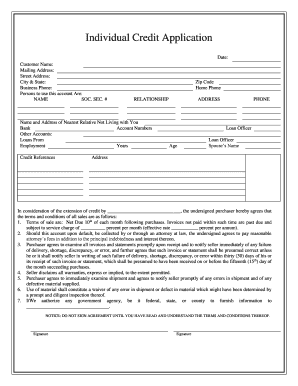

Indiana Individual Credit Application Form

What is the Indiana Individual Credit Application?

The Indiana Individual Credit Application is a formal document used by individuals to apply for credit from financial institutions. This form gathers essential personal and financial information necessary for lenders to assess creditworthiness. It typically includes details such as the applicant's name, address, Social Security number, income, and employment history. Understanding the purpose of this application is crucial for anyone looking to secure financing, whether for a personal loan, mortgage, or credit card.

Steps to complete the Indiana Individual Credit Application

Completing the Indiana Individual Credit Application involves several key steps to ensure accuracy and compliance. Here are the main steps:

- Gather necessary documents: Collect financial statements, proof of income, and identification.

- Fill out the application form: Provide accurate personal and financial information in the designated fields.

- Review your information: Double-check all entries for completeness and accuracy to avoid delays.

- Sign the application: Ensure that you provide your signature, which may be required for processing.

- Submit the application: Choose your preferred submission method, whether online or by mail.

Legal use of the Indiana Individual Credit Application

The Indiana Individual Credit Application must adhere to specific legal standards to be considered valid. This includes compliance with federal and state regulations governing consumer credit. The application should clearly outline the terms and conditions of the credit being offered. Additionally, it is essential that the applicant understands their rights, including the right to receive a copy of the completed application and any adverse action taken based on the application.

Required Documents

When filling out the Indiana Individual Credit Application, certain documents are typically required to support your application. These may include:

- Government-issued identification (e.g., driver's license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements for the past few months

- Employment verification letter

Having these documents ready can streamline the application process and improve your chances of approval.

Eligibility Criteria

Eligibility for the Indiana Individual Credit Application varies by lender but generally includes several common criteria. Applicants typically need to demonstrate a stable income, a good credit history, and a reasonable debt-to-income ratio. Some lenders may also consider factors such as employment stability and existing financial obligations. Understanding these criteria can help applicants prepare their information accordingly.

Form Submission Methods

The Indiana Individual Credit Application can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online submission: Many lenders offer digital platforms for completing and submitting the application.

- Mail: Applicants can print the completed form and send it via postal service.

- In-person: Some applicants may prefer to visit a branch location to submit their application directly.

Choosing the right submission method can impact the speed and efficiency of the application process.

Quick guide on how to complete indiana individual credit application

Complete Indiana Individual Credit Application effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to find the necessary document and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Manage Indiana Individual Credit Application on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to modify and eSign Indiana Individual Credit Application with ease

- Find Indiana Individual Credit Application and click Get Form to begin.

- Use the tools we provide to finish your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and is legally equivalent to a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Indiana Individual Credit Application and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a credit application form PDF and how can it benefit my business?

A credit application form PDF is a digital document used by businesses to collect necessary information from customers applying for credit. Using a credit application form PDF streamlines the process, allowing businesses to quickly assess creditworthiness and make informed decisions. It's an efficient tool that enhances customer experience while reducing paperwork.

-

How do I create a credit application form PDF with airSlate SignNow?

Creating a credit application form PDF with airSlate SignNow is easy and intuitive. Simply use our drag-and-drop editor to design your form, include necessary fields, and convert it into a PDF. You can then share this document with your clients for seamless eSigning.

-

What features does the credit application form PDF offer?

The credit application form PDF includes features like customizable fields, eSigning capabilities, and tracking tools to monitor the document's status. Additionally, you can integrate it with other software for a more comprehensive workflow. This enhances productivity and ensures all applications are managed efficiently.

-

Is there any cost associated with using airSlate SignNow for a credit application form PDF?

While airSlate SignNow offers a free trial for users to explore its capabilities, there are subscription plans available for ongoing use. Depending on your business size and needs, you can choose a pricing plan that allows unlimited access to features related to the credit application form PDF. Invest in a solution that saves you time and money.

-

Can I integrate the credit application form PDF with other business applications?

Yes, airSlate SignNow allows you to integrate your credit application form PDF with various business applications such as CRM systems and accounting software. This integration simplifies data management and enhances overall operational efficiency. You can easily sync your documents with existing workflows.

-

How secure is the information collected in the credit application form PDF?

Security is a top priority with airSlate SignNow. All data collected through the credit application form PDF is encrypted and stored securely, ensuring that sensitive customer information is protected. Our platform also complies with industry standards to provide peace of mind when handling confidential data.

-

How can using a credit application form PDF improve the customer experience?

Using a credit application form PDF can signNowly enhance the customer experience by providing a quick and convenient way to apply for credit. Customers can fill out the form at their convenience, eSign it, and submit it online without the hassle of printing and mailing. This speed and simplicity foster positive engagement with your business.

Get more for Indiana Individual Credit Application

- Probate court of county ohio estate of deceased case no form

- T s c of o supreme court of form

- Control number oh name 3 form

- If married or divorceddissolution please provide the following information

- Probatecomestate planning ampampamp probate lawyers form

- Application for change of name of adult clermont county form

- Probate court of county ohio in re change of name of to form

- Change of name of ashtabula county courts form

Find out other Indiana Individual Credit Application

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile