payment schedule, and any collateral securing the loan. In Utah, promissory notes can be used for various purposes, including personal loans, business financing, and real estate transactions. Understanding the specific terms and conditions is crucial for both parties to ensure compliance and protect their interests.

Key elements of the Utah promissory note

Several essential components must be included in a Utah promissory note to ensure its validity and enforceability:

- Parties involved: Clearly identify the borrower and lender, including their legal names and addresses.

- Loan amount: Specify the total amount being borrowed.

- Interest rate: Indicate the applicable interest rate, whether fixed or variable.

- Payment terms: Outline the payment schedule, including due dates and the number of payments.

- Collateral: If applicable, describe any assets securing the loan.

- Default terms: Define the conditions under which the borrower would be considered in default.

- Governing law: State that the note is governed by Utah law.

Steps to complete the Utah promissory note

Completing a Utah promissory note involves several straightforward steps:

- Gather information: Collect the necessary details about the borrower, lender, loan amount, and terms.

- Choose a template: Select a legally compliant promissory note template that suits your needs.

- Fill in the details: Accurately input all relevant information into the template.

- Review the document: Both parties should carefully review the note to ensure accuracy and clarity.

- Sign the document: Both the borrower and lender must sign the note, either electronically or in person.

- Distribute copies: Provide each party with a signed copy of the promissory note for their records.

Legal use of the Utah promissory note

The legal use of a Utah promissory note is governed by state laws and regulations. It is essential to ensure that the note complies with the Uniform Commercial Code (UCC) and any specific state statutes. A properly executed promissory note can be enforced in court, allowing the lender to recover the owed amount in case of default. To maintain its legal standing, the note should be clear, unambiguous, and free from any misleading terms.

How to obtain the Utah promissory note

Obtaining a Utah promissory note can be done through several methods:

- Online templates: Many legal websites provide downloadable templates that comply with Utah laws.

- Legal professionals: Consulting with an attorney can ensure that the note is tailored to specific needs and complies with legal standards.

- Financial institutions: Some banks and credit unions may offer their own versions of promissory notes for personal or business loans.

State-specific rules for the Utah promissory note

Utah has specific rules regarding promissory notes that must be adhered to for the document to be enforceable. These include requirements for interest rates, which must comply with state usury laws, and stipulations regarding the format and content of the note. Additionally, certain disclosures may be required, depending on the nature of the loan and the parties involved. Familiarity with these rules can help both borrowers and lenders avoid legal issues in the future.

Quick guide on how to complete utah utah installments fixed rate promissory note secured by residential real estate

Easily Prepare Utah Utah Installments Fixed Rate Promissory Note Secured By Residential Real Estate on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any holdups. Handle Utah Utah Installments Fixed Rate Promissory Note Secured By Residential Real Estate on any platform using airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign Utah Utah Installments Fixed Rate Promissory Note Secured By Residential Real Estate Effortlessly

- Locate Utah Utah Installments Fixed Rate Promissory Note Secured By Residential Real Estate and then click Get Form to begin.

- Take advantage of the tools we provide to fill in your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Utah Utah Installments Fixed Rate Promissory Note Secured By Residential Real Estate and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Utah promissory note?

A Utah promissory note is a legal document that provides a written promise from one party to another to pay a specified amount of money under agreed terms. This document is commonly used for personal loans or private financing in Utah. Understanding the specific requirements of a Utah promissory note is essential for ensuring its enforceability.

-

How can airSlate SignNow help with a Utah promissory note?

airSlate SignNow streamlines the process of creating, sending, and signing your Utah promissory note. Our platform allows users to quickly generate customizable templates and securely collect signatures from all parties involved. This saves you time and ensures that your promissory note is legally binding and compliant.

-

What features does airSlate SignNow offer for managing Utah promissory notes?

airSlate SignNow provides a host of features such as document templates, customizable workflows, and real-time tracking for your Utah promissory note. Users can also integrate with other applications, making it easier to manage documents and streamline the signing process. These features enhance the overall user experience and efficiency.

-

Is airSlate SignNow affordable for small businesses dealing with Utah promissory notes?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses managing Utah promissory notes. Our plans are designed to provide excellent value, ensuring that even small enterprises have access to professional eSigning solutions. You can choose a plan that fits your budget and needs.

-

Can I customize a Utah promissory note template in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize your Utah promissory note templates to meet your specific needs. You can easily add terms, amounts, and conditions specific to your agreement. This flexibility ensures that your documents reflect your unique requirements.

-

Does airSlate SignNow ensure the security of my Utah promissory note?

Yes, airSlate SignNow prioritizes the security of your documents, including Utah promissory notes. Our platform uses industry-standard encryption and secure storage protocols to protect your sensitive information. You can trust that your documents are safe from unauthorized access.

-

How can I track the status of my Utah promissory note with airSlate SignNow?

airSlate SignNow offers real-time tracking features that allow you to monitor the status of your Utah promissory note. You’ll be notified when your document is sent, viewed, and signed by all parties, ensuring transparency and accountability throughout the process. This helps you stay informed at all times.

Get more for Utah Utah Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Vermont minor name change name change form

- Vermont form

- Court calendarsvermont judiciary form

- Interim temporary final default form

- Instructions you are required to complete and file the 813b if form

- Waiver of service of summons vermont judiciary form

- We request that the agreed upon provisions be made part of a temporary order and remain in form

- Notice of appearance by pro se litigant change form

Find out other Utah Utah Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter